NRG Energy, Inc. (NRG)

NRG Energy (NRG) Tops Q2 Earnings and Revenue Estimates

NRG Energy (NRG) came out with quarterly earnings of $1.48 per share, beating the Zacks Consensus Estimate of $1.30 per share. This compares to earnings of $1.10 per share a year ago.

Titan NRG, Inc. Secures Major Propane Contract With Southern Arizona Reservation

TUCSON, AZ / ACCESSWIRE / August 7, 2024 / Titan NRG, Inc. ("Titan NRG") (OTC PINK:TTNN), a leader in downstream energy and transportation through its wholly owned subsidiaries, announces the award of a 150,000-gallon contract. Alex R. Majalca Jr., president and CEO of Titan NRG, Inc., proudly announces a new milestone for the company - a substantial contract for the sale of 150,000 gallons of propane over the next year to a southern Arizona reservation.

Is NRG (NRG) a Buy as Wall Street Analysts Look Optimistic?

The recommendations of Wall Street analysts are often relied on by investors when deciding whether to buy, sell, or hold a stock. Media reports about these brokerage-firm-employed (or sell-side) analysts changing their ratings often affect a stock's price.

NRG Energy (NRG) to Report Q2 Earnings: What's in Store?

NRG Energy's (NRG) second-quarter results are expected to continue to benefit from Vivint Smart Home integration, share repurchases and debt reduction initiatives.

NRG Energy (NRG) Reports Next Week: Wall Street Expects Earnings Growth

NRG (NRG) doesn't possess the right combination of the two key ingredients for a likely earnings beat in its upcoming report. Get prepared with the key expectations.

NRG Energy (NRG) Declines More Than Market: Some Information for Investors

NRG Energy (NRG) closed at $73.33 in the latest trading session, marking a -1.35% move from the prior day.

Why NRG Energy (NRG) Outpaced the Stock Market Today

In the most recent trading session, NRG Energy (NRG) closed at $74.33, indicating a +0.84% shift from the previous trading day.

Here's Why NRG Energy (NRG) Fell More Than Broader Market

In the latest trading session, NRG Energy (NRG) closed at $76.61, marking a -0.31% move from the previous day.

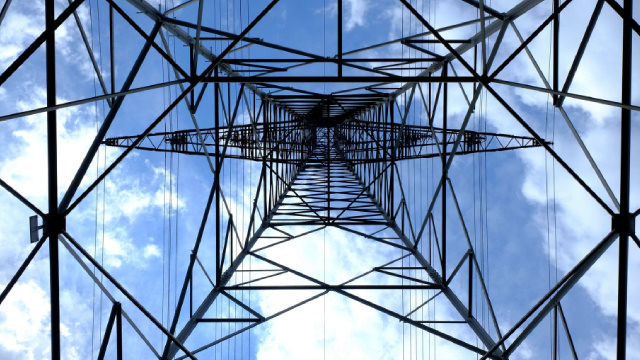

NRG Energy (NRG) Gains From Investments & Share Repurchase

NRG Energy (NRG) gains from investments in infrastructure and addition of clean sources to produce electricity and serve its customers. Yet, risks relating to numerous laws and regulations remain.

NRG Energy (NRG) Exceeds Market Returns: Some Facts to Consider

In the closing of the recent trading day, NRG Energy (NRG) stood at $76.43, denoting a +1.38% change from the preceding trading day.

Why NRG Energy (NRG) Outpaced the Stock Market Today

In the latest trading session, NRG Energy (NRG) closed at $79.26, marking a +0.88% move from the previous day.

Brokers Suggest Investing in NRG (NRG): Read This Before Placing a Bet

Investors often turn to recommendations made by Wall Street analysts before making a Buy, Sell, or Hold decision about a stock. While media reports about rating changes by these brokerage-firm employed (or sell-side) analysts often affect a stock's price, do they really matter?