NVIDIA Corporation (NVDA)

Peter Thiel Dumps NVIDIA and Slashes Tesla Stake—Is the AI Bubble About to Pop?

Billionaire investor Peter Thiel's hedge fund, Thiel Macro LLC, reported two significant sales in its 13F filing for the quarter ending September 30, 2025.

Demmert: Investors Overblew A.I. Bubble Fears, NVDA Growth Justifies Valuation

James Demmert says investors underestimated Nvidia (NVDA) into its earnings and overblew A.I. bubble concerns.

Even Nvidia can't help a stock market that's in real trouble

The S&P 500 needs to stay above 6,500 — or all bets are off.

Nvidia's Record Earnings Explained: Dan Ives on What Investors Missed

Dan Ives breaks down Nvidia's strong quarter, why the stock still sold off, and what Wall Street is overlooking about the next phase of the AI boom.

Feds charge 4 in plot to export restricted Nvidia chips to China, Hong Kong

Four men were indicted on federal criminal charges related to a plot to export Nvidia chips worth millions of dollars to China and Hong Kong. The chips are highly restricted from exports because of their use in AI and supercomputing applications, the indictment notes.

NVIDIA's Strong Earnings Report Dispels AI Bubble Fears Amid Circular Financing Concerns

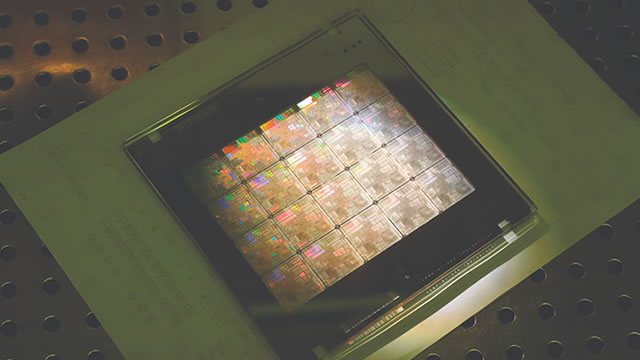

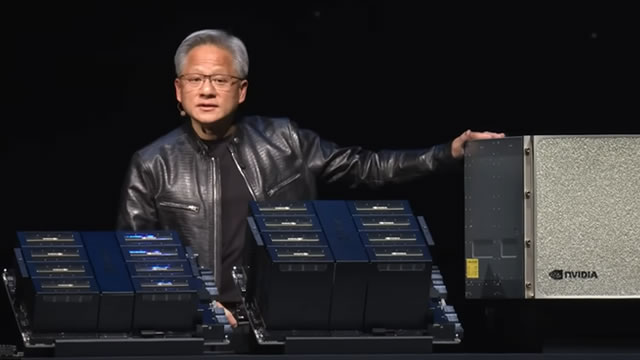

NVIDIA delivered a blockbuster third-quarter earnings report yesterday, surpassing Wall Street expectations with record revenue of $57 billion and providing an upbeat forecast that contrasts concerns about an AI bubble, according to CNBC. CEO Jensen Huang highlighted robust demand for the company's AI chips, stating NVIDIA has visibility into a half-trillion-dollar sales pipeline for 2025 and 2026, excluding recent major deals like expansions with Anthropic and Saudi Arabia.

Nvidia: Picks And Shovels Is No Longer The Way To Outperform The Market

Nvidia Corporation delivered yet another strong quarter that defied expectations, but the share price is telling a different story. Investors should accept the fact that investing in picks and shovels is no-longer the winning strategy within the AI space. More importantly, some recent developments highlight some important risks for NVDA investors that should be taken into account.

Do Nvidia Earnings Put Fears of an AI Stock Market Bubble To Rest?

A lot hinged on Nvidia's (NVDA) earnings report, and the AI chip giant didn't disappoint.

Stocks on track for biggest blown gain since April as Nvidia-inspired rebound falters. Here's what investors need to know.

An early stock-market rally on Thursday has given way to broad-based selling as doubts about the artificial-intelligence trade re-emerged following the latest batch of earnings from Nvidia.

"See-Sawing" Trading After NVDA Earnings Show Sticky A.I. Bubble Fears

Nvidia's (NVDA) earnings posted record numbers for the company and bolstered a market-wide rally early in Thursday's session. That rally faded by the afternoon when the stock fell 6% from its intraday high.

Nvidia shares reverse after blockbuster earnings meet a wall of investor skepticism

Nvidia Corp (NASDAQ:NVDA, XETRA:NVD) delivered another blockbuster quarter, with demand for its AI chips still running red-hot and its newest Blackwell products selling faster than the company can produce them. Analysts at Bank of America and UBS said the results were so strong that Wall Street will likely need to raise its earnings forecasts for several years out.

Nvidia's rising stock price takes fellow chip giants along for the ride as renewed AI enthusiasm fuels fresh rally

Yesterday, after the stock market's closing bell, Nvidia Corporation (Nasdaq: NVDA) reported its Q3 2026 financials.