PayPal Holdings Inc. (PYPL)

PayPal: Strong Earnings But Stock Trailing Lower

PayPal reported strong Q1'24 earnings, beating estimates and showing healthy total payment volume and revenue growth. The company's new CEO, Alex Chriss, is implementing new business strategies and building a new C-Suite to turn PayPal into a more focused and profitable company. Positive indicators of future growth include increased gross margin, expanded operating margins, and positive momentum in active accounts and revenue-driving metrics.

1 Stock Down 74% That Could Make You Richer in 2024 and Beyond

PayPal is not performing nearly as well as it was just four years ago. However, the company is implementing various growth strategies.

Forget Nvidia. Two Billionaire Investors Just Cut Their Positions -- and They Both Bought the Same Fintech Stock.

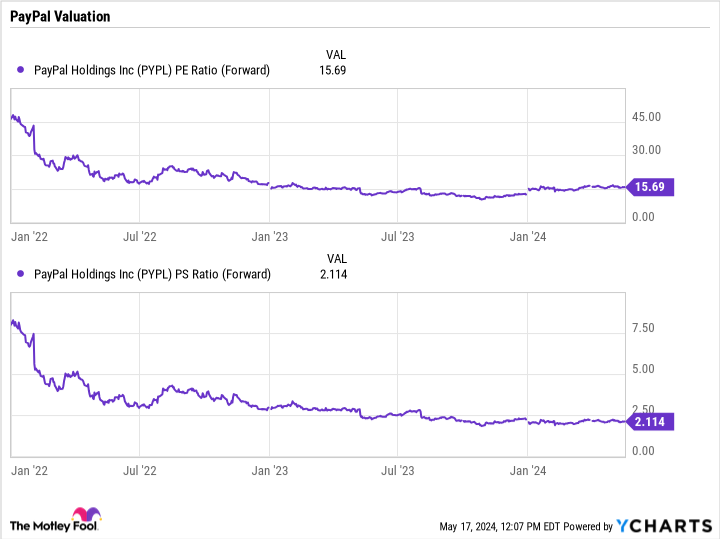

Billionaire hedge fund pioneer Paul Tudor Jones of Tudor Investment reduced his stake in chip giant Nvidia in the first quarter, undoubtedly making a tidy profit on the sale. He then funneled that money into a new investment in embattled fintech company PayPal (NASDAQ: PYPL). Jones wasn't the only investor making this move, as Philippe Laffont of Coatue Management made a similar move, trimming his stake in Nvidia while adding to his PayPal position. The investor, worth an estimated $6 billion, piled into PayPal shares, taking his holdings from 27,200 shares at the end of 2023 to over 8 million shares at the end of March. Let's look at what may have attracted these billionaires to PayPal and if investors should follow their lead and scoop up the stock. One of the first things that likely drew Tutor Investment and Coatue Management to PayPal's stock is its valuation. The stock has had a rough go the past few years, down over 40% the last five years. During that time, PayPal has still solidly grown its revenue; however, it has seen some gross margin pressure the past two years. Nonetheless, that has left the stock trading at a very attractive valuation. The company only trades at a forward price-to-earnings (P/E) ratio of just over 15.5 times and forward price-to-sales (P/S) ratio near 2 times. That does not tell the whole story, as the company also has $8 billion in net cash and investments, of which about $1.8 billon was in equity investments. Excluding that, its forward P/E drops closer to 13.5 times. That's an inexpensive valuation, but a cheap stock alone is not reason enough to invest in PayPal. The other big factor that likely attracted these billionaire investors to PayPal is CEO James Chriss and his plans to turn the company around and position it for the future. Chriss took the reins as chief executive of PayPal last September, coming over from Intuit where he ran the company's Small Business and Self-Employed Group. He quickly established himself a strong leader pushing PayPal to innovate. Since Chriss has taken over, the company has come up with a number of artificial intelligence (AI) driven advances. Perhaps the most exciting is its Fastlane product. This new checkout solution enables a merchant's customers to check out with a single tap without having to set up an account and provide credit card information across various merchants. Online retailers lose quite a lot of potential business when consumers fail to complete their purchases. In early tests, the PayPal merchants testing Fastlane have seen an 80% increase in conversion rates. This is a big win for retailers and makes a product like Fastlane highly desirable. The company will start rolling the product out domestically in the second half of the year. PayPal has introduced a number of other value-added solutions as well. It announced a couple of marketing-oriented products, such as Smart Receipts and Advanced Offer Platforms, that will allow merchants to craft personalized recommendations and customize offers using data based on what customers have bought in the past, either at their own websites or across the internet. It has introduced a fraud management solution as well. With innovation, the company is also looking to change how its solutions are priced. One of PayPal's issues over the last few years has been a deterioration in gross margins, as companies have moved more toward its lower-margin unbranded solution BrainTree. Chriss believes the value of PayPal's solutions far exceeds that of competitive offers, and thus he plans to start pricing based on value. On PayPal's Q1 earnings call, Chriss said that while this process will take time, the company is already having conversations with its top customers about pricing and focusing on commercial outcomes. PayPal is an inexpensive stock with a strong balance sheet that has continued to solidly grow its revenue. Gross margins have been an issue, but the company clearly has a plan in place to address this issue through innovation and pricing based on value. That's an attractive combination and why the stock has been starting to gain the attention of well-regarded billionaire investors. While there is always the risk that PayPal's new products don't gain traction or that its pricing power is limited, given its valuation, this looks a good opportunity to invest in the stock ahead of a potential turnaround. As such, now is still a great time to buy the fintech stock. Before you buy stock in PayPal, consider this: The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and PayPal wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years. Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $566,624!* Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*. See the 10 stocks » *Stock Advisor returns as of May 13, 2024 Geoffrey Seiler has positions in PayPal. The Motley Fool has positions in and recommends Intuit, Nvidia, and PayPal. The Motley Fool recommends the following options: short June 2024 $67.50 calls on PayPal. The Motley Fool has a disclosure policy. Forget Nvidia. Two Billionaire Investors Just Cut Their Positions -- and They Both Bought the Same Fintech Stock. was originally published by The Motley Fool

Forget Nvidia. Two Billionaire Investors Just Cut Their Positions -- and They Both Bought the Same Fintech Stock.

Billionaires Paul Tudor Jones and Philippe Laffont both just reduced their stakes in Nvidia and bought PayPal shares. PayPal shares are cheap with the stock well off its highs.

PayPal: Rewriting The Rules In A Transitional Year

PYPL is trying to bounce back after three years of underperformance, and its valuation hitting rock bottom all-time lows after 80% sell-off. PayPal's first-quarter results show a 9% revenue increase and a 14% rise in Total Payment Volume, driven by enhanced features in Venmo and strategic market expansions. Bolstered by Fibonacci retracements and a positive Volume Price Trend, PayPal's stock is projected to reach $79 by the end of 2024, balancing bullish indicators with existing market volatility.

PayPal: A Great Value For Long-Term Investors

PayPal's undemanding valuation does not align with its strong fundamentals and growth prospects. The company has a leading position in the digital payments industry and has grown through organic initiatives and acquisitions. While PayPal's growth has slowed in recent years, it remains highly cash generative and has a solid financial position.

PayPal Holdings, Inc. (PYPL) is Attracting Investor Attention: Here is What You Should Know

Paypal (PYPL) has been one of the stocks most watched by Zacks.com users lately. So, it is worth exploring what lies ahead for the stock.

Is PayPal a Millionaire Maker?

The long-term growth of e-commerce and digital payments should propel PayPal for many years. PayPal generates sizable free cash flow that it uses to fund share buybacks.

AppTech Payments Aims to Take on Venmo With InstaCash

Frictionless commerce firm AppTech Payments completed the pilot of its Banking-as-a-Service (BaaS) platform. Now, the company will use the BaaS solution for the commercial launch of InstaCash, a real-time pay-by-bank transaction system that AppTech is positioning as a rival to both Venmo and Western Union, according to a Thursday (May 16) press release.