Rigetti Computing, Inc. (RGTI)

Rigetti Computing: Rating Downgrade Driven By Overheated Valuation

Rigetti Computing (RGTI) is making technical progress and expanding partnerships, but financials remain weak with declining revenue and widening losses. RGTI trades at extremely high valuation multiples—over 1,000x sales—despite falling revenue, high cash burn, and heavy reliance on government contracts. Recent momentum and hype have driven the stock up nearly 92%, but fundamentals have not caught up to justify the price surge.

Alert: Rigetti Computing (RGTI) Stock Is Vulnerable

Instead of looking for the “next” artificial intelligence (AI) stock, some traders are turning to quantum computing stocks for big price moves.

Rigetti Computing, Inc. (RGTI) Reports Q3 Loss, Lags Revenue Estimates

Rigetti Computing, Inc. (RGTI) came out with a quarterly loss of $0.03 per share versus the Zacks Consensus Estimate of a loss of $0.05. This compares to a loss of $0.08 per share a year ago.

Rigetti's New Orders and India MoU: Will They Boost Q3 Performance?

RGTI secures $5.7M in Novera system orders and India MOU, but Q3 will test if momentum can turn into real revenue growth.

Rigetti Pre-Q3 Earnings Analysis: Buy, Sell or Hold the Stock?

RGTI's Q3 results are likely to reflect steady quantum progress but limited near-term revenue growth as public-sector funding uncertainty lingers.

Rigetti Computing to Post Q3 Earnings: What's in Store for the Stock?

RGTI's Q3 results are likely to gain from U.S. funding clarity, new contracts and gains from its next-gen quantum system.

Rigetti Computing (RGTI) Is Considered a Good Investment by Brokers: Is That True?

Investors often turn to recommendations made by Wall Street analysts before making a Buy, Sell, or Hold decision about a stock. While media reports about rating changes by these brokerage-firm employed (or sell-side) analysts often affect a stock's price, do they really matter?

Rigetti Computing, Inc. (RGTI) Stock Falls Amid Market Uptick: What Investors Need to Know

In the most recent trading session, Rigetti Computing, Inc. (RGTI) closed at $39.12, indicating a -11.63% shift from the previous trading day.

Promising Value Stocks To Follow Today – October 28th

Invesco QQQ, Rigetti Computing, CoreWeave, AltC Acquisition, United Parcel Service, BigBear.ai, and D-Wave Quantum are the seven Value stocks to watch today, according to MarketBeat's stock screener tool. Value stocks are shares of companies that appear to trade below their intrinsic or fair value based on fundamentals such as earnings, book value, or cash flow.

Is Trending Stock Rigetti Computing, Inc. (RGTI) a Buy Now?

Recently, Zacks.com users have been paying close attention to Rigetti Computing (RGTI). This makes it worthwhile to examine what the stock has in store.

Where Will Rigetti Computing Stock Be in 10 Years?

Quantum computing is attracting investor attention, but it could be decades before it is ready for prime time. Is it too early to bet on pure plays like Rigetti?

Should You Buy Rigetti Computing After Its 3,800% Rally Over the Past Year?

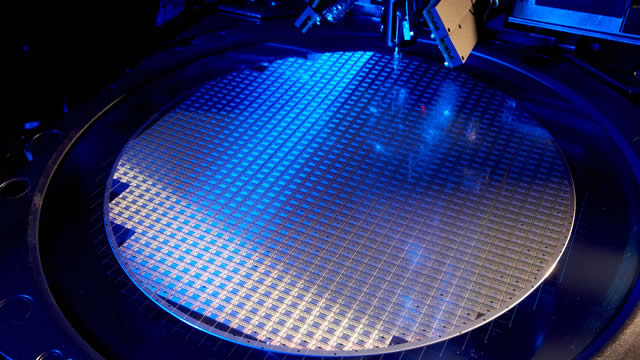

Rigetti Computing recently sold two of its quantum computing systems. The stock has pulled back from its all-time high.