Taiwan Semiconductor Manufacturing Co. Ltd. ADR (TSM)

Is Taiwan Semiconductor Stock a Buy Now?

Taiwan Semiconductor Manufacturing (TSM -0.50%) is on a roll. On the heels of a three-year slump in chipmaking services, TSMC is facing unprecedented production demand.

A Once-in-a-Decade Investment Opportunity: 1 Artificial Intelligence (AI) Semiconductor Stock to Buy Hand Over Fist and Hold for Years (Hint: It's Not Nvidia)

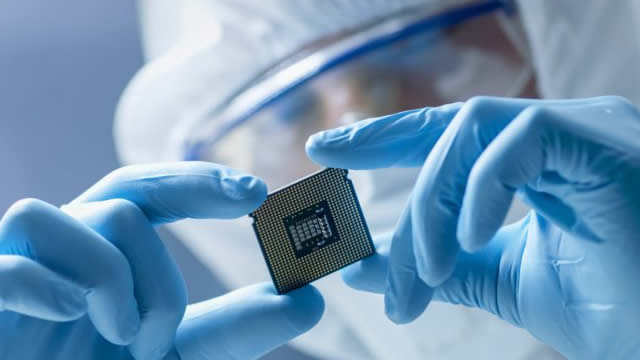

When it comes to the semiconductor industry, no other company has become as well-known as Nvidia. The company specializes in designing graphics processing units (GPU), a unique piece of hardware architecture that's used for all sorts of generative AI applications.

Taiwan Semiconductor: The Powerhouse At The Heart Of The AI Revolution

TSMC's dominance in advanced semiconductor manufacturing positions it as a key player in the AI revolution, supplying giants like NVIDIA, AMD, and Apple. The company's advanced packaging technologies, such as CoWoS, and its leadership in 3nm and 2nm nodes, ensure its competitive edge in HPC and AI markets. Financially robust, TSMC reported $23.5 billion in revenue with a 36% YOY growth and maintains a strong balance sheet with $69 billion in cash.

TSMC Stock Poised for Best Year in 25 Years - A Top Pick for 2025

TSMC stock is poised for growth in the new year due to advanced chip technology, a diverse business model, and market leadership, making it a solid buy.

TSMC shares reach record high amid booming AI demand

Taiwan Semiconductor Manufacturing Co. (TSMC), the world's largest contract chipmaker, is on track to achieve its best stock performance in 25 years. The company's shares briefly reached an all-time high in Taipei trading, reflecting its pivotal role in the artificial intelligence (AI) market.

TSMC: Market Outperformance Expected, Driven By N2 Advancements And Strong ASIC Demand

TSMC is poised for 25%+ revenue growth in 2025, driven by robust AI demand, N2 chip debut, and overseas fab production ramp. The debut of N2 nodes in H2 2025, featuring GAA advanced nanosheet transistors, will significantly enhance performance and power efficiency. TSMC's market share and pricing power will increase with a 10-20% price hike for N2 & N3 wafers, offsetting overseas fab ramp costs.

Exclusive: US plans to blacklist company that ordered TSMC chip found in Huawei processor -- source

The Biden administration plans to blacklist a Chinese company whose TSMC-made chip was illegally incorporated into a Huawei AI processor, according to a person familiar with the matter.

Is Trending Stock Taiwan Semiconductor Manufacturing Company Ltd. (TSM) a Buy Now?

TSMC (TSM) has been one of the stocks most watched by Zacks.com users lately. So, it is worth exploring what lies ahead for the stock.

Taiwan Semiconductor Almost Doubled In 2024 - What's Next For 2025

TSMC, the world's largest chip foundry, has outperformed the S&P 500 and tech sector in 2024, nearly doubling its stock price. Strong revenue growth, high margins, and robust demand for advanced technologies like AI and HPC support TSMC's continued market leadership and EPS growth. TSMC's disciplined CapEx and strategic diversification mitigate geopolitical risks, making it a "Buy" despite competition and operational challenges.

These Are My 2 Biggest Winning AI Stocks in 2024: Here's What I Think About Them Now

In this video, Motley Fool contributor Jason Hall breaks down why Nvidia (NVDA -1.22%) and Taiwan Semiconductor (TSM -0.77%) have been his best-performing artificial intelligence stocks in 2024 and why activity at Advanced Micro Devices (AMD -1.32%), along with its CEO's expectations, are worth knowing.

2 Stocks Set to Dominate in 2025

Sometimes, it's fairly obvious which companies will have a successful year before we're actually in it. I think that's the case with two companies: Taiwan Semiconductor (TSM -0.77%) and Amazon (AMZN -0.76%) although others could certainly make the list, too.

Taiwan Semiconductor Stock Doesn't Need To Break Out To Make Money

This option strategy let's you profit whether a stock breaks out or not while limiting your risk. The post Taiwan Semiconductor Stock Doesn't Need To Break Out To Make Money appeared first on Investor's Business Daily.