Taiwan Semiconductor Manufacturing Co. Ltd. ADR (TSM)

3 Reasons Taiwan Semiconductor Is a Must-Buy for Long-Term Investors

The recent market sell-off has created some nice bargains in the market. One stock that looks particularly attractive is Taiwan Semiconductor Manufacturing (TSM 1.46%), or TSMC for short.

Taiwan Semiconductor's Huge U.S. Move—Stock Impact Ahead

Taiwan Semiconductor Manufacturing NYSE: TSM is making a massive investment in the United States. This move may be the biggest economic success for the Trump administration so far.

This Top Chipmaker Stock Has Rallied More Than 200% in 5 Years, and It Still Looks Like a Cheap Buy

Investing in tech stocks right now can look like a dangerous proposition, given the weakness in the markets of late. If tariffs and trade wars sink the economy into a recession, tech spending could come under pressure, and the growth in artificial intelligence (AI) could slow drastically.

Taiwan Semiconductor: Thank You, Mr. Market, For The Gift

TSMC investors endured a brutal round trip as Mr. Market sent the stock spiraling downward. TSMC's reliance on key US customers and geopolitical tensions pose risks, but AI growth and capex investments underpin long-term prospects. TSMC's dominance in advanced chip production is crucial for the AI ambitions of US chip designers.

Taiwan Semiconductor: Company Is Selling The Shovels To The AI Race

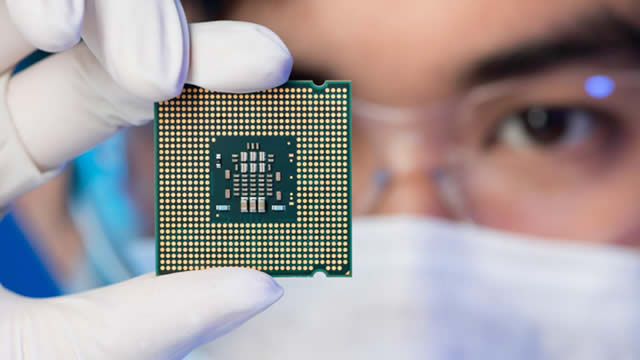

TSMC dominates the semiconductor market with advanced 3 nm chips, crucial for AI, robotics, and defense, making it a strategic asset. The stock's recent 20% drop offers an excellent entry point, with TSMC outperforming the S&P 500 over the last 10 years. TSMC's solid financials include a 59% gross margin, 49% operating margin, and a strong balance sheet with $76.3 bn in cash.

TSMC: Solidifying Market Dominance With Advanced Technology

Taiwan Semiconductor Manufacturing Company is increasingly expanding its market share lead as the prime foundry. Recent capital expenditure fears driven by DeepSeek have been dispelled as hyperscalers increase their spending forecasts. TSMC has the first-mover advantage as the most advanced foundry, deterring other competitors from trying to compete.

TSMC: Don't Fear AI Investments

Taiwan Semiconductor's $100 billion U.S. investment plan raises cost concerns but won't impact its financials significantly before 2030. The fab company reported soaring February revenues, supporting a 39% growth target for Q1; strong financial performance is expected to continue. While U.S. fabs will dilute margins slightly, the impact is minimal due to the small scale.

Taiwan Semiconductor Stock: A Trump Tariff Buy?

In this video, analysts look at the recent tariffs imposed by the Trump administration and their implications for the stock market. Taiwan Semiconductor Manufacturing (TSM) remains a key player, but increased geopolitical risks are now a factor for investors to consider.

Analysts revise price targets for the world's most important company

Taiwan Semiconductor Manufacturing (NYSE: TSM) might just be the most important company in the world — and even with the level of publicity that goes along with it, TSM stock might very well be undervalued at the moment.

Investors Heavily Search Taiwan Semiconductor Manufacturing Company Ltd. (TSM): Here is What You Need to Know

TSMC (TSM) has received quite a bit of attention from Zacks.com users lately. Therefore, it is wise to be aware of the facts that can impact the stock's prospects.

Taiwan Semiconductor Announces a $100 Billion U.S. Investment. Is The Stock a Buy?

Taiwan Semiconductor Manufacturing (TSM -3.64%) (TSMC) made headlines recently when it announced an additional $100 billion investment in U.S. production facilities. This is huge news for the company, as it helps ease one of the biggest investment concerns Wall Street has with TSMC.

What Trump Tariffs Mean for Your Portfolio: Resilient Stock Picks and Risk Tips

In today's video, our panel dives into the impact of recent tariffs on Taiwan Semiconductor Manufacturing (TSM -3.64%) and the broader market. With insights on consumer behavior and investment strategies, we analyze whether this chip giant can maintain its position amid economic uncertainty.