Oscar Health, Inc. (OSCR)

3 Stocks With the Potential to Double Your Money in 2 Years

Funding high-growth stocks is a critical strategy to achieve significant returns in a recovering market. Here, the focus is on three high-growth stocks positioned to double investment within the next two years.

Oscar Health, Inc. (OSCR) Exceeds Market Returns: Some Facts to Consider

The latest trading day saw Oscar Health, Inc. (OSCR) settling at $16.19, representing a +1.19% change from its previous close.

Oscar Health, Inc. (OSCR) Ascends While Market Falls: Some Facts to Note

Oscar Health, Inc. (OSCR) closed the most recent trading day at $16.59, moving +1.22% from the previous trading session.

Is Oscar Health (OSCR) Outperforming Other Finance Stocks This Year?

Here is how Oscar Health, Inc. (OSCR) and Palomar (PLMR) have performed compared to their sector so far this year.

Oscar Health Aims to More Than Double Membership by 2027

Oscar Health reportedly aims to expand its presence in the employer market by providing more affordable health plans for small- and medium-sized businesses (SMBs). Using its position in the Affordable Care Act market, Oscar Health aims to compete with larger insurers and increase transparency on pharmacy benefits, CNBC reported Friday (June 7).

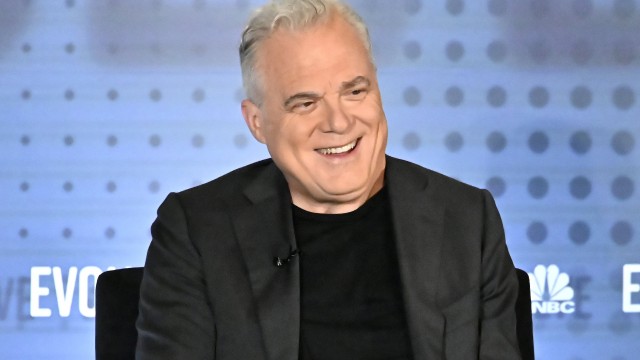

Oscar Health CEO Mark Bertolini is ready to take on the employer market

Oscar Health CEO Mark Bertolini outlined the health insurers three-year plan to become a bigger player in the employer market ahead of the company's investor day. Bertolini says Oscar can leverage its position in the ACA market to compete with larger insurers to provide more affordable health plans for small- and mid-sized companies.

Oscar Health To Double Insurer's Market Reach

Oscar Health is doubling its “market footprint” over the next three years to grow its business selling individual health insurance known as Obamacare under the Affordable Care Act as well as a new form of coverage for workers and employers.

Wall Street Bulls Look Optimistic About Oscar Health (OSCR): Should You Buy?

When deciding whether to buy, sell, or hold a stock, investors often rely on analyst recommendations. Media reports about rating changes by these brokerage-firm-employed (or sell-side) analysts often influence a stock's price, but are they really important?

Oscar Health (OSCR) Is Attractively Priced Despite Fast-paced Momentum

Oscar Health (OSCR) could be a great choice for investors looking to buy stocks that have gained strong momentum recently but are still trading at reasonable prices. It is one of the several stocks that made it through our 'Fast-Paced Momentum at a Bargain' screen.