Raymond James Financial Inc. (RJF)

Raymond James Financial (RJF) Q4 Earnings: How Key Metrics Compare to Wall Street Estimates

Although the revenue and EPS for Raymond James Financial (RJF) give a sense of how its business performed in the quarter ended September 2024, it might be worth considering how some key metrics compare with Wall Street estimates and the year-ago numbers.

Raymond James Financial, Inc. (RJF) Tops Q4 Earnings and Revenue Estimates

Raymond James Financial, Inc. (RJF) came out with quarterly earnings of $2.95 per share, beating the Zacks Consensus Estimate of $2.44 per share. This compares to earnings of $2.13 per share a year ago.

What Analyst Projections for Key Metrics Reveal About Raymond James Financial (RJF) Q4 Earnings

Beyond analysts' top -and-bottom-line estimates for Raymond James Financial (RJF), evaluate projections for some of its key metrics to gain a better insight into how the business might have performed for the quarter ended September 2024.

IB & Trading to Aid Raymond James' Q4 Earnings, High Costs to Hurt

Decent IB fees, NII and trading revenue growth are likely to have aided RJF's fourth-quarter fiscal 2024 earnings, while higher expenses are likely to have hurt.

Raymond James Financial, Inc. (RJF) Earnings Expected to Grow: What to Know Ahead of Next Week's Release

Raymond James Financial (RJF) doesn't possess the right combination of the two key ingredients for a likely earnings beat in its upcoming report. Get prepared with the key expectations.

Strategic Buyouts & Diverse Revenues Aid Raymond James Amid Cost Woes

RJF is well-poised for growth on solid PCG segment performance and strategic acquisitions. Yet, volatile capital market performance and high costs are woes.

Why Raymond James Financial, Inc. (RJF) is a Top Value Stock for the Long-Term

Wondering how to pick strong, market-beating stocks for your investment portfolio? Look no further than the Zacks Style Scores.

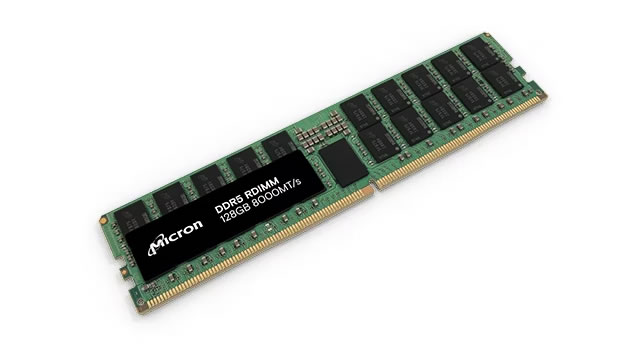

Why Micron Stock Is Sinking Today

Raymond James and Exane BNP Paribas both lowered their price targets for Micron stock today. Raymond James still thinks the stock is a buy, but it's lowering its forecast due to weaker-than-expected growth trends.

Here's Why Raymond James Financial, Inc. (RJF) is a Strong Value Stock

Whether you're a value, growth, or momentum investor, finding strong stocks becomes easier with the Zacks Style Scores, a top feature of the Zacks Premium research service.

Here's Why Raymond James Financial, Inc. (RJF) is a Strong Momentum Stock

Whether you're a value, growth, or momentum investor, finding strong stocks becomes easier with the Zacks Style Scores, a top feature of the Zacks Premium research service.

Raymond James: Undervalued Opportunity To Buy Profitable Asset Manager And Wealth Advisor

Signs of market undervaluation after the summer downgrade from Wolfe Research present potential to buy below the 200-day SMA. Proven YoY revenue and earnings growth along with future analyst EPS growth forecast, driven by AUA and fee-driven business. Tier 1 capital is well above regulatory minimums, and CRE loan exposure is part of a large and diversified asset portfolio.

Raymond James: Ignore Schwab Earnings, Bank Is Solid

Charles Schwab shares dropped 9% after a disappointing quarterly report, announcing a shift to rely more on third-party banks for capital and funding risks. This caused Raymond James Financial, Inc. stock to sell off. However, Raymond James is outperforming Schwab operationally with better balance sheet management, strategic foresight, and strong financial resilience, leading to my strong buy opinion. Raymond James' strong growth in assets under management, revenue, and strategic initiatives position them as an ideal long-term investment with potential upside.