Nasdaq, Inc. (NDAQ)

My Top 5 Bargain AI Stocks to Buy in the Nasdaq Correction

The Nasdaq, an index that led overall stock market gains over the past two years, has done just the opposite over the past few weeks. The tech-heavy benchmark fell into correction territory, dropping more than 10% from its most recent peak on Dec. 16.

Nasdaq Correction: 2 Brilliant Stocks Down 39% and 60% to Buy Before They Soar, According to Wall Street

The Nasdaq Composite (^IXIC -1.71%) entered market correction territory on March 6, meaning it closed more than 10% below its recent bull-market high. The index has continued to fall since then and currently trades 12% below the record high it reached in December.

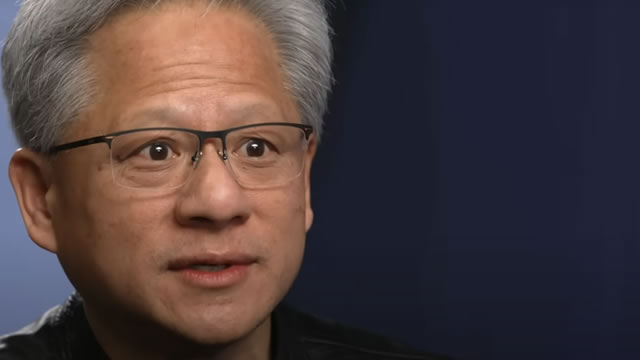

Nasdaq Falls 300 Points As Nvidia, Palantir Decline: Greed Index Remains In 'Extreme Fear' Zone

The CNN Money Fear and Greed index showed a decline in the overall market sentiment, while the index remained in the “Extreme Fear” zone on Tuesday.

Prediction: This Nasdaq Stock Could Start Soaring After March 20

The past few weeks have been rough for technology stocks. The sector has been hammered by the tariff-induced trade war, which has led investors to book profits and enter a risk-off mode amid concerns regarding a potential economic slowdown.

Live Nasdaq Composite: NVDA Falls Ahead of CEO Keynote

The major indices remain lower across the board, with the Nasdaq Composite taking the brunt of the selling for a 1.8% decline.

S&P 500 and Nasdaq 100: Tech Stocks Brace for Volatility as Nvidia's GTC Nears

Nasdaq 100 and S&P 500 slip as Nvidia's GTC looms. Traders brace for AI spending insights and the Fed's next rate decision.

Nasdaq to lead Wall Street decline as gold and oil surge ahead of Trump-Putin call

US stocks are predicted to open lower on Tuesday as the Federal Reserve's two-day meeting begins and investors await the results of a phone call between Presidents Trump and Putin over a potential deal between Russia and Ukraine. After a mostly positive start to the week, futures were pointing to the S&P 500 losing 0.2%, with Dow Jones futures down 0.15% and Nasdaq 100 futures down 0.4%.

Nasdaq Correction: 3 Artificial Intelligence (AI) Stocks That Could Make You a Millionaire

Many investors are starting to panic with the Nasdaq index in correction territory (marked by the index being down at least 10% from its all-time high). However, corrections happen quite often, usually about once per year on average.

Nasdaq Sell-Off: 3 Stocks to Buy That Billionaire Money Managers Also Love

News flash: stocks can go down just as easily as they can climb. Every now and then, investors are given a wake-up call that the stock market wouldn't be a "market" without the ability for equities to move in both directions.

Beat the Nasdaq With This Cash-Gushing Dividend Stock

If you're looking for market-beating stocks, it can sometimes be good to travel a bit off the beaten path to find more unusual options. Innovative Industrial Properties (IIPR -7.61%) offers just such an option.

Trump Tariffs and the Nasdaq Correction Have Been No Match for These Stock Market Sectors

The S&P 500 (SNPINDEX: ^GSPC) is cooling off after rip-roaring gains of over 20% in both 2023 and 2024.

Live Nasdaq Composite: INTC Climbs 7 Percent, PEP's Merger Monday

After starting with gains across the board, the markets have turned mixed, with the Nasdaq Composite lagging the Dow Jones Industrial Average and S&P 500.