Powell Industries Inc. (POWL)

POWL vs. ABBNY: Which Stock Is the Better Value Option?

Investors with an interest in Manufacturing - Electronics stocks have likely encountered both Powell Industries (POWL) and ABB (ABBNY). But which of these two stocks offers value investors a better bang for their buck right now?

Is Powell Industries (POWL) Outperforming Other Industrial Products Stocks This Year?

Here is how Powell Industries (POWL) and Zurn Water (ZWS) have performed compared to their sector so far this year.

Here is What to Know Beyond Why Powell Industries, Inc. (POWL) is a Trending Stock

Powell Industries (POWL) has received quite a bit of attention from Zacks.com users lately. Therefore, it is wise to be aware of the facts that can impact the stock's prospects.

Powell Industries: Don't Chase This Rally - No Margin Of Safety

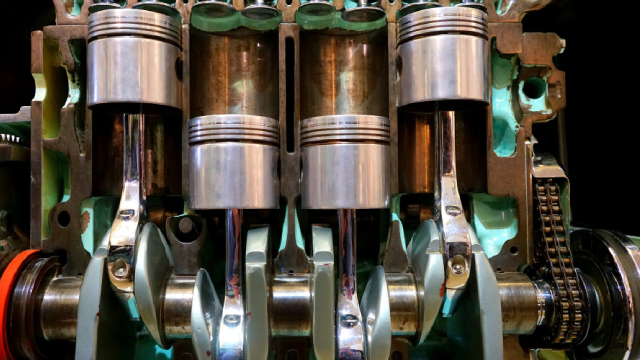

POWL continues to enjoy growth tailwinds from the multi-year oil/ gas capex along with the data center capex boom. These have triggered the robust FY2024 numbers along with the stable multi-year backlog, significantly aided by the ongoing manufacturing expansions set to be completed by H1'25. If anything, POWL's ability to grow organically, while maintaining a healthy balance sheet and zero debt, has been impressive indeed.

POWL or ETN: Which Is the Better Value Stock Right Now?

Investors with an interest in Manufacturing - Electronics stocks have likely encountered both Powell Industries (POWL) and Eaton (ETN). But which of these two stocks presents investors with the better value opportunity right now?

Powell Stock Plunges 10.1% Post Q4 Earnings: Is This a Buy Opportunity?

With POWL's shares losing 10.1% after reporting fiscal fourth-quarter results, let us find the best strategy for investors now.

Is Trending Stock Powell Industries, Inc. (POWL) a Buy Now?

Powell Industries (POWL) has been one of the stocks most watched by Zacks.com users lately. So, it is worth exploring what lies ahead for the stock.

Why Powell Industries (POWL) Might be Well Poised for a Surge

Powell Industries (POWL) shares have started gaining and might continue moving higher in the near term, as indicated by solid earnings estimate revisions.

Powell Industries, Inc. (POWL) Q4 2024 Earnings Call Transcript

Powell Industries, Inc. (NASDAQ:POWL ) Q4 2024 Results Conference Call November 20, 2024 11:00 AM ET Company Participants Ryan Coleman - IR Brett Cope - Chairman & CEO Mike Metcalf - CFO Conference Call Participants John Franzreb - Sidoti & Company Jon Braatz - Kansas City Capital Operator Welcome to the Powell Industries' Earnings Conference Call. All participants will be in a listen-only mode.

Powell Industries Powers Forward After Q4 Earnings As Shorts Drive Down Stock Price

Powell Industries has experienced significant growth due to Industry 4.0 trends, but recent earnings suggest a slowdown, prompting a downgrade to Hold. Despite strong FY 2024 results, including a 45% revenue increase and 150% net income growth, valuation metrics indicate POWL stock is overvalued. High short interest and post-earnings sell-off reflect market concerns about slower growth and potential volatility, especially with a cautious FY 2025 outlook.

Powell Industries' Q4 Earnings Surpass Estimates, Increase Y/Y

POWL's fourth-quarter fiscal 2024 revenues increase 32% year over year, driven by growth across petrochemical, oil & gas and commercial & other industrial sectors.

Powell Industries Earnings: Deceleration Sparks Concerns

Powell Industries' strong balance sheet and reasonable valuation are overshadowed by stagnant backlog and decelerating revenue growth, leading to a neutral rating. Despite solid momentum in emerging sectors, fiscal Q1 2025 revenue growth is expected to decelerate significantly, raising investor concerns. Operating profit margins have improved, but substantial cash flow will be allocated to capital projects, limiting shareholder returns.