Nasdaq, Inc. (NDAQ)

Nasdaq Sell-Off: Can Buying These 2 Safe Stocks Today Set You Up for Life?

Investors are experiencing the first big stock market sell-off of 2025. I have no idea -- and neither does anyone else -- when this drawdown will end or when another one will occur.

The Nasdaq Just Hit Correction Territory: This Magnificent AI Stock Is a Rare Bargain

The Nasdaq index is now in correction territory, meaning it is now more than 10% down from its all-time high. While this may seem like a big deal, 10% corrections tend to occur just about every year, so this is something that investors must understand happens quite frequently.

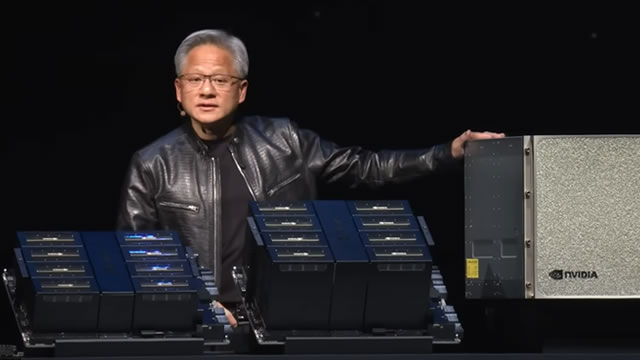

Nasdaq Stock Market Correction: Is Nvidia a Screaming Buy Right Now?

In just a matter of weeks, tech stocks have gone from stretching to all-time highs to plunging on concerns around tariffs and even a recession.

Nasdaq Correction: I'd Consider Buying the Dip on All "Magnificent Seven" Stocks -- Except This One

After peaking on Dec. 16, the Nasdaq Composite -- which tracks almost every stock trading on the Nasdaq stock exchange -- has entered into a correction. The index is down around 9% year to date and 13% from its December peak.

The Nasdaq Just Hit Correction Territory: Time to Buy the Dip on Meta Platforms Stock?

Following the stock market's record-breaking run last year, the start of 2025 offers a timely reminder that risk and price volatility are normal parts of the investing process.

Nasdaq Sell-Off: 2 Tech Stocks Down 58% to 86% to Buy Right Now

The 4% drop in the Nasdaq Composite Index (^IXIC 0.19%) on March 10 served as a wake-up call to investors. While that was not a record drop by any measure, it was the worst one-day decline since the fall of 2022, meaning many newer investors had never experienced a comparable decline.

Live Nasdaq Composite: TSLA, NVDA Lead Market Rebound

Technology stocks are continuing to lead the market higher, buoying the Nasdaq Composite and S&P 500 while the Dow Jones Industrial Average has slipped into the red.

Nasdaq Stock Market Correction: Is Nvidia Stock a Buy at 27% Off Its High?

Nvidia (NVDA 5.20%) stock has been a fantastic medium- and long-term winner and even a winner over the last year. But shares of the artificial intelligence (AI) chip and technology leader have been having a tough time recently.

Nasdaq Correction: Hold These 3 Mag-7 Stocks Instead of Letting Go

In recent trading sessions, Wall Street witnessed a bloodbath, with the “Magnificent Seven” stocks dragging the Nasdaq lower. Yet, it's still wise to have faith in three of them.

Nasdaq Sell-Off: Don't Panic; Use This Strategy Instead

With the Nasdaq Composite hitting correction territory earlier this week, which is defined as at least a 10% decline from a recent high, investors may be getting worried. That's normal.

Nasdaq Sell-Off: This Magnificent Stock Is a Rare Bargain

The start of 2025 has proven to be more challenging for investors compared to the stock market's record-breaking highs of 2024. The Nasdaq Composite index is down approximately 13% from its all-time high, amid renewed jitters regarding the strength of the economy and uncertainty over the effect of trade tariffs being implemented by the Trump administration.

Prediction: You'll Regret Not Buying These 2 Industry-Leading Stocks During the Nasdaq Sell-Off

With fears of a trade war and a potential economic recession rising, the Nasdaq Composite has fallen into correction territory, retreating more than 10% from its mid-December high. With this decline, a number of quality stocks have fallen to attractive entry points.