Shopify Inc. (SHOP)

Shopify: If You Can't Beat Them, Join Them

Shopify's robust growth and dominant platform position support a compelling long-term outlook, with potential to double shares by 2030. Current valuation is steep at 75x forward earnings, making near-term upside dependent on consistently exceeding high expectations. Short-term risks include possible Q3 guidance disappointment and macro uncertainty, which could trigger a valuation reset.

Shopify: This Year's Dip Is A Buying Opportunity

Shopify remains a top conviction growth stock despite recent market pullback, thanks to its dominant position and long-term expansion opportunities. The company is vastly underpenetrated in a massive $849 billion global TAM, with strong revenue and GMV growth outpacing smaller rivals. Shopify's rapid AI innovation, including new tools like an automatic tariff calculator, strengthens its platform and merchant appeal.

Shopify (SHOP) Stock Slides as Market Rises: Facts to Know Before You Trade

In the most recent trading session, Shopify (SHOP) closed at $109.21, indicating a -4.31% shift from the previous trading day.

Brokers Suggest Investing in Shopify (SHOP): Read This Before Placing a Bet

When deciding whether to buy, sell, or hold a stock, investors often rely on analyst recommendations. Media reports about rating changes by these brokerage-firm-employed (or sell-side) analysts often influence a stock's price, but are they really important?

Can Shopify's Expanding Merchant Base Sustain Its Growth Momentum?

SHOP expands its merchant base with tools like Shop Pay and new partnerships, but faces mounting pressure from AMZN and BABA.

Shopify vs. Amazon: Which E-Commerce Stock Has The Edge Now?

SHOP's merchant growth and AI tools impress, but AMZN leads with global reach, essentials focus, and earnings strength.

Investors Heavily Search Shopify Inc. (SHOP): Here is What You Need to Know

Zacks.com users have recently been watching Shopify (SHOP) quite a bit. Thus, it is worth knowing the facts that could determine the stock's prospects.

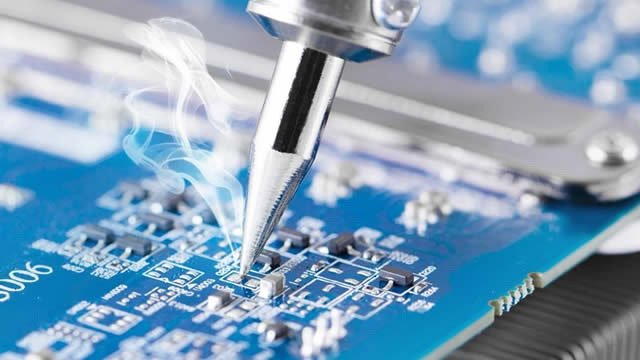

Stock Market Rebound: Nvidia, Shopify and Marvell Popping Today

Are you ahead, or behind on retirement? SmartAsset's free tool can match you with a financial advisor in minutes to help you answer that today.

2 Monster Growth Stocks to Buy and Hold for 10 Years

The market's recent correction looks like a massive drop on a year-to-date chart. However, it will look far less daunting in a decade; that's what happens over the long run.

Shopify launches AI tool that builds complete online stores from keywords

Shopify , on Wednesday rolled out a generative artificial intelligence feature that would allow merchants on its e-commerce platform to set up their online stores by entering descriptive keywords.

National Health Investors: Why I'm Bullish On This Durable Income Stock

NHI offers a well-covered 4.8% dividend yield, robust FAD growth, and a conservative balance sheet, supporting durable income for investors. Its transition to the SHOP model is unlocking NOI upside, with 12-15% targeted SHOP NOI growth and strong occupancy recovery driving future FFO expansion. While SHOP introduces some operational risk, NHI's strategic execution and solid tenant rent coverage make it a compelling buy for income-focused investors.

SHOP Surges 34% in a Month: Should You Buy the Stock Now or Wait?

Shopify shares benefit from strong merchant growth and AI tools, but stretched valuation and fierce competition remain a concern.