TriMas Corporation (TRS)

Why TriMas (TRS) is a Top Growth Stock for the Long-Term

Wondering how to pick strong, market-beating stocks for your investment portfolio? Look no further than the Zacks Style Scores.

TriMas (TRS) Upgraded to Strong Buy: What Does It Mean for the Stock?

TriMas (TRS) might move higher on growing optimism about its earnings prospects, which is reflected by its upgrade to a Zacks Rank #1 (Strong Buy).

Here's Why TriMas (TRS) is a Strong Growth Stock

The Zacks Style Scores offers investors a way to easily find top-rated stocks based on their investing style. Here's why you should take advantage.

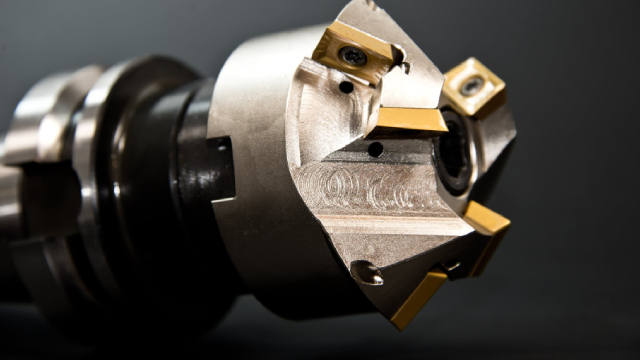

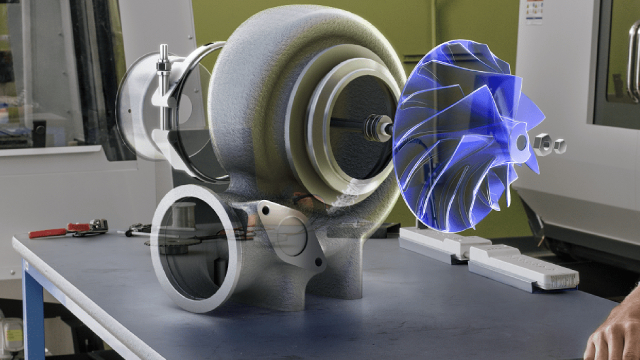

TriMas to Sell Aerospace Segment for $1.45 Billion

TriMas agreed to sell its aerospace business for $1.45 billion to an affiliate of private investment firm Tinicum. Funds managed by Blackstone will be a minority investor in the transaction.

Why TriMas (TRS) is a Top Growth Stock for the Long-Term

The Zacks Style Scores offers investors a way to easily find top-rated stocks based on their investing style. Here's why you should take advantage.

TriMas Corporation (TRS) Q3 2025 Earnings Call Transcript

TriMas Corporation (NASDAQ:TRS ) Q3 2025 Earnings Call October 28, 2025 10:00 AM EDT Company Participants Sherry Lauderback - Vice President of Investor Relations, Communications & Sustainability Thomas Snyder - President, CEO & Director Teresa Finley - CFO, Treasurer & Director Conference Call Participants Katie Fleischer - KeyBanc Capital Markets Inc., Research Division Hamed Khorsand - BWS Financial Inc. Presentation Operator Greetings, and welcome to the TriMas Third Quarter 2025 Earnings Conference Call. [Operator Instructions] As a reminder, this conference is being recorded.

TriMas (TRS) Q3 Earnings and Revenues Top Estimates

TriMas (TRS) came out with quarterly earnings of $0.61 per share, beating the Zacks Consensus Estimate of $0.57 per share. This compares to earnings of $0.43 per share a year ago.

TriMas (TRS) is a Great Momentum Stock: Should You Buy?

Does TriMas (TRS) have what it takes to be a top stock pick for momentum investors? Let's find out.

What Makes TriMas (TRS) a Strong Momentum Stock: Buy Now?

Does TriMas (TRS) have what it takes to be a top stock pick for momentum investors? Let's find out.

Why Is TriMas (TRS) Up 8.3% Since Last Earnings Report?

TriMas (TRS) reported earnings 30 days ago. What's next for the stock?

TriMas (TRS) Beats Q2 Earnings and Revenue Estimates

TriMas (TRS) came out with quarterly earnings of $0.61 per share, beating the Zacks Consensus Estimate of $0.5 per share. This compares to earnings of $0.43 per share a year ago.

TriMas Corporation: Still A Good Catalyst In Play

TriMas stock remains a soft 'buy' due to ongoing strategic review and potential catalysts, despite recent share price appreciation. Aerospace segment drove strong Q1 revenue growth, while Packaging saw modest gains and Specialty Products contracted due to divestiture. Profitability improved year-over-year, with net income and EBITDA rising, and management forecasts further earnings growth for 2025.