Stryker Corporation (SYK)

Stryker Q2: Record Mako Installation And High Utilization

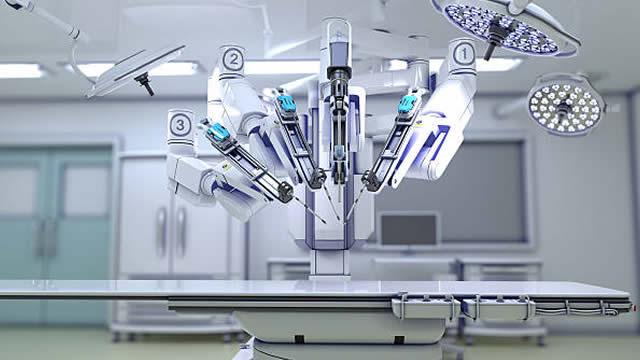

I reiterate a Hold rating on Stryker Corporation, with a fair value of $382 per share, despite recent strong quarterly results. Stryker's Mako installations and utilization remain robust, and upcoming Mako Spine and shoulder launches are on track to drive future growth. SYK management is focused on margin expansion through supply chain efficiencies, but cost synergies from past acquisitions remain under-realized.

Stryker: Strong Multi-Faceted Growth Continuing To Support The Shares

Stryker continues to outperform peers with strong revenue growth, margin expansion, and successful product innovation. Recent quarterly results beat expectations, driven by robust performance across the business and ongoing market share gains. Management remains focused on growth and margin optimization, with M&A and innovation — especially in robotics and neuromodulation — central to the strategy.

Stryker (SYK) Upgraded to Buy: What Does It Mean for the Stock?

Stryker (SYK) might move higher on growing optimism about its earnings prospects, which is reflected by its upgrade to a Zacks Rank #2 (Buy).

Are Medical Stocks Lagging Stryker (SYK) This Year?

Here is how Stryker (SYK) and BrightSpring Health Services, Inc. (BTSG) have performed compared to their sector so far this year.

Stryker (SYK) Reports Q2 Earnings: What Key Metrics Have to Say

The headline numbers for Stryker (SYK) give insight into how the company performed in the quarter ended June 2025, but it may be worthwhile to compare some of its key metrics to Wall Street estimates and the year-ago actuals.

SYK Stock Falls Despite Q2 Earnings & Sales Beat, '25 View Up

SYK's second-quarter results reflect strong segmental performance, along with a rise in operating margin.

Stryker Corporation (SYK) Q2 2025 Earnings Call Transcript

Stryker Corporation (NYSE:SYK ) Q2 2025 Earnings Conference Call July 31, 2025 4:30 PM ET Company Participants Jason Beach - Vice President of Finance & Investor Relations Kevin A. Lobo - Chairman, CEO & President Preston Wells - VP & CFO Conference Call Participants Caitlin Cronin - Canaccord Genuity Corp., Research Division Christopher Thomas Pasquale - Nephron Research LLC Danielle Joy Antalffy - UBS Investment Bank, Research Division Joanne Karen Wuensch - Citigroup Inc., Research Division Lawrence H.

Stryker (SYK) Q2 Earnings and Revenues Beat Estimates

Stryker (SYK) came out with quarterly earnings of $3.13 per share, beating the Zacks Consensus Estimate of $3.06 per share. This compares to earnings of $2.81 per share a year ago.

Will SYK's Q2 Earnings Reflect Strong Growth Despite Tariff Overhang?

Stryker's second-quarter 2025 results are expected to reflect strong segmental performance. However, rising costs and tariffs are likely to have continued to hurt margins.

Stryker (SYK) Earnings Expected to Grow: What to Know Ahead of Next Week's Release

Stryker (SYK) doesn't possess the right combination of the two key ingredients for a likely earnings beat in its upcoming report. Get prepared with the key expectations.

SYK Boosts Foot & Ankle Portfolio With FDA-Cleared Total Ankle System

Stryker expands its Foot & Ankle portfolio with FDA-cleared InCompass, targeting streamlined total ankle replacement.