ProShares UltraShort Financials Fund (SKF)

Summary

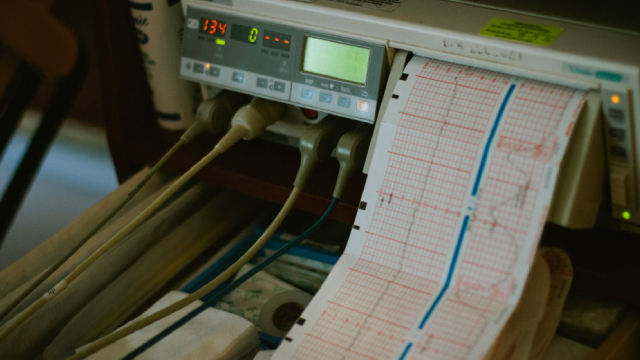

SKF Chart

SKF: Swedish Special Situation

SKF's planned spin-off of its Automotive segment will enhance financial performance by removing a lower-margin business. The separation allows each company to focus on its core strengths, improving management effectiveness and strategic clarity. Pure-play companies like the post-spin SKF are easier to analyze, value, and typically avoid the conglomerate discount.

AB SKF: A Strategic Split That Could Drive Long-Term Gains

SKF faces declining demand in key regions and pressure from currency fluctuations, impacting revenue growth despite cost-cutting efforts. The company continues to explore new markets, investing 90% of its R&D budget into high-growth areas like high-speed machinery, aerospace, and electric vehicles. It maintains strong financial health with a high-interest coverage ratio of 47.5x, indicating low insolvency risk even during profitability fluctuations.

SKF: Temporary Friction Preventing Growth, But Valuation Is Very Compelling

SKF is facing short-term growth challenges, with declining sales and weak demand across key markets, particularly in China and North East Asia. Despite a -7.4% organic sales decline in Q2, profitability remains strong, aided by cost-cutting and strategically exiting unprofitable business lines. The company is investing in R&D, decentralizing operations, and planning a spin-off of its vehicle business, potentially unlocking value.

ProShares UltraShort Financials Fund (SKF) FAQ

What is the stock price today?

On which exchange is it traded?

What is its stock symbol?

Does it pay dividends? What is the current yield?

What is its market cap?

Has ProShares UltraShort Financials Fund ever had a stock split?

ProShares UltraShort Financials Fund Profile

| ARCA Exchange | US Country |

Overview

The described fund operates within the financial sector, focusing specifically on U.S. companies within the financials industry. Its unique investment strategy is propelled by the expertise of ProShare Advisors, who select financial instruments that are expected to collectively yield daily returns that align with the fund's predetermined investment objective. Notably, the fund adopts a non-diversified approach, channeling its investments into a concentrated portfolio of financial instruments that mirror the performance of the designated financials sector index.

Products and Services

- Daily Returns Investment Strategy

This strategy is central to the fund's operations, aiming to achieve daily returns that match its investment objective. ProShare Advisors employs a meticulous analysis to identify financial instruments, ensuring they collectively contribute towards the anticipated daily performance, in alignment with the sector's index.

- Financial Sector Focus

The fund specifically invests in companies within the U.S. financials industry. This targeted approach allows for a specialization in a sector that plays a crucial role in the economy, involving banks, insurance companies, and other financial services institutions. The fund's investment framework is designed to capture the dynamics and growth potential inherent in the financial sector.

- Non-Diversified Fund Structure

Unlike diversified funds, this fund concentrates its investments into a narrow spectrum of financial instruments within the financials industry. This strategic choice may raise the potential for higher returns, albeit with increased risk, given the concentrated exposure to the sector's performance. It's an approach that appeals to investors who are looking for more pronounced sector-specific growth opportunities and understand the associated risks.