Primoris Services Corporation (PRIM)

Should Value Investors Buy Primoris Services (PRIM) Stock?

Here at Zacks, our focus is on the proven Zacks Rank system, which emphasizes earnings estimates and estimate revisions to find great stocks. Nevertheless, we are always paying attention to the latest value, growth, and momentum trends to underscore strong picks.

Are Investors Undervaluing Primoris Services (PRIM) Right Now?

Here at Zacks, our focus is on the proven Zacks Rank system, which emphasizes earnings estimates and estimate revisions to find great stocks. Nevertheless, we are always paying attention to the latest value, growth, and momentum trends to underscore strong picks.

Wall Street Analysts Predict a 36.26% Upside in Primoris Services (PRIM): Here's What You Should Know

The average of price targets set by Wall Street analysts indicates a potential upside of 36.3% in Primoris Services (PRIM). While the effectiveness of this highly sought-after metric is questionable, the positive trend in earnings estimate revisions might translate into an upside in the stock.

Should Value Investors Buy Primoris Services (PRIM) Stock?

Here at Zacks, our focus is on the proven Zacks Rank system, which emphasizes earnings estimates and estimate revisions to find great stocks. Nevertheless, we are always paying attention to the latest value, growth, and momentum trends to underscore strong picks.

Primoris: Some Admirable Facets, But Going Through Some Wobbles

Primoris Services Corporation has surged by 55% over the past year, outperforming its Russell 2000 peers and infrastructure sector counterparts quite handsomely. We touch upon some of the alluring facets of the Primoris story. Relative to its peers, PRIM may appear to be cheap on a P/E basis (although it is not cheap relative to its own average), but this is a function of weak earnings.

Are Investors Undervaluing Primoris Services (PRIM) Right Now?

Here at Zacks, our focus is on the proven Zacks Rank system, which emphasizes earnings estimates and estimate revisions to find great stocks. Nevertheless, we are always paying attention to the latest value, growth, and momentum trends to underscore strong picks.

Primoris Services Corporation (PRIM) Q4 2024 Earnings Call Transcript

Primoris Services Corporation (NYSE:PRIM ) Q4 2024 Earnings Conference Call February 25, 2025 10:00 AM ET Company Participants Blake Holcomb - Vice President of Investor Relations Thomas McCormick - President and Chief Executive Officer Ken Dodgen - Chief Financial Officer Conference Call Participants Steven Fisher - UBS Sangita Jain - KeyBanc Capital Markets Inc. Joseph Osha - Guggenheim Securities Adam Thalhimer - Thompson, Davis & Company, Inc. Brent Thielman - D.A. Davidson & Co. Adam Bubes - Goldman Sachs Group, Inc. Drew Chamberlain - JPMorgan Chase & Co. Brian Russo - Jefferies Operator Ladies and gentlemen, thank you for standing by.

Primoris Services (PRIM) Q4 Earnings and Revenues Top Estimates

Primoris Services (PRIM) came out with quarterly earnings of $1.13 per share, beating the Zacks Consensus Estimate of $0.73 per share. This compares to earnings of $0.85 per share a year ago.

Primoris Services (PRIM) Upgraded to Strong Buy: Here's What You Should Know

Primoris Services (PRIM) has been upgraded to a Zacks Rank #1 (Strong Buy), reflecting growing optimism about the company's earnings prospects. This might drive the stock higher in the near term.

Primoris Services Corporation (PRIM) Q3 2024 Earnings Call Transcript

Primoris Services Corporation (NYSE:PRIM ) Q3 2024 Results Conference Call November 5, 2024 10:00 AM ET Company Participants Blake Holcomb - Vice President, Investor Relations Tom McCormick - President and Chief Executive Officer Ken Dodgen - Chief Financial Officer Conference Call Participants Pete Lukas - CJS Securities Adam Bubes - Goldman Sachs Drew Chamberlain - JPMorgan Kevin Gainey - Thompson Davis Brent Thielman - D.A. Davidson Judah Aronovitz - UBS Alex Hantman - Sidoti Operator Ladies and gentlemen, good day, and thank you for standing by.

Primoris Services (PRIM) Q3 Earnings and Revenues Top Estimates

Primoris Services (PRIM) came out with quarterly earnings of $1.22 per share, beating the Zacks Consensus Estimate of $0.95 per share. This compares to earnings of $1.02 per share a year ago.

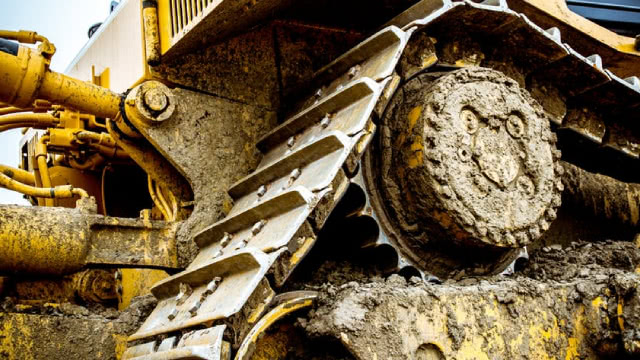

Primoris Is A Politically Neutral Renewables Infrastructure Value Play

Shrill political rhetoric supporting and opposing climate change, renewables, etc.