Rocket Lab Corporation (RKLB)

Best-Performing Leveraged ETFs of Last Week

Trump's sweeping tariff threats rattled markets, but leveraged ETFs like MSOX and ETHU soared on sector momentum.

Stocks Up 50% to Buy for the Second Half of 2025

Key Points in This Article: The stock market in 2025 has faced significant volatility due to macroeconomic pressures like trade policies and high interest rates, yet the S&P 500 has reached new highs, highlighting opportunities in resilient, high-growth sectors.

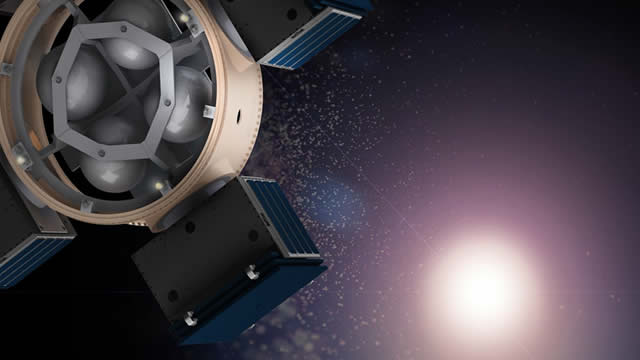

The Meteoric Rise of Rocket Lab: A Space Stock to Watch

Rocket Lab was founded in 2006 by CEO Peter Beck and went public via SPAC in 2021. Initially known for its small satellite launch capabilities via its Electron rocket, the company has since expanded into spacecraft manufacturing, satellite components, and now satellite payloads.

Trump's latest clash with Elon Musk gives this stock a big boost

Shares of Rocket Lab Corp. ended Monday's session up 9% amid the ongoing clash between President Donald Trump and SpaceX Chief Executive Elon Musk.

Rocket Lab: Runway Still Clear

Rocket Lab's Q1-FY25 revenue hit $122.6 million, up 32.1% YoY, driven by strong Space Systems performance. Neutron rocket development targets 13-ton payloads with a $50–55 million ASP, competing directly with SpaceX's Falcon 9. Vertical integration boosts gross margin to 28.8% GAAP and 33.4% non-GAAP, exceeding management's guided ranges.

Rocket Lab: Latest Catalysts Bolster the Bull Case

Rocket Lab USA NASDAQ: RKLB continues to defy expectations. While the broader market grapples with macroeconomic uncertainty and rising volatility, this vertically integrated space and defense company continues to deliver.

Another Reason To Add Rocket Lab: Moving Forward With U.S. Space Defense

Rocket Lab Corporation's flawless Electron launch record and growing backlog highlight strong operational execution and robust demand for both launch and space systems. Steps forward in the $515M Department of Defense contract mark a major milestone, positioning Rocket Lab as a prime contractor for U.S. space defense. Despite recent all-time highs and a pullback to sub-$35, I see this as a fresh buying opportunity given the company's growth trajectory and contract wins.

Rocket Lab's Quiet Power Move

Rocket Lab reported Q1 2025 revenue of $122.6 million, with $87 million driven by its high-margin Space Systems segment. The company's $1.067 billion backlog, over 56% convertible within 12 months, anchors multi-year sovereign and defense contracts. The global space economy projected to triple to $1.8 trillion by 2035, with backbone and reach segments growing at 7% and 11% CAGR.

Rocket Lab CEO Peter Beck: One thing I don't worry about at night is demand

Peter Beck, Rocket Lab CEO, joins 'Closing Bell Overtime' to talk its record launches, demand in the space, M&A, and more.

Rocket Lab ($RKLB) | Eve Air Mobility ($EVEX) | JinkoSolar ($JKS) | Hut 8 ($HUT)

Welcome to the Green Stock News brief for Monday June 30th. Here are today's top headlines: Rocket Lab (NASDAQ: RKLB) has successfully launched its 68th Electron rocket from New Zealand, deploying a satellite for a commercial customer in a mission called “Symphony In The Stars.

Should You Buy Rocket Lab While It's Below $40?

Space and defense stocks have gone to the moon this market cycle (pun intended). Rocket Lab (RKLB -1.99%) is one of the great beneficiaries of this trend, as the rocket launch, space systems, and defense company has seen its stock soar close to 600% in the last 12 months, absolutely crushing the broad market indices.

Rocket Lab Corporation (RKLB) Stock Sinks As Market Gains: Here's Why

Rocket Lab Corporation (RKLB) concluded the recent trading session at $35.38, signifying a -2.1% move from its prior day's close.