PayPal Holdings Inc. (PYPL)

PayPal Stock: This Rally May Be Just The Beginning

I think PayPal's recent rally is just the beginning, as the stock remains undervalued given its growth prospects and strategic cost-saving measures. Q2 2024 results exceeded expectations with an 8% revenue increase, 28% adjusted net income growth, and substantial EPS gains, showcasing effective cost control. PayPal's expansion into cryptocurrency for U.S. business customers and innovative payment solutions like "Buy Now Pay Later" drive future growth and user retention.

PayPal Stock Is Up 20% in 2 Months. Here's Why the Stock Could Double From Here

PayPal's stock is just getting started.

You'll Never Believe Which Beaten-Down Financial Stock Is Suddenly Outperforming the S&P 500 in 2024

It might have just taken a little time for the wheels on this turnaround to get some traction on the road to recovery.

PayPal CEO's first year was praised by Wall Street, but hard part starts now for struggling payments company

PayPal CEO Alex Chriss just wrapped up his first year on the job at the payments company, which was in a protracted downturn when he took over. Bolstered by cost cuts and improved margins, the stock jumped 34% in the third quarter, which closed on Monday, its best quarterly performance since 2020.

Paypal (PYPL) Rises But Trails Market: What Investors Should Know

The latest trading day saw Paypal (PYPL) settling at $78.03, representing a +0.19% change from its previous close.

PayPal Soars To New Heights: Why Analysts See More Upside

There aren't many deals to consider for further value in the technology sector. However, one stock is looking to change that narrative by delivering on previous promises.

PayPal is headed for a total transformation, CEO says

Turning around an iconic company that has been stumbling is no small task. Sometimes, a turnaround never materializes.

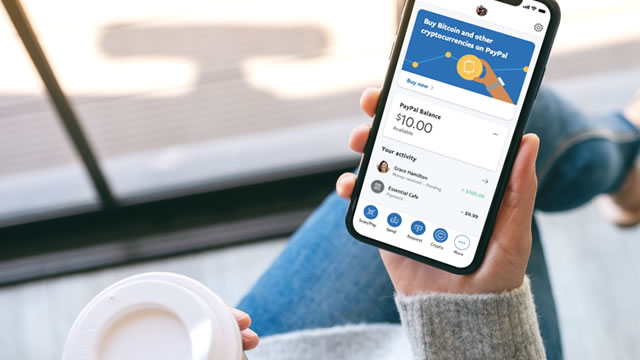

PayPal Will Allow Businesses to Buy and Sell Crypto

PayPal will bring bitcoin and other virtual coins to "millions" of merchants across the US.

PayPal's stock is having its best year since 2020, and this is a big reason why

When PayPal CEO Alex Chriss took over a year ago, investors questioned whether the company had a future. Now he says product innovations have helped change the conversation.

Final Trades: Palo Alto Networks, Delta Air Lines, PayPal and the XLV

The Investment Committee give you their top stocks to watch for the second half.

Paypal (PYPL) Is Up 9.50% in One Week: What You Should Know

Does Paypal (PYPL) have what it takes to be a top stock pick for momentum investors? Let's find out.