Regal Rexnord Corporation (RRX)

Regal Rexnord Corporation (RRX) Presents at Baird 55th Annual Global Industrial Conference Transcript

Regal Rexnord Corporation ( RRX ) Baird 55th Annual Global Industrial Conference November 12, 2025 1:00 PM EST Company Participants Louis Pinkham - CEO & Director Robert Rehard - Executive VP & CFO Conference Call Participants Michael Halloran - Robert W. Baird & Co. Incorporated, Research Division Presentation Michael Halloran Robert W.

Regal Rexnord Corporation (RRX) Q3 2025 Earnings Call Transcript

Regal Rexnord Corporation ( RRX ) Q3 2025 Earnings Call October 30, 2025 10:00 AM EDT Company Participants Robert Barry - Vice President of Investor Relations Louis Pinkham - CEO & Director Robert Rehard - Executive VP & CFO Rakesh Sachdev Conference Call Participants Michael Halloran - Robert W. Baird & Co. Incorporated, Research Division Julian Mitchell - Barclays Bank PLC, Research Division Jeffrey Hammond - KeyBanc Capital Markets Inc., Research Division Kyle Menges - Citigroup Inc., Research Division Tomohiko Sano - JPMorgan Chase & Co, Research Division Nigel Coe - Wolfe Research, LLC Christopher Glynn - Oppenheimer & Co. Inc., Research Division Presentation Operator Good morning, and welcome to the Regal Rexnord Third Quarter 2025 Earnings Conference Call.

Regal Rexnord (RRX) Reports Q3 Earnings: What Key Metrics Have to Say

Although the revenue and EPS for Regal Rexnord (RRX) give a sense of how its business performed in the quarter ended September 2025, it might be worth considering how some key metrics compare with Wall Street estimates and the year-ago numbers.

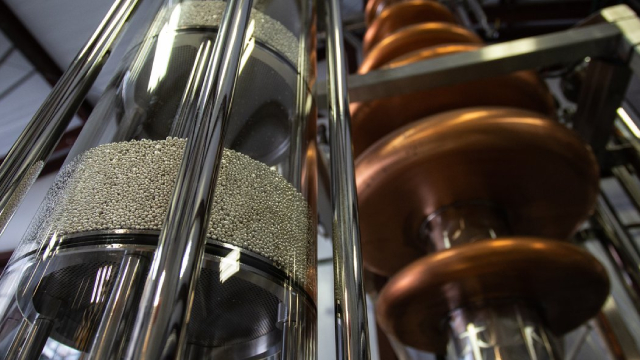

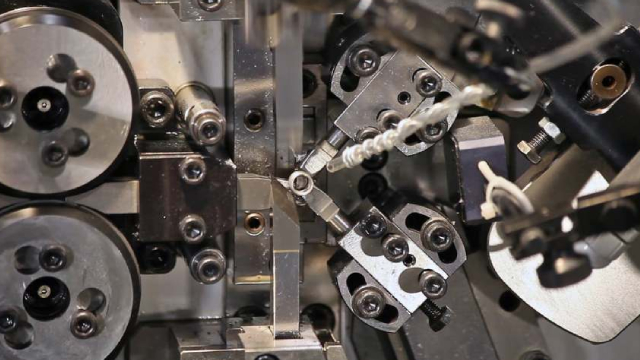

Regal Rexnord: Exposure To Two Major Tailwinds

Regal Rexnord is rated a buy, with the market underestimating its exposure to data centers and humanoid robotics growth trends. RRX's data center and robotics segments are poised for rapid expansion, supported by recent large orders and strong customer relationships. Aftermarket services, especially in the IPS segment, provide recurring high-margin revenue and significant long-term earnings growth potential for RRX.

Regal Rexnord (RRX) Reports Next Week: Wall Street Expects Earnings Growth

Regal Rexnord (RRX) doesn't possess the right combination of the two key ingredients for a likely earnings beat in its upcoming report. Get prepared with the key expectations.

Regal Rexnord: Cycle-Proofing In Progress, Upside Ahead

Regal Rexnord is undervalued, benefiting from secular growth trends, margin expansion, and synergy capture post-acquisitions, with nearly half its revenue now less cyclical. Q2 results showed mixed topline, but underlying improvements in mix, backlog, and cross-selling position the company for more resilient, content-driven growth and higher margins. Valuation remains at a significant discount to peers despite similar fundamentals; upside exists as synergies and operating leverage become more visible in results.

Regal Rexnord Corporation (RRX) Q2 2025 Earnings Call Transcript

Regal Rexnord Corporation (NYSE:RRX ) Q2 2025 Earnings Conference Call August 6, 2025 10:00 AM ET Company Participants Louis Vernon Pinkham - CEO & Director Robert Douglas Barry - Vice President of Investor Relations Robert J. Rehard - Executive VP & CFO Conference Call Participants Jeffrey David Hammond - KeyBanc Capital Markets Inc., Research Division Joseph Alfred Ritchie - Goldman Sachs Group, Inc., Research Division Julian C.H.

Regal Rexnord (RRX) Reports Q2 Earnings: What Key Metrics Have to Say

The headline numbers for Regal Rexnord (RRX) give insight into how the company performed in the quarter ended June 2025, but it may be worthwhile to compare some of its key metrics to Wall Street estimates and the year-ago actuals.

Regal Rexnord (RRX) Tops Q2 Earnings and Revenue Estimates

Regal Rexnord (RRX) came out with quarterly earnings of $2.48 per share, beating the Zacks Consensus Estimate of $2.42 per share. This compares to earnings of $2.29 per share a year ago.

RRX vs. TRMB: Which Stock Is the Better Value Option?

Investors looking for stocks in the Manufacturing - General Industrial sector might want to consider either Regal Rexnord (RRX) or Trimble Navigation (TRMB). But which of these two companies is the best option for those looking for undervalued stocks?

Is the Options Market Predicting a Spike in Regal Rexnord Stock?

Investors need to pay close attention to RRX stock based on the movements in the options market lately.

RRX or TRMB: Which Is the Better Value Stock Right Now?

Investors interested in stocks from the Manufacturing - General Industrial sector have probably already heard of Regal Rexnord (RRX) and Trimble Navigation (TRMB). But which of these two stocks presents investors with the better value opportunity right now?