NVIDIA Corporation (NVDA)

Nvidia Says These Magic Words, and Stocks Shed Their AI-Related Angst

Nvidia CEO Jensen Huang said exactly what the markets wanted to hear.

Nvidia's 'Massive' Q3 Results And Forecast Might Not Impress The Market

Nvidia's Q3 results, while ostensibly driven by AI demand and its central role in the 'Circular AI Deal Machine,' show significant signs of a slowdown in growth. While AI infrastructure spending is surging, questions rise about the true value, sustainability, and reproducibility of current AI investments. Rising debt and inflated deal projections among AI firms and data center operators raise concerns about a bubble and long-term profitability.

Wall Street predicts Nvidia (NVDA) stock price for next 12 months

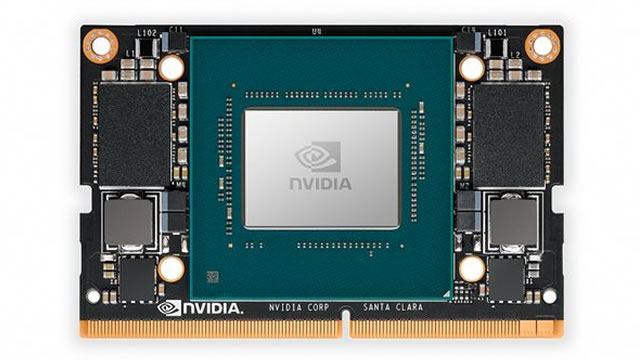

Nvidia (NASDAQ: NVDA) is on fire on Thursday, November 20, following strong third-quarter numbers, including $57 billion in revenue.

While Nvidia is thriving, this CEO hails an anti-AI bet — and is winning

TKO Holdings wants to sell real-life experiences expensively, not the virtual for free.

Nvidia's Strong Results Show AI Fears Are Premature

The chip maker says demand looks strong through next year, while a selloff has made the $4.5 trillion company look cheap.

Nvidia Stock Surges as Earnings Hush AI Bubble Talk. There's More Good News.

Nvidia stock rises with management confident in delivering more than $500 billion in cumulative revenue from Blackwell and next-generation Rubin chips.

Nvidia stock pops 5% in premarket trading after stronger-than-expected results

Nvidia shares moved 5.5% higher in premarket trade on Thursday. In its earning call, the AI chipmaker worked to 'disprove pretty much all of the bear cases out there,' one analyst told CNBC.

Fed Narrative Shifted More Than Nvidia's: 3-Minutes MLIV

Anna Edwards, Guy Johnson, Kriti Gupta and Mark Cudmore break down today's key themes for analysts and investors on "Bloomberg: The Opening Trade." Chapters: 00:00:00 - MLIV 00:00:08 - Nvidia, Big Tech Worries 00:00:58 - Crypto Outlook 00:01:54 - December Fed Cut 00:02:36 - Fed Rate Cut Importance -------- More on Bloomberg Television and Markets Like this video?

Nvidia shrugs off AI bubble fears, tops Q3 profit expectations

Nvidia beats expectations in Q3 earnings and guides beyond projections for 2026, sending shares up 5 per cent in after-hours trading. CEO Jensen Huang remains sanguine about over-stretched A.I.

Nvidia blows past expectations

For the past week, global markets have behaved like someone slowly realising they may have overpaid for the world's most hyped gadget. A 3% slide in the tech-heavy Nasdaq, hand-wringing over whether AI stocks have become dangerously inflated, and high-profile selling (Peter Thiel dumping $100 million of Nvidia shares and SoftBank delicately trimming its own holding) all fed a growing sense that the AI party might be losing its fizz.

Nvidia earnings clear lofty hurdle set by analysts amid fears about an AI bubble

Nvidia's sales of the computing chips powering the artificial intelligence craze surged beyond the lofty bar set by stock market analysts in a performance that may ease recent jitters about a Big Tech boom turning into a bust that topples the world's most valuable company.

Nvidia CEO predicts 'crazy good' Q4 after strong earnings calm AI bubble fears

Nvidia CEO Jensen Huang calls Q4 guidance 'crazy good' as chipmaker rides AI boom wave. Stock jumps 5% after beating earnings expectations in third quarter.