NRG Energy, Inc. (NRG)

NRG: A Rare Buy, With Data-Center Contracts And VPP Growth Fueling A Multi-Year Cash Flow Boom

Data center contracts and the retail VPP give NRG a rare mix of visibility and margin strength. Cash flow generation supports both growth projects and aggressive buybacks without stretching leverage. The company is reshaping its portfolio through LS Power assets and Texas projects, positioning for AI-driven demand.

Is Most-Watched Stock NRG Energy, Inc. (NRG) Worth Betting on Now?

NRG (NRG) has been one of the stocks most watched by Zacks.com users lately. So, it is worth exploring what lies ahead for the stock.

Why NRG Energy (NRG) is a Top Value Stock for the Long-Term

Wondering how to pick strong, market-beating stocks for your investment portfolio? Look no further than the Zacks Style Scores.

Here's Why NRG Energy (NRG) is a Strong Momentum Stock

Wondering how to pick strong, market-beating stocks for your investment portfolio? Look no further than the Zacks Style Scores.

NRG Energy, Inc. (NRG) Q2 2025 Earnings Call Transcript

NRG Energy, Inc. (NYSE:NRG ) Q2 2025 Earnings Conference Call August 6, 2025 9:00 AM ET Company Participants Brendan Mulhern - Corporate Participant Bruce Chung - EVP & CFO Lawrence Stephen Coben - President, CEO & Chairman of the Board Robert J. Gaudette - Executive VP, President of NRG Business & Wholesale Operations Conference Call Participants Agnieszka Anna Storozynski - Seaport Research Partners Carly S.

NRG Energy (NRG) Q2 Earnings and Revenues Beat Estimates

NRG Energy (NRG) came out with quarterly earnings of $1.68 per share, beating the Zacks Consensus Estimate of $1.54 per share. This compares to earnings of $1.48 per share a year ago.

NRG Energy (NRG) Expected to Beat Earnings Estimates: Can the Stock Move Higher?

NRG (NRG) possesses the right combination of the two key ingredients for a likely earnings beat in its upcoming report. Get prepared with the key expectations.

Ex-Dividend Reminder: NRG Energy, Emera And Pinnacle West Capital

On 8/1/25, NRG Energy, Emera, and Pinnacle West Capital will all trade ex-dividend for their respective upcoming dividends. NRG Energy will pay its quarterly dividend of $0.44 on 8/15/25, Emera will pay its quarterly dividend of $0.725 on 8/15/25, and Pinnacle West Capital will pay its quarterly dividend of $0.895 on 9/2/25.

NRG Energy, Inc. (NRG) is Attracting Investor Attention: Here is What You Should Know

Zacks.com users have recently been watching NRG (NRG) quite a bit. Thus, it is worth knowing the facts that could determine the stock's prospects.

NRG Energy (NRG) Beats Stock Market Upswing: What Investors Need to Know

In the most recent trading session, NRG Energy (NRG) closed at $158.54, indicating a +1.25% shift from the previous trading day.

NRG Energy (NRG) Increases Despite Market Slip: Here's What You Need to Know

In the closing of the recent trading day, NRG Energy (NRG) stood at $151.75, denoting a +2.97% move from the preceding trading day.

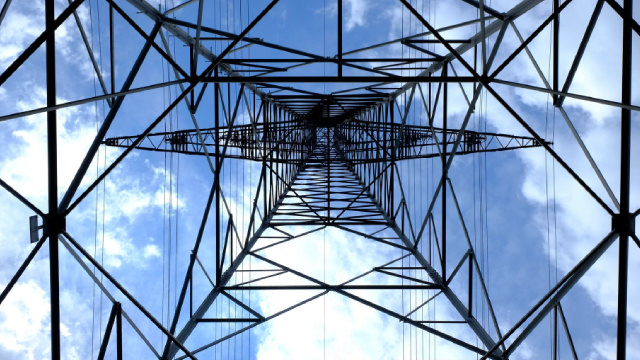

NRG Energy: Data Center Boom And Texas Growth Key To Electrify Long-Term Growth

New partnerships with PowLan and Menlo Equities, starting in 2026, can scale NRG's capacity up to 6.5 GW long-term and enable the company to capitalize on the data center boom. The LS Power acquisition will double NRG's total production capacity to meet rising power demands in key markets, with an accretive 14% CAGR in EPS and FCFbG projected. The VPP platform will provide NRG a competitive advantage in Texas, with ERCOT projecting the state's electricity peak demand to nearly double to 218 GW in 2031.