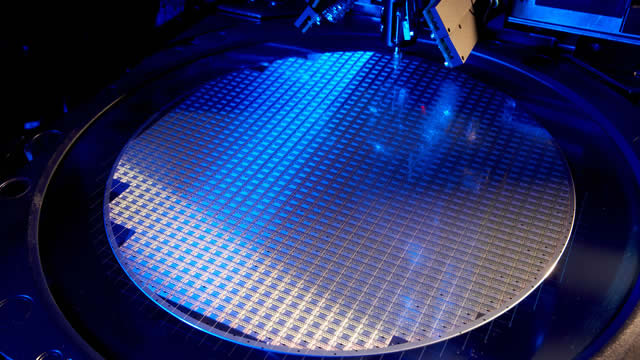

Taiwan Semiconductor Manufacturing Co. Ltd. ADR (TSM)

TSMC Profit Surges to Record as Earnings Beat. The AI Chips Boom Isn't Slowing.

Taiwan Semiconductor Manufacturing reported a record quarterly net profit that handily beat expectations.

TSMC Q3 profit expected to set record on AI spending boom

TSMC, the world's largest manufacturer of advanced artificial intelligence chips, is set to post a 28% jump in third-quarter profit to reach a record high due to surging demand for AI infrastructure, though U.S. tariffs may complicate its outlook.

TSMC Earnings: Here's What To Expect As AI Reaches A Fever Pitch

Taiwan Semiconductor Manufacturing Company Limited reports earnings on Thursday. The AI craze has reached a new peak, with TSM as one of the primary beneficiaries. The company's dominant market position and wide moat make TSM a stock to own for a long time.

Buy the Surge in Taiwan Semiconductor Stock as Q3 Results Approach?

Riding a wave of unprecedented demand for next-gen AI chips, Taiwan Semiconductor is expected to post record Q3 results on Thursday, October 16.

Rising AI Chip Demand to Boost Taiwan Semiconductor's Q3 Revenues

TSM's Q3 revenues are likely to reflect the benefits of surging demand for advanced AI chips, while rising operation costs may have weighed on profitability.

Taiwan Semi (TSM) is Going to $400

Taiwan Semiconductor ( TSM ) reports September quarter results Thursday morning and as the stock bounces back sharply from Friday's trade war jitters, investors look forward to the continuous good news from the planet's top AI foundry. For instance, Susquehanna raised their price target to $400 from $300 last week after TSM reported a 31.4% increase in September sales (vs.

TSMC: The Quiet Powerhouse Behind The AI Revolution

TSMC remains the world's leading semiconductor foundry, delivering 9 consecutive double-beat quarters with 54% YoY revenue and 71% EPS growth in FQ2 2025, driven by surging AI demand. Despite trading at a premium, valuation appears justified by superior profitability — 59% gross margin, 69% EBITDA margin, and 42% net income margin — all far above industry averages. Strong balance sheet with over $90 billion in cash and positive net interest income positions TSMC to thrive in both high and low-rate environments while maintaining double-digit EPS growth.

TSMC: I Am Loading Up Before Earnings

AI tailwinds do not show any signs of weakness, as the global AI market is expected to attract $3 trillion in investments in the next few years. TSMC consistently beats earnings expectations, boasts accelerating revenue, and EPS growth, and is rapidly expanding its global foundry market share. AI and data center demand, robust client contracts, and a $55 billion net cash position support TSM's long-term growth and innovation potential.

TSMC: Expecting Strong 3Q FY2025 Earnings, And Tariff Threat Looks Overblown

Taiwan Semiconductor (TSM)'s stock fell 6% in a single day, amid market volatility following Trump's 100% tariff threat against China, set to take effect on November 1st. The 100% tariff threat is likely just a bluff, as we saw back in April. It shouldn't largely affect the AI spending in the near term. The July–September revenue report beat estimates, indicating that the upcoming 3Q FY2025 earnings will be robust, but its gross margin may decline further.

TSMC: Ultra Bullish Going Into Q3 Earnings

I reiterate my strong buy rating on TSMC going into Q3 2025 earnings, citing strong AI/HPC demand as noted by the monthly revenue data, with very tight N3/N5 capacity. N2 remains on track for 2H25. Bigger lift likely from N2P (2H26) and A16 (2H26, first process node with backside power). Near term, 2026 deployments (Vera-Rubin, MI4xx) remain on 3nm. Valuation is still attractive at 20x next year's P/CF and 30x forward P/E (below sector median), with room for multiple expansion as Nvidia/AMD GPU ramps next year.

TSMC Heads Into Q3 With Strong Momentum

TSMC surged nearly 40% since June, strongly outperforming the market as investors priced in its advanced-node leadership. FY25 revenue reached NT$2.76 trillion through September, up 36.4% YoY, with Q3 revenue at NT$989.9 billion. Advanced nodes (7nm and below) contributed 74% of wafer sales in Q2-FY25, driving 58.6% gross margins.

TSMC Stock: Still A Strong Buy As AI Efficiency Breakthroughs Fuel The Next Growth Phase

Taiwan Semiconductor Manufacturing Company remains a strong buy, with a 32% upside to a $387 price target. TSM's growth is fueled by robust AI-driven chip demand, technological leadership, and upcoming 2nm chip ramp addressing power efficiency bottlenecks. Despite forex and margin headwinds from overseas fabs, TSM continues to deliver strong earnings and revenue growth, consistently beating analyst estimates.