Perfect Corp. (PERF)

Is Lululemon's Recent Pullback Your Perfect Entry Point?

Lululemon stock (NASDAQ:LULU) is currently trading at approximately $331 and seems undervalued based on its strong fundamentals, even though the stock often experiences volatility during turbulent market conditions. The company provided impressive Q1 2025 results, with revenue increasing by 7% to $2.37 billion and EPS rising to $2.60, just surpassing expectations.

Energy Transfer Is Your Perfect AI Bet

Energy Transfer offers an undervalued AI play, with its vast natural gas infrastructure poised to power energy-hungry data centers, despite recent stock underperformance versus the S&P 500. Q1 FY2025 showed resilient financials: adjusted EBITDA rose 5.1% YoY to $4.1 billion, and distributable cash flow (DCF) remained strong at $2.3 billion, supporting unitholder payouts. ET is targeting ~150 Texas data centers, with significant announcements anticipated soon, leveraging existing infrastructure for low-cost, quick revenue generation from AI's surging power needs.

Outfront Media: High Yield, Low Valuation Make The Perfect Setup

OUTFRONT Media offers a compelling 7.6% dividend yield and trades at a discounted 8.3x forward P/FFO, presenting strong value for income investors. Digital and transit segments are driving growth, with digital revenues now comprising 33% of total organic sales and programmatic sales up 20% YoY. With digital transformation, attractive yield, and undervaluation, OUT is well-positioned for potential double-digit total returns.

Goldman Sachs: An Almost Perfect GARP Opportunity (Rating Upgrade)

Since my last writing, a few changes have made Goldman Sachs stock an attractive combination of growth, value, and dividends. GS's profits doubled YOY in FQ4 2024, with significant contributions from Global Banking & Markets and Asset Management continuing into FQ1 2025. I see robust growth continuing given the many ongoing catalysts, such as the new Capital Solutions Group and the potential for enhanced private credit/private equity offerings.

Argenx Q1 Earnings: Less Than Perfect Report Gets Punished

Shares of argenx declined yesterday as Vyvgart missed investors' expectations. Vyvgart saw the usual negative seasonal headwinds in the U.S. in the first quarter that were further exacerbated by the Medicare redesign. Underlying demand was strong across the globe, and Vyvgart looks well positioned for continued growth, which should be helped by the approval of the PFS and international indication expansion.

Perfect Corp. (PERF) Q1 2025 Earnings Call Transcript

Perfect Corp. (NYSE:PERF ) Q1 2025 Earnings Conference Call April 28, 2025 8:00 PM ET Company Participants Jimmy Xia - Investor Relations Alice Chang - Founder, Chairwoman and Chief Executive Officer Louis Chen - Executive Vice President and Chief Strategy Officer Conference Call Participants Lisa Thompson - Zacks Investment Research Patrick McCann - Noble Capital Markets Aashi Shah - Sidoti & Company Operator Good morning, and good evening, ladies and gentlemen. Thank you for standing by and welcome to the Perfect Corp.'s First Quarter 2025 Earnings Conference Call.

Two Market Bottom Signals With Perfect Track Records

While no indicator can guarantee future market results, the Zweig Breadth Thrust's historical consistency and extreme VIX spikes above 50 offer compelling data for savvy investors to consider.

The Perfect Storm Is Forming For REIT Outperformance

REITs have been in the doghouse for years. However, that could all be changing soon—don't miss the window. I also discuss one near-zero net debt REIT offers inflation protection, recession resistance, and deep value.

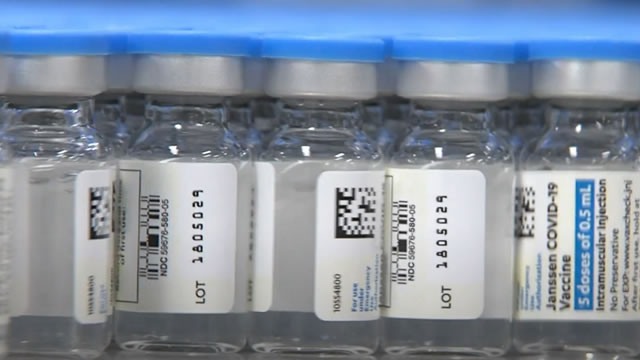

4 Reasons Johnson & Johnson Could Be the Perfect Stock to Own in Today's Turbulent Market

It's less than four months into the year, and many investors are already exhausted. The wild stock market swings fueled by the Trump administration's tariffs are to blame.

Estée Lauder: Caught In A Perfect Storm, Why I'm Buying

Estée Lauder shares have plummeted 85% from their 2022 high due to management missteps, growth challenges in China and tariff-related fears. Despite Estée Lauder's current challenges, I have opened a position in EL stock, as I believe that the market is currently underestimating the company's potential. The company's solid gross profitability and manageable debt levels suggest a turnaround is possible, making EL shares an attractive long-term investment at their current valuation.

A Market Downturn Creates a Perfect Entry Point for This Promising AI Player

Across the board, AI stocks had a difficult 2025. Some companies have lost hundreds of billions of dollars in value over the first three months of the year.

When It Comes To Investing, Nobody's Perfect, But Two Out Of Three Ain't Bad

Predicting market outcomes is challenging; my recommendations are based on historical data and probabilities rather than certainties. I reviewed my 2025 picks: 67% of Buy ratings and 78% of Hold ratings delivered positive alpha, outperforming many experts. Midstream energy and covered call income funds have shown strong performance, while recent market corrections impacted some picks.