Nordson Corporation (NDSN)

Compared to Estimates, Nordson (NDSN) Q1 Earnings: A Look at Key Metrics

The headline numbers for Nordson (NDSN) give insight into how the company performed in the quarter ended January 2025, but it may be worthwhile to compare some of its key metrics to Wall Street estimates and the year-ago actuals.

Nordson (NDSN) Q1 Earnings and Revenues Lag Estimates

Nordson (NDSN) came out with quarterly earnings of $2.06 per share, missing the Zacks Consensus Estimate of $2.08 per share. This compares to earnings of $2.21 per share a year ago.

Nordson Gears Up to Report Q1 Earnings: What's in the Offing?

NDSN's first-quarter fiscal 2025 results are likely to benefit from solid momentum in the Industrial Precision Solutions segment, partly offset by cost inflation.

Unlocking Q1 Potential of Nordson (NDSN): Exploring Wall Street Estimates for Key Metrics

Get a deeper insight into the potential performance of Nordson (NDSN) for the quarter ended January 2025 by going beyond Wall Street's top -and-bottom-line estimates and examining the estimates for some of its key metrics.

Here's Why You Should Retain Nordson Stock in Your Portfolio Now

NDSN is set to gain from strength in the Industrial Precision Solutions unit, buyouts and shareholder-friendly policies. Softness in the Advanced Technology Solutions unit remains concerning.

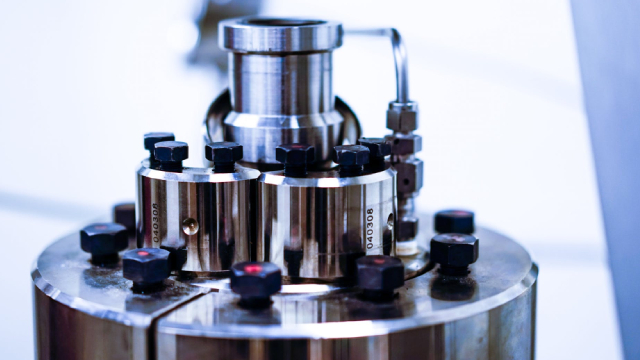

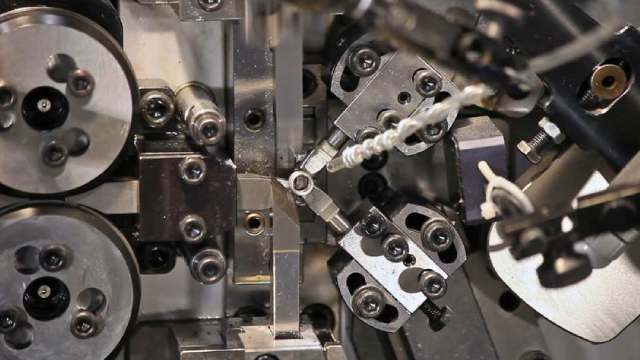

Nordson: A Dividend Aristocrat Reinforcing Its Position Through Tuck-In Acquisitions

Nordson Corp., an American multinational corporation that manufactures equipment used for the precise dispensing of adhesives, coatings, sealants, and other materials, is now a $12 billion (by market cap) manufacturing might. NDSN has taken all of this simple and practical wonderfulness and combined it with a programmatic acquisition strategy that scales the business beyond organic growth potential through tuck-in acquisitions designed to open up new opportunities and markets. The company increased its dividend for an incredible 61 consecutive years, with a 10-year dividend growth rate of 15.4%.

Nordson Benefits From Industrial Precision Unit Amid Headwinds

NDSN benefits from persistent strength in the Industrial Precision Solutions unit, buyouts and shareholder-friendly policies. Softness in the Advanced Technology Solutions unit remains a woe.

Nordson's Q4 Earnings & Revenues Top Estimates, Increase Y/Y

NDSN's Q4 fiscal 2024 revenues increase 4% due to strong momentum in the Medical and Fluid Solutions segment.

Nordson Corporation (NDSN) Q4 2024 Earnings Call Transcript

Nordson Corporation (NASDAQ:NDSN ) Q4 2024 Earnings Conference Call December 12, 2024 8:30 AM ET Company Participants Lara Mahoney - Vice President, Investor Relations and Corporate Communications Sundaram Nagarajan - President and Chief Executive Officer Daniel Hopgood - Executive Vice President and Chief Financial Officer Conference Call Participants Mike Halloran - Baird Saree Boroditsky - Jefferies Christopher Glynn - Oppenheimer Matt Summerville - D.A. Davidson Jeff Hammond - KeyBanc Capital Markets Andrew Buscaglia - BNP Walt Liptak - Seaport Operator Thank you for standing by and welcome to the Nordson Corporation Fourth Quarter Fiscal Year 2024 Conference Call.

Here's What Key Metrics Tell Us About Nordson (NDSN) Q4 Earnings

While the top- and bottom-line numbers for Nordson (NDSN) give a sense of how the business performed in the quarter ended October 2024, it could be worth looking at how some of its key metrics compare to Wall Street estimates and year-ago values.

Nordson (NDSN) Q4 Earnings and Revenues Beat Estimates

Nordson (NDSN) came out with quarterly earnings of $2.78 per share, beating the Zacks Consensus Estimate of $2.59 per share. This compares to earnings of $2.46 per share a year ago.

How To Earn $500 A Month From Nordson Stock Ahead Of Q4 Earnings

Nordson Corporation NDSN will release earnings for its fourth quarter, after the closing bell on Wednesday, Dec. 11.