Ouster, Inc. (OUST)

Ouster, Inc. (OUST) Laps the Stock Market: Here's Why

The latest trading day saw Ouster, Inc. (OUST) settling at $36.83, representing a +1.85% change from its previous close.

Ouster Stock Moves Above 50-Day SMA: What Should Investors Know?

Ouster surges past its 50-day average, backed by strong revenue growth, expanding software strategy and bullish analyst sentiment.

Ouster, Inc. (OUST) Registers a Bigger Fall Than the Market: Important Facts to Note

Ouster, Inc. (OUST) reached $28.95 at the closing of the latest trading day, reflecting a -5.79% change compared to its last close.

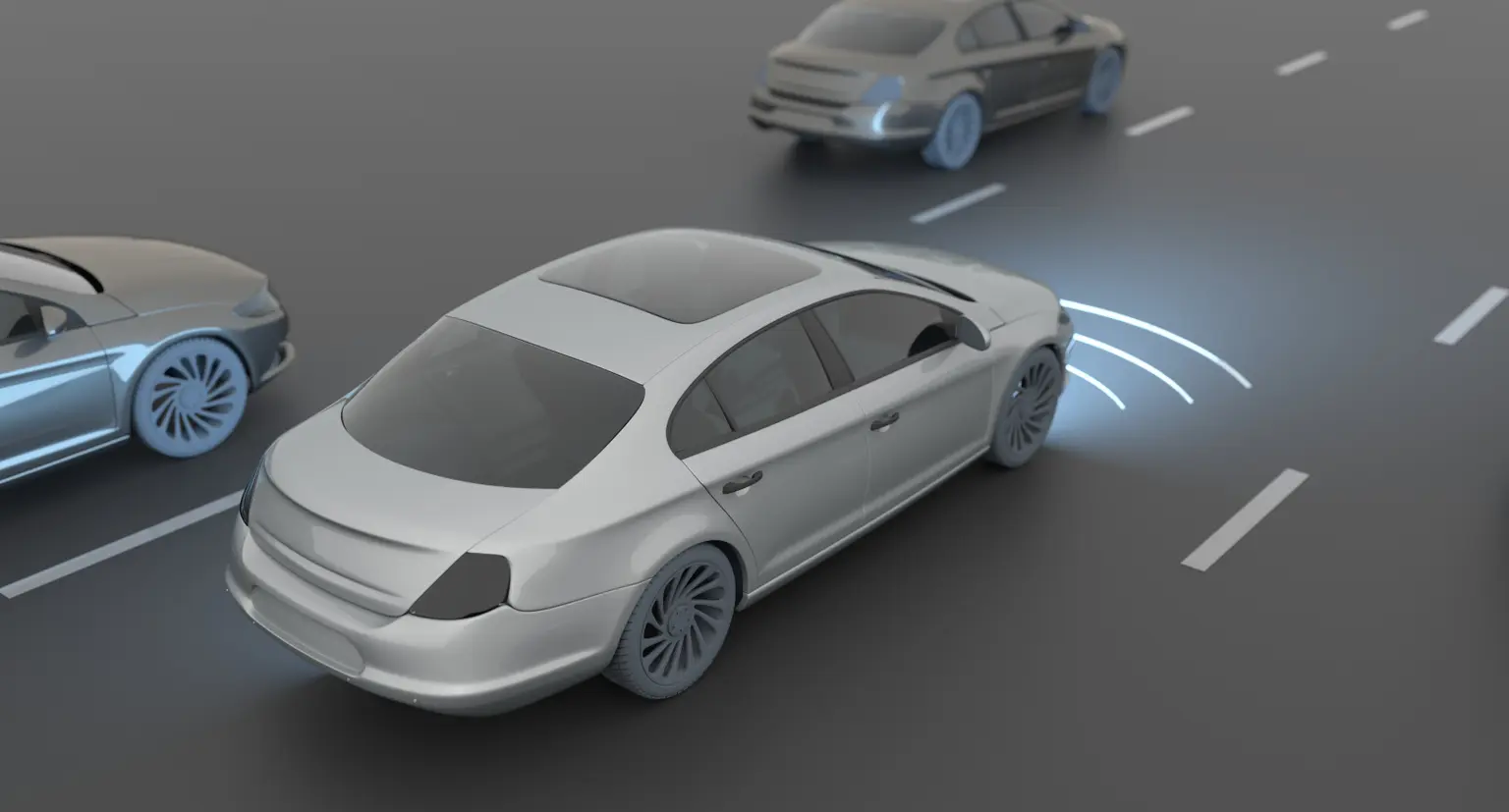

Ouster: Stronger Lidar Signals

Ouster has emerged as a domestic leader in Lidar, driven by robust non-automotive sales and consistent 30%+ growth. Customer adoption is accelerating, with pilots converting to large production orders and significant wins in smart infrastructure and robotics. Ouster's financials are strong, boasting 52% gross margins, limited cash burn, and a solid $229 million cash position.

Is Ouster (OUST) a Buy as Wall Street Analysts Look Optimistic?

The recommendations of Wall Street analysts are often relied on by investors when deciding whether to buy, sell, or hold a stock. Media reports about these brokerage-firm-employed (or sell-side) analysts changing their ratings often affect a stock's price.

Could Ouster (OUST) Stock 10X If Robotics Takes Off in the Next Decade?

Robotics Potential: The integration of AI into robotics is anticipated to revolutionize everyday tasks, with significant implications for dozens of industries.

Ouster, Inc. (OUST) Is Up 17.38% in One Week: What You Should Know

Does Ouster, Inc. (OUST) have what it takes to be a top stock pick for momentum investors? Let's find out.

Ouster, Inc. (OUST) Q2 2025 Earnings Call Transcript

Ouster, Inc. (NASDAQ:OUST ) Q2 2025 Earnings Conference Call August 7, 2025 5:00 PM ET Company Participants Charles Angus Pacala - Co-Founder, CEO & Director Chen Geng - Senior VP of Strategic Finance & Treasurer Kenneth P. Gianella - Chief Financial Officer Conference Call Participants Anand Balaji - Cantor Fitzgerald & Co., Research Division Colin William Rusch - Oppenheimer & Co. Inc., Research Division Kevin Garrigan - Rosenblatt Securities Inc., Research Division Richard Cutts Shannon - Craig-Hallum Capital Group LLC, Research Division Timothy Paul Savageaux - Northland Capital Markets, Research Division Operator Hello, and welcome to Ouster's Second Quarter 2025 Earnings Conference Call.

Ouster, Inc. (OUST) Reports Q2 Loss, Beats Revenue Estimates

Ouster, Inc. (OUST) came out with a quarterly loss of $0.38 per share versus the Zacks Consensus Estimate of a loss of $0.45. This compares to a loss of $0.53 per share a year ago.

Will Ouster, Inc. (OUST) Report Negative Earnings Next Week? What You Should Know

Ouster (OUST) doesn't possess the right combination of the two key ingredients for a likely earnings beat in its upcoming report. Get prepared with the key expectations.

Here's Why Ouster, Inc. (OUST) Fell More Than Broader Market

Ouster, Inc. (OUST) reached $23.22 at the closing of the latest trading day, reflecting a -10.47% change compared to its last close.

Ouster: Strong Lidar Sector Signals

Lidar demand has reached an inflection point, with Ouster, Inc. poised for rapid growth from deals in robotaxis, delivery robots, and defense. Consensus revenue estimates appear conservative given accelerating Lidar adoption, with potential for hockey stick growth as Lidar becomes essential for autonomy. I remain ultra bullish on OUST; any stock weakness is a buying opportunity ahead of Q2 earnings and anticipated upward guidance revisions.