Rockwell Automation, Inc. (ROK)

Summary

ROK Chart

Why Rockwell Automation (ROK) is a Top Growth Stock for the Long-Term

Whether you're a value, growth, or momentum investor, finding strong stocks becomes easier with the Zacks Style Scores, a top feature of the Zacks Premium research service.

Are You Looking for a Top Momentum Pick? Why Rockwell Automation (ROK) is a Great Choice

Does Rockwell Automation (ROK) have what it takes to be a top stock pick for momentum investors? Let's find out.

Rockwell Automation, Inc. (ROK) Hit a 52 Week High, Can the Run Continue?

Rockwell Automation (ROK) is at a 52-week high, but can investors hope for more gains in the future? We take a look at the company's fundamentals for clues.

Rockwell Automation, Inc. (ROK) FAQ

What is the stock price today?

On which exchange is it traded?

What is its stock symbol?

Does it pay dividends? What is the current yield?

What is its market cap?

What is the earnings per share?

When is the next earnings date?

Has Rockwell Automation, Inc. ever had a stock split?

Rockwell Automation, Inc. Profile

| Machinery Industry | Industrials Sector | Blake D. Moret CEO | XWBO Exchange | US7739031091 ISIN |

| US Country | 27,000 Employees | 17 Nov 2025 Last Dividend | 14 Apr 1987 Last Split | 1 Jan 1987 IPO Date |

Overview

Rockwell Automation, Inc. is a prominent provider of industrial automation and digital transformation solutions, with a global presence that encompasses North America, Europe, the Middle East, Africa, the Asia Pacific, and Latin America. The company organizes its operations into three main segments: Intelligent Devices, Software & Control, and Lifecycle Services. Rockwell Automation delivers an extensive range of hardware and software products alongside services designed to cater to various industrial requirements. Originally founded in 1903 and based in Milwaukee, Wisconsin, the company has a long history of innovation and service in the automation industry. It chiefly markets its solutions through an extensive network of independent distributors, supplemented by its direct sales force, addressing the needs of discrete, hybrid, and process end markets across diverse industries such as automotive, life sciences, and oil and gas, among others.

Products and Services

Rockwell Automation, Inc.'s extensive range of products and services is categorized into three distinct segments, addressing different aspects of industrial automation and digitalization:

-

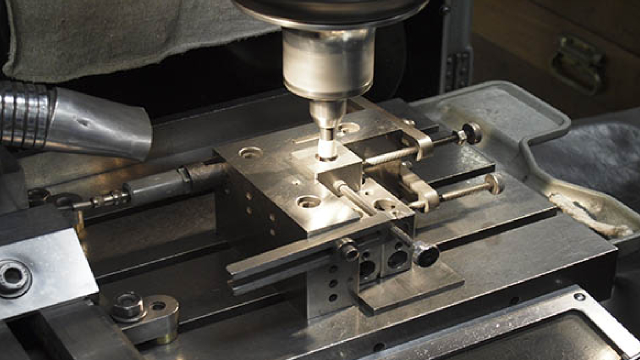

Intelligent Devices:

This segment encompasses a variety of automation components including drives, motion control systems, safety products, sensing devices, industrial components, and products tailored to specific order requirements. These devices are crucial for the effective automation of mechanical processes and ensure enhanced safety and efficiency in industrial operations.

-

Software & Control:

Offering both software and hardware solutions, this segment is focused on control and visualization applications, information software, and the provision of networking and security infrastructure solutions. It supports the seamless integration of data across various levels of an organization, aiding in the optimization of production processes through advanced control strategies and visualization technologies.

-

Lifecycle Services:

Rockwell Automation completes its portfolio with consulting, professional services, and connected maintenance services, alongside specific solutions provided throughout the lifecycle of an industrial operation. These services are designed to ensure the long-term viability and optimization of automation investments, facilitating ongoing improvement in operational efficiency and productivity.