Targa Resources Corp. (TRGP)

Targa Resources to Acquire Stakeholder Midstream for $1.25 Billion

Targa Resources agreed to acquire Stakeholder Midstream, which provides natural gas gathering and processing services in the Permian Basin, for $1.25 billion in cash.

Targa Resources (TRGP) Reports Q3 Earnings: What Key Metrics Have to Say

Although the revenue and EPS for Targa Resources (TRGP) give a sense of how its business performed in the quarter ended September 2025, it might be worth considering how some key metrics compare with Wall Street estimates and the year-ago numbers.

Targa Resources Corp. (TRGP) Q3 2025 Earnings Call Transcript

Targa Resources Corp. ( TRGP ) Q3 2025 Earnings Call November 5, 2025 11:00 AM EST Company Participants Tristan Richardson Matt Meloy - CEO & Director Jennifer Kneale - President William Byers - Chief Financial Officer Robert Muraro - Chief Commercial Officer D. Pryor - President of Logistics & Transportation Patrick McDonie - President of Gathering & Processing Conference Call Participants Jeremy Tonet - JPMorgan Chase & Co, Research Division Spiro Dounis - Citigroup Inc., Research Division Theresa Chen - Barclays Bank PLC, Research Division Keith Stanley - Wolfe Research, LLC Michael Blum - Wells Fargo Securities, LLC, Research Division Manav Gupta - UBS Investment Bank, Research Division Andrew John O'Donnell - Tudor, Pickering, Holt & Co. Securities, LLC, Research Division John Mackay - Goldman Sachs Group, Inc., Research Division Jean Ann Salisbury - BofA Securities, Research Division Jason Gabelman - TD Cowen, Research Division Sunil Sibal - Seaport Research Partners Brandon Bingham - Scotiabank Global Banking and Markets, Research Division Presentation Operator Thank you for standing by.

Unlocking Q3 Potential of Targa Resources (TRGP): Exploring Wall Street Estimates for Key Metrics

Evaluate the expected performance of Targa Resources (TRGP) for the quarter ended September 2025, looking beyond the conventional Wall Street top-and-bottom-line estimates and examining some of its key metrics for better insight.

Why Targa Resources, Inc. (TRGP) is a Top Dividend Stock for Your Portfolio

Dividends are one of the best benefits to being a shareholder, but finding a great dividend stock is no easy task. Does Targa Resources (TRGP) have what it takes?

Targa Resources, Inc. (TRGP) is a Top Dividend Stock Right Now: Should You Buy?

Dividends are one of the best benefits to being a shareholder, but finding a great dividend stock is no easy task. Does Targa Resources (TRGP) have what it takes?

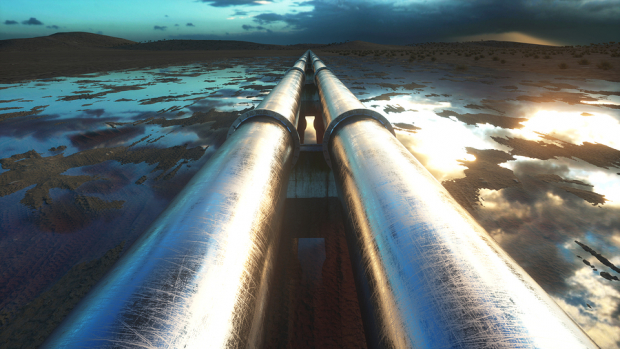

Targa Resources Announces New Permian Investments

In big news for the energy infrastructure space, Targa Resources Corp. (TRGP) has announced significant new investments in its Permian Basin operations. The announcement includes a new natural gas liquids (NGL) pipeline and incremental natural gas infrastructure.

Targa Opens Non-Binding Forza Pipeline Bids to Boost Delaware Gas Flow

TRGP launches open season for its Forza Pipeline, aiming to boost Delaware Basin gas connectivity to Texas markets by mid-2028.

Targa Resources: A Unique Focus On Growth In The Midstream Sector

Targa Resources is well positioned in the Permian Basin, driving strong volume and cash flow growth through aggressive capital investment and infrastructure expansion. Despite a lower dividend yield than peers, Targa's buyback program and future dividend growth potential make it attractive for long-term investors. The company maintains a solid balance sheet, manageable leverage, and benefits from tax changes, supporting ongoing growth projects without financial strain.

Targa Resources Stock: Is It a Smart Hold in Today's Market?

TRGP benefits from strong global LPG demand, fee-based revenues, tax advantages and Permian scale, but faces risks from overbuild, execution and competition.

Targa Resources Q2 Earnings Beat Estimates, Revenues Miss

TRGP expects full-year 2025 adjusted EBITDA of $4.65-$4.85 billion and net growth capital expenditures of $3 billion.

Compared to Estimates, Targa Resources (TRGP) Q2 Earnings: A Look at Key Metrics

While the top- and bottom-line numbers for Targa Resources (TRGP) give a sense of how the business performed in the quarter ended June 2025, it could be worth looking at how some of its key metrics compare to Wall Street estimates and year-ago values.