NVIDIA Corp (NVDA)

Nvidia-backed Reflection AI eyes $5.5 billion valuation as AI runs hot, FT reports

Nvidia-backed Reflection AI is raising around $1 billion in a financing that will value the startup at up to $5.5 billion, the Financial Times reported on Tuesday, citing people familiar with the matter.

Nvidia and its Big Tech peers have $1 trillion to spend. What should they do with it?

The combined operating cash flow and net cash of the “Magnificent Seven” could reach more than $1 trillion by the end of the year, analysts at HSBC estimated — and they have ideas as to how some of the companies could and should spend it.

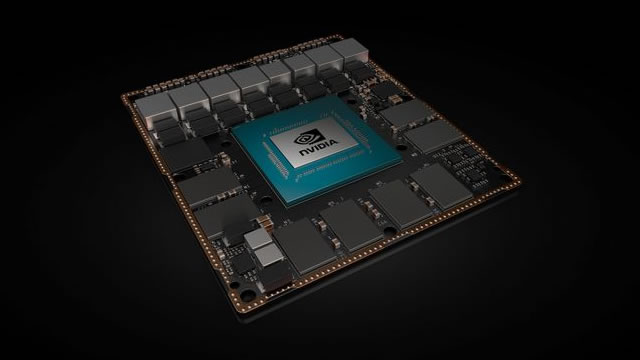

Nvidia unveils AI chips for video, software generation

Nvidia said on Tuesday it would launch a new artificial intelligence chip by the end of next year, designed to handle complex functions such as creating videos and software.

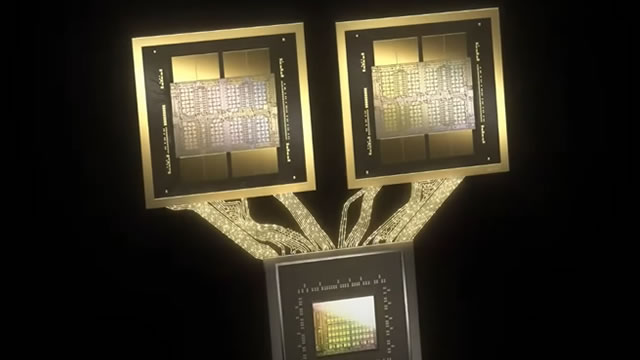

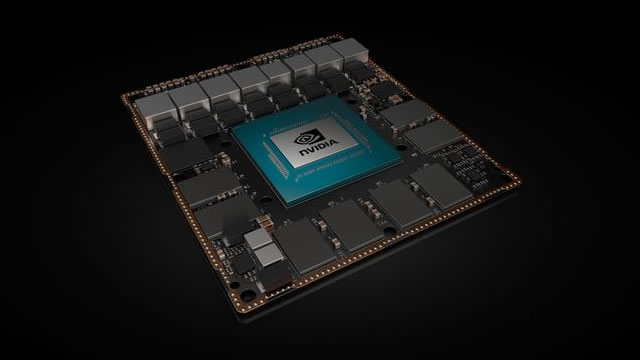

Nvidia unveils new GPU designed for long-context inference

At the AI Infrastructure Summit on Tuesday, Nvidia announced a new GPU called the Rubin CPX, designed for context windows larger than 1 million tokens.

Nvidia: Time To Double Down

Nvidia Corporation's Q2 performance exceeded expectations, driven by surging global demand for AI accelerators, despite ongoing China-related challenges. The AI infrastructure boom continues, with hyperscalers ramping up spending, positioning Nvidia as a primary beneficiary due to its dominant GPU market share. While loss of the Chinese market limits some upside, Nvidia's growth trajectory remains strong, supported by robust demand and new product cycles.

Analyst sets date when Nvidia stock will trade at $245

The share price of American semiconductor giant Nvidia (NASDAQ: NVDA) is likely to extend its rally and surpass the $200 mark before the end of the year.

Nvidia stock bearish signal emerges as drop below $150 on the horizon

Nvidia (NASDAQ: NVDA) stock's ongoing near-term bearish sentiment is likely to persist in the coming days, with technical indicators suggesting a potential drop below $150 may be on the horizon.

Nvidia: I Didn't Think I Could Get More Bullish - Then Q2 Happened

The Blackwell ramp leads the narrative. GB300 is in volume production at a rate of 1,000/week. Q3 revenue was projected at a growth rate of +54% yoy. Guided FQ3 gross margin at 73.3%–73.5%. A 15% H20 China arrangement could unlock $2–$5B Q3 shipments, and the outlook excludes H20 to China. $650M H20 already sold outside China. Rubin (Vera CPU, Rubin GPU, CX9, NVLink 144, Spectrum-X, silicon photonics) is in final pre-production at TSMC; on schedule for volume next year, with mass production targeted for H2 2026.

Nvidia AI and gaming chips revenue, why the August jobs report 'cements' a September rate cut

Market Domination anchor Josh Lipton breaks down the latest news on financial markets for September 5, 2025. Truist's Keith Lerner discusses the weak August jobs report and what it means for the Fed, saying, "It would cement a rate cut for September.

Nvidia's China Revenue Constraints Don't Negate The Bull Case

Nvidia Corporation remains a high-growth portfolio ballast, but I don't think it should be treated as a "set and forget" compounder. It requires careful monitoring. China revenue will likely not be a meaningful upside source for Nvidia in the foreseeable future, given China's isolationist direction. Regardless of this loss, NVDA is still benefiting from an AI investment supercycle and benefits from being the leading GPU supplier to globally integrated open economic architecture.

Advanced Micro Devices' 2026 Forecasts Are Way Too Low

Suppose the channel checks reported by Wedbush concerning the supply-demand imbalance for NVIDIA's NASDAQ: NVDA AI GPUs are correct. In that case, it isn't a matter of Advanced Micro Devices NASDAQ: AMD taking share but claiming it.

Nvidia Stock To Fall 50% As AI Cycle Turns?

Nvidia (NASDAQ: NVDA) has indisputably led the AI boom. Its GPUs are considered the gold standard for training extensive AI models, resulting in sales growth from $27 billion in FY'23 to an anticipated $200 billion this fiscal year.