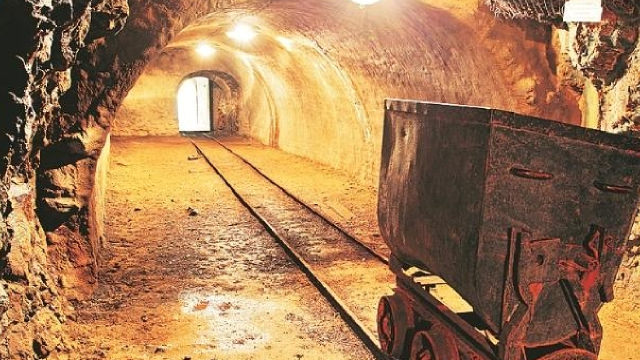

Newmont Corporation (NEM)

Newmont shares plunge 15% after missing earnings estimates amid labour cost woes

Gold miners have been struggling to capitalise on higher demand for the yellow metal as higher input and operating costs weigh. The largest gold mining company in the world, Newmont Corp shares plunged 15% post its earnings results as profit and revenue missed analysts' expectations.

Newmont Corporation (NEM) Q3 2024 Earnings Conference Call Transcript

Newmont Corporation (NYSE:NEM ) Q3 2024 Earnings Conference Call October 24, 2024 11:00 AM ET Company Participants Thomas Palmer - President and CEO Natascha Viljoen - EVP and COO Karyn Ovelmen - EVP and CFO Conference Call Participants Daniel Major - UBS Josh Wolfson - RBC Capital Markets Matthew Murphy - Jefferies Anita Soni - CIBC Mike Parkin - National Bank Lawson Winder - Bank of America Merrill Lynch Alex Hacking - HSBC Tanya Jakusconek - Scotiabank Operator Good morning, and welcome to Newmont's Third Quarter 2024 Earnings Call. [Operator Instructions].

Newmont misses on costs but boosts share buyback program by $2B

Newmont Corporation (NYSE:NEM, TSX:NGT, ASX:NEM, ETR:NMM) reported mixed third-quarter earnings, with adjusted earnings per share (EPS) of $0.81 falling short of estimates. Analysts at Jefferies had estimated EPS of $0.85 while Street consensus expectations were $0.86.

Newmont: Improved Free Cash Flow Generation On The Back Of Record Gold Prices

Newmont Corporation had a satisfactory Q3 2024 operationally, though partially dragged down by another relatively soft quarter at NGM and a slower than planned ramp-up at PV 14MTPa Expansion. Meanwhile, costs rose sharply year-over-year to $1,611/oz with a $30/oz+ impact from higher gold prices (royalties), but the record gold price fortunately picked up all the slack. In this update, we'll dig into the Q3 '24 results, recent developments, and whether NEM is an attractive investment at current levels.

Newmont Stock Is Dropping. Here's Why.

The gold miner's third-quarter report came up short on earnings and sales.

Newmont's Earnings Miss, Revenues Surpass Estimates in Q3

Higher average realized gold prices and sales volumes aid NEM's third-quarter performance.

Newmont Corporation (NEM) Q3 Earnings Lag Estimates

Newmont Corporation (NEM) came out with quarterly earnings of $0.81 per share, missing the Zacks Consensus Estimate of $0.83 per share. This compares to earnings of $0.36 per share a year ago.

Wall Street Bulls Look Optimistic About Newmont (NEM): Should You Buy?

Investors often turn to recommendations made by Wall Street analysts before making a Buy, Sell, or Hold decision about a stock. While media reports about rating changes by these brokerage-firm employed (or sell-side) analysts often affect a stock's price, do they really matter?

Is Newmont Stock a Smart Buy Before Q3 Earnings Release?

NEM is expected to have benefited from increased production volumes, lower unit costs and higher gold prices in the third quarter.

Here is Why Growth Investors Should Buy Newmont (NEM) Now

Newmont (NEM) could produce exceptional returns because of its solid growth attributes.

What Makes Newmont Corporation (NEM) a Strong Momentum Stock: Buy Now?

Does Newmont Corporation (NEM) have what it takes to be a top stock pick for momentum investors? Let's find out.

Newmont Corporation (NEM) Earnings Expected to Grow: Should You Buy?

Newmont (NEM) doesn't possess the right combination of the two key ingredients for a likely earnings beat in its upcoming report. Get prepared with the key expectations.