Synopsys Inc. (SNPS)

Here is What to Know Beyond Why Synopsys, Inc. (SNPS) is a Trending Stock

Synopsys (SNPS) has been one of the stocks most watched by Zacks.com users lately. So, it is worth exploring what lies ahead for the stock.

SNPS vs. MRVL: Which Stock Has an Edge in the Interconnect Market?

Marvell Technology gains an edge over Synopsys in the fast-growing AI and data center interconnect market as Synopsys faces margin and competition pressures.

Synopsys: Long-Term Growth Intact Amid Post-Merger Noise

Synopsys is upgraded from Hold to Buy, with a 12% upside to $502, following successful Ansys integration and resilient financials. Post-Ansys deal, SNPS aggressively manages debt, optimizes operations, and divests non-core assets, supporting double-digit growth prospects. Q3 saw 14% revenue growth, driven by EDA segment strength, despite Design IP weakness from China export restrictions and a major customer issue.

SNPS Stock Plunges 25% in 3 Months: Should You Buy, Sell or Hold?

Synopsys' AI-driven EDA push can't offset falling margins, Design IP weakness, and a stretched valuation that make the stock a sell.

Synopsys Correction: Execution Misses, Not A Broken Moat

Synopsys' EDA dominance, deep client integration, and IP portfolio ensure resilience; recent weakness stems from execution timing, not competitive or structural erosion. Rising chip complexity, AI-driven design, and the Ansys acquisition expand long-term TAM across automotive, aerospace, and industrial markets, sustaining durable multi-year growth visibility. Current softness in IP merely reflects short-term operational missteps, not decay.

Why Synopsys (SNPS) Outpaced the Stock Market Today

In the closing of the recent trading day, Synopsys (SNPS) stood at $453.35, denoting a +1.28% move from the preceding trading day.

Why Synopsys (SNPS) Outpaced the Stock Market Today

In the most recent trading session, Synopsys (SNPS) closed at $448, indicating a +2.07% shift from the previous trading day.

Is It Worth Investing in Synopsys (SNPS) Based on Wall Street's Bullish Views?

Investors often turn to recommendations made by Wall Street analysts before making a Buy, Sell, or Hold decision about a stock. While media reports about rating changes by these brokerage-firm employed (or sell-side) analysts often affect a stock's price, do they really matter?

Synopsys Stock To $575?

Synopsys (SNPS) stock should be on your watchlist. Here is why.

Synopsys (SNPS) Declines More Than Market: Some Information for Investors

In the closing of the recent trading day, Synopsys (SNPS) stood at $484.41, denoting a -1.01% move from the preceding trading day.

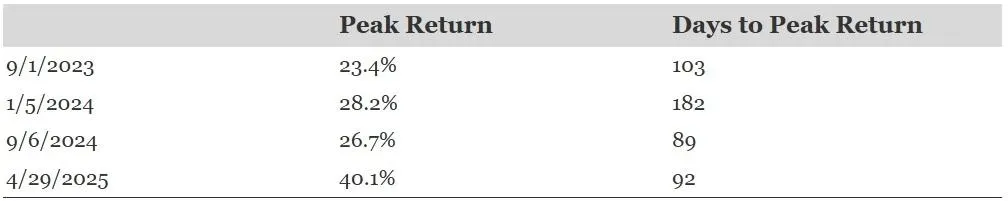

Synopsys (SNPS) Up 26.2% Since Last Earnings Report: Can It Continue?

Synopsys (SNPS) reported earnings 30 days ago. What's next for the stock?

Synopsys Posts Record Backlog: Is it the Sign of Business Resilience?

SNPS' record $10.1 billion backlog, fueled by AI-driven tools and the Ansys boost, signals strength amid rising EDA competition.