Super Micro Computer, Inc. (SMCI)

Summary

SMCI Chart

Can SMCI Stock Recover If It Falls Another 30%?

Super Micro Computer (SMCI) shares have decreased by 13.1% over the last 21 trading days. This recent decline indicates a shift in investor interest away from AI-related stocks and highlights the execution risks and margin pressures faced by SMCI.

AI GPU Platforms Drive 75% of SMCI's Revenues: More Upside Ahead?

Super Micro Computer's AI GPU platforms drive more than 75% of Q1 FY26 revenues as new NVIDIA Blackwell liquid-cooled systems ramp for volume shipments.

Why Is SMCI Stock Falling?

Super Micro Computer (SMCI) stock reached the fifth day of a streak characterized by losses, accumulating a total return of -11% during this timeframe. The company has seen a decline of approximately $3.6 billion in value over the past five days, resulting in a current market capitalization of about $19 billion.

Super Micro Computer, Inc. (SMCI) FAQ

What is the stock price today?

On which exchange is it traded?

What is its stock symbol?

Does it pay dividends? What is the current yield?

What is its market cap?

What is the earnings per share?

When is the next earnings date?

Has Super Micro Computer, Inc. ever had a stock split?

Super Micro Computer, Inc. Profile

| Technology Hardware, Storage & Peripherals Industry | Information Technology Sector | Charles Liang CEO | XMEX Exchange | US86800U3023 ISIN |

| US Country | 5,684 Employees | - Last Dividend | 1 Oct 2024 Last Split | 29 Mar 2007 IPO Date |

Overview

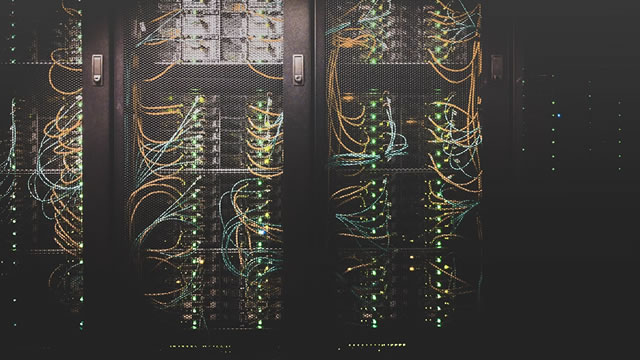

Super Micro Computer, Inc., a stalwart in the high-performance server and storage solutions industry, orchestrates and manufactures cutting-edge products characterized by their modular and open architecture. With a global footprint extending across the United States, Europe, Asia, and other international markets, the company stands as a pillar of innovation and efficiency in the computing world. Super Micro Computer, Inc. is dedicated to providing versatile solutions that meet the expanding needs of enterprise data centers, cloud computing environments, artificial intelligence technologies, and the emerging realms of 5G and edge computing. Its inception in 1993 and subsequent establishment of its headquarters in San Jose, California, mark the beginning of a journey aimed at revolutionizing server and storage capabilities worldwide, leveraging both direct and indirect sales channels, including distributors, value-added resellers, system integrators, and original equipment manufacturers, to reach its vast and varied clientele.

Products and Services

- Complete Server and Storage Systems - Tailor-made solutions including rackmount and blade servers, designed for high performance and efficiency in data-intensive environments.

- Modular Blade Servers and Blades - Flexible and scalable server solutions that can be customized to meet the unique needs of any organization, enhancing computation and storage capabilities.

- Workstations and Full Racks - High-quality workstations for professional applications, alongside full rack solutions to accommodate extensive server and storage requirements.

- Networking Devices - Sophisticated networking solutions that ensure reliable and fast communication between various hardware components within data centers.

- Server Sub-systems and Security Software - Core components such as server boards, chassis, power supplies, alongside robust security software to safeguard critical data.

- Server Software Management Solutions - A comprehensive suite including Supermicro Server Manager, Power Management software, Update Manager, SuperCloud Composer, and SuperDoctor 5, designed to streamline server management and operational efficiency.

- Technical Documentation and Support Services - Extensive support ranging from initial system integration and software upgrades to ongoing maintenance and technical assistance, ensuring customers maximize the utility and longevity of their Super Micro solutions.