Southern Company (SO)

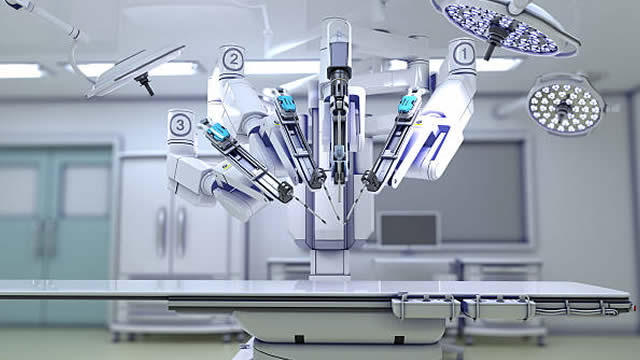

Will Direct Distribution in Southern Europe Boost ISRG's Margins?

ISRG plans a 2026 shift to direct distribution in Italy, Spain, and Portugal, aiming to lift margins by capturing distributor economics with execution risk.

UK's Serica Energy to buy Southern North Sea assets for $76 million

Britain's Serica Energy said on Tuesday it had agreed to acquire a portfolio of Southern North Sea assets from Spirit Energy for an upfront consideration of 57 million pounds ($76.19 million).

Recent Pullback Provides Opportunity In Southern Company

The Southern Company is rated a Buy after a 15% pullback, offering a stable, income-producing utility with multiple growth catalysts for 2026. SO projects 5–7% annual EPS growth, supported by 8% regulated rate base and electric load growth through 2029, with 90% of earnings from regulated utilities. The company's $76 billion capital plan is 77% equity-funded through 2029, and SO will become a Dividend Aristocrat in 2025, likely driving ETF demand.

SO Stock Declines 6% in Past 6 Months: Here's How to Play

Southern Company faces stock underperformance, yet rising large-load demand, strong regulation and $76B growth pipeline strengthen its long-term outlook.

Southern Company: Solid Execution And Data-Center Tailwinds Unlock Upside

Southern Company (SO) is rated Buy with a $96 target, offering 12% upside and a 3.5% dividend yield. Q3 results exceeded expectations, driven by strong demand from data centers and regional economic growth. SO's revenue structure is shifting, with long-term sales growth underpinned by contracted industrial and data center clients.

Here's Why Southern Co. (SO) is a Strong Growth Stock

Wondering how to pick strong, market-beating stocks for your investment portfolio? Look no further than the Zacks Style Scores.

Southern Company Pledges Steady Customer Rates Through 2027

SO's subsidiary Alabama Power commits to steady rates through 2027 while strengthening the grid and offering tools to help households manage monthly bills.

Waymo gets regulatory approval to expand across Bay Area and Southern California

Waymo continues to expand its reach, with the robotaxi company posting Friday that it's now “officially authorized to drive fully autonomously across more of the Golden State.”

Southern Company Rises 10% YTD: Time to Buy, Sell or Hold?

SO benefits from strong load growth, long-term contracts, major regulated investments and steady dividends, but faces regulatory risks, high valuation and interest cost pressure.

Here's Why Southern Co. (SO) is a Strong Growth Stock

Wondering how to pick strong, market-beating stocks for your investment portfolio? Look no further than the Zacks Style Scores.

Southern Company Q3 Earnings Top on Usage, New Customers

SO beats Q3 estimates as revenues and earnings climb on higher power usage and customer gains.

The Southern Company (SO) Q3 2025 Earnings Call Transcript

The Southern Company ( SO ) Q3 2025 Earnings Call October 30, 2025 1:00 PM EDT Company Participants Greg MacLeod - Director of Investor Relations Christopher Womack - CEO, President & Chairman David Poroch - Executive VP & CFO Conference Call Participants Steven Fleishman - Wolfe Research, LLC Carly Davenport - Goldman Sachs Group, Inc., Research Division Julien Dumoulin-Smith - Jefferies LLC, Research Division Shahriar Pourreza - Wells Fargo Securities, LLC, Research Division Anthony Crowdell - Mizuho Securities USA LLC, Research Division Jeremy Tonet - JPMorgan Chase & Co, Research Division Andrew Weisel - Scotiabank Global Banking and Markets, Research Division David Arcaro - Morgan Stanley, Research Division Agnieszka Storozynski - Seaport Research Partners Paul Fremont - Ladenburg Thalmann & Co. Inc., Research Division Travis Miller - Morningstar Inc., Research Division Presentation Operator Good afternoon. My name is Diego, and I will be your conference operator today.