Novo Nordisk A/S Sponsored ADR (NVO)

Novo Nordisk: The Market Is Giving Us A Free Lunch

Novo Nordisk A/S's stock is severely oversold as the market overreacts to short-term news, which has created what appears to be a rare buying opportunity. While Q2 guidance was lowered, the underlying business remains strong with 18% year-over-year sales growth, proving that NVO's core momentum is still intact. Strategic catalysts like the exclusive CVS formulary win and the NovoCare direct-to-patient channel are actively working to secure future revenue and protect market share.

Novo Nordisk Stock Rises. Its Diabetes Pill Cleared a Key Hurdle.

Clinical trial results that showed the treatment reduced cardiovascular death, heart attack and stroke by 14% compared with placebo.

Novo Nordisk (NVO) Ascends While Market Falls: Some Facts to Note

Novo Nordisk (NVO) reached $54.87 at the closing of the latest trading day, reflecting a +1.05% change compared to its last close.

Novo Nordisk: Job Cuts, Profit Guidance Shock - Why Investors Should Hold Firm

Novo Nordisk A/S announced this morning that it will cut ~9k staff and that the one-off costs of doing so will severely impact profitability in 2025. Novo Nordisk's 2025 has been turbulent, but I believe investors shouldn't panic given the company's long-term strengths. Despite NVO management missteps and external headwinds, semaglutide remains a best-in-class asset with blockbuster potential across obesity, diabetes, and other indications.

Novo Nordisk: Keep It Low So I Can Keep Accumulating (Rating Upgrade)

Novo Nordisk A/S's strong Q2 results, led by Wegovy's explosive growth and robust profitability, reinforce my bullish outlook and justify recent share accumulation. NVO dominates the obesity and diabetes markets globally, with superior international reach and a 71% market share outside the U.S., outpacing competitors like Eli Lilly. A deep, innovative pipeline—including next-gen obesity drugs—positions Novo Nordisk for sustained long-term growth and reinforces its competitive moat.

Healthy Returns: Novo Nordisk's head of research and development previews the first-ever obesity pill

Novo Nordisk's Martin Holst Lange preveiwed the company's obesity pill, while OpenAI launches new initiative to speed up scientific discovery.

Wegovy trial result gives boost to Novo Nordisk amid U.S. market woes

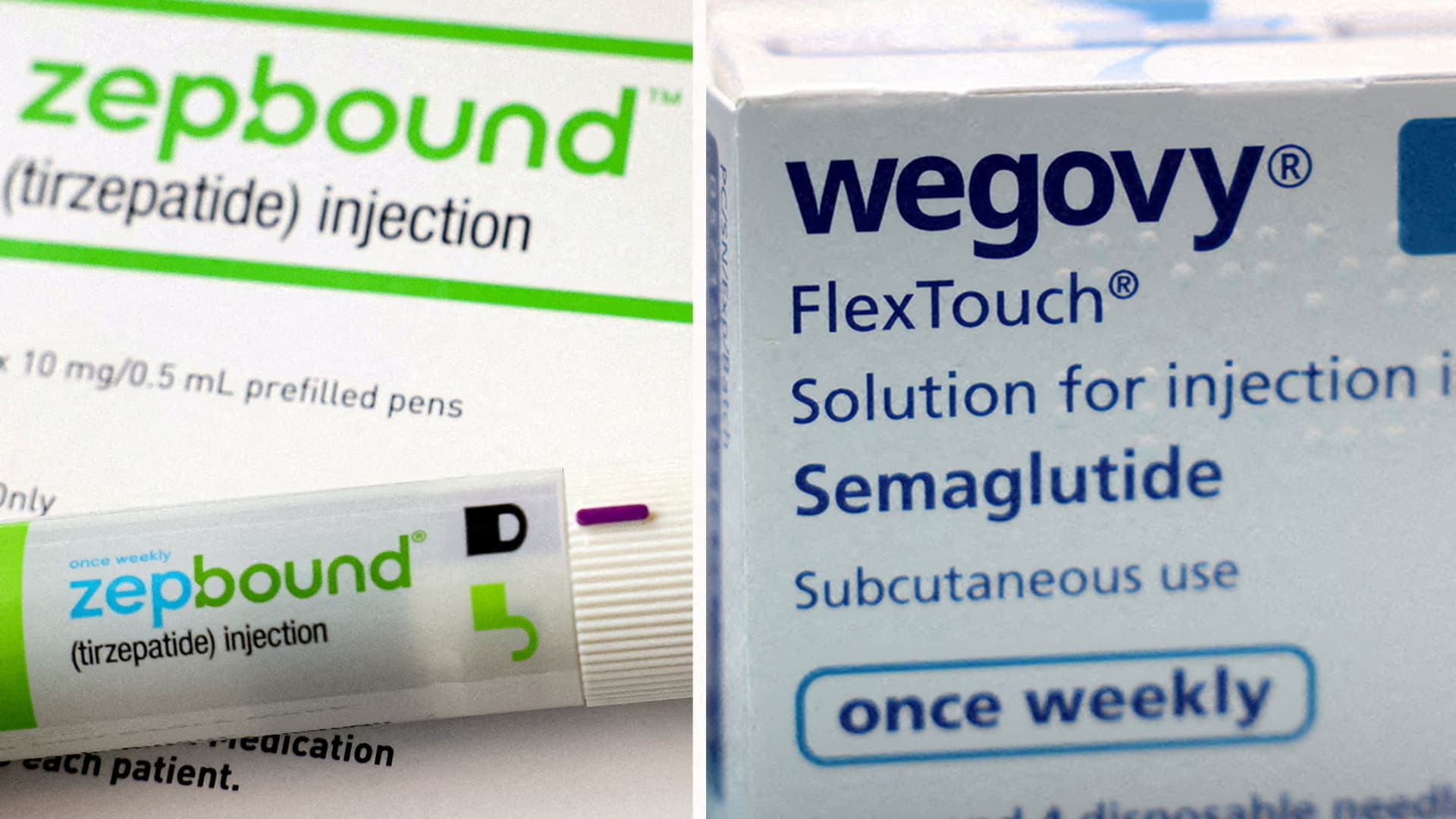

Trial data released by Novo Nordisk showed a significant reduction in the risk of heart attack, stroke or death in certain patients on its blockbuster weight-loss treatment Wegovy, compared with drugs produced by the Danish firm's U.S. rival Eli Lilly. The companies are the leading players in the weight loss space, both grappling with challenges from copycat compounders and the race to develop next-generation treatments.

Investors Heavily Search Novo Nordisk A/S (NVO): Here is What You Need to Know

Zacks.com users have recently been watching Novo Nordisk (NVO) quite a bit. Thus, it is worth knowing the facts that could determine the stock's prospects.

Novo Nordisk: Undervalued Pharma Heavyweight With Upside Potential

Novo Nordisk is deeply undervalued, trading at a forward P/E of 14, despite 20%+ top and bottom-line growth and dominant weight-loss market share. The anti-obesity market is set to grow nearly 10x by 2035; Novo's 71% international share and strong R&D position it for outsized gains. Current valuation reflects excessive pessimism—NVO is oversold, with profitability and growth far outpacing sector averages, making this a rare buying opportunity.

Novo Nordisk Roars Back: 6 Catalysts Driving the Pharma's Path to Dominance

Key Points in This Article: Novo Nordisk (NVO) pioneered GLP-1 drugs with Ozempic and Wegovy, but lost ground to Eli Lilly's Mounjaro and Zepbound.

Novo Nordisk: This Options Strategy Was Profitable Even With The Stock Down

Novo Nordisk's economic moat is eroding due to increased competition and US drug price pressures, but growth in international markets and new launches support the outlook. My updated fair value estimate is $67.65, down from $83, reflecting lowered guidance but still offering about 25% upside from current levels. I continue to manage risk with a Put Spread strategy, adapting positions as the stock declines, which has delivered a solid 16-20% ROI even with the stock down ~20%.

Fat busters having a muted impact consumer sector. But for how long?

Fine dining under pressure, beer sales at risk, and snack makers bracing for a shake-up. The rise of GLP-1 weight-loss drugs is starting to ripple through the consumer economy.