PayPal Holdings Inc. (PYPL)

Is Solana the Next PayPal?

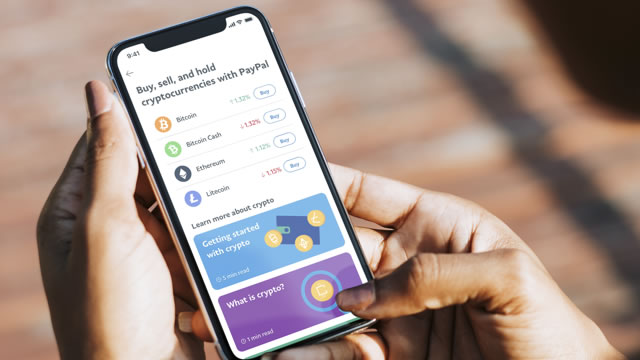

Solana's fast transaction times and low fees could be exactly what merchants are looking for. PayPal has long dominated the electronic payments niche, generating billions of free cash flow.

Investors Heavily Search PayPal Holdings, Inc. (PYPL): Here is What You Need to Know

Paypal (PYPL) has been one of the stocks most watched by Zacks.com users lately. So, it is worth exploring what lies ahead for the stock.

Why PayPal's Strategic Moves Make It A Buy In The Digital Payments Space

PayPal's Q2 results demonstrated the company's financial strength: revenues continue to grow at a healthy pace and margins remain strong despite the less profitable success of Braintree. Strategic initiatives to drive branded checkout, combined with digital advertising capabilities, will support revenues and margins going forward. Expanding partnerships partially mitigates the risk of digital payment competition. From a financial perspective, the strategy is working well.

Paypal (PYPL) Up 7.1% Since Last Earnings Report: Can It Continue?

Paypal (PYPL) reported earnings 30 days ago. What's next for the stock?

Is PayPal's Growth At Risk? A Deep Dive Into Market Dynamics (Technical Analysis)

PayPal stock remains a buy, with significant gains achieved from previous recommendations, but faces potential short-term resistance and risks. The financial sector's growth contrasts with rising household debt and declining savings, raising concerns about consumption sustainability. PYPL is recovering from a downtrend, aiming for a long-term uptrend, but caution is needed as it encounters critical resistance levels.

PayPal Solid Financials Indicating a Strong Buying Opportunity

PayPal is forming a bottom at long-term support, backed by solid financials, as reported in the Q2 2024 earnings report.

PayPal: The Transformation Is Finally Here

PayPal's intrinsic value is $125 per share, representing 75% upside, even while accounting for a loss of market share. If the management were to use 100% of FCF toward buybacks, they could repurchase all outstanding shares within the decade. A stark contrast to the "dead money" argument. Fastlane, PayPal's new passwordless checkout solution, is now rolling out. It significantly improves merchant conversion rates and consumer experience, a win-win situation for both.

PayPal's Partnership With Adyen And The Launch Of Fastlane Are Simplifying Guest Checkouts Speeding Up Processes And Fueling A 42% Recovery From Recent Lows

Strategic partnerships between major companies like PayPal Holdings Inc PYPL and Adyen NV ADYEN are raising the bar for efficiency and consumer convenience. Their new project, Fastlane by PayPal, is set to revolutionize the checkout process for millions of U.S. users, particularly targeting enterprise and marketplace clients.

Is It Too Late to Buy PayPal Stock?

PayPal's new CEO has been focusing on improving the consumer experience to drive higher growth in its PayPal-branded business. It's fixing its price structure in the unbranded business to drive higher profits.

1 Undervalued Growth Stock Down 75% You'll Regret Not Buying

Despite increased competition, PayPal is becoming a stronger business.

PayPal's Reversal Is Here: Buy This Gift Before The Breakout Happens

PYPL's new management has delivered promising performance metrics, while raising its FY2024 guidance, thanks to the growing monetization of its existing fintech offerings. This is on top of the new growth initiatives through Fastlane and PayPal Ads, with it likely to continue driving user growth and accelerating top/ bottom-lines. With another beat and raise quarter likely in the FQ3'24 earnings call, we believe that PYPL remains a compelling growth stock for opportunistic investors.

1 Stock I'm Buying Hand Over Fist in 2024

Two of our contributors agree that this turnaround play could be a home run for patient investors.