Taiwan Semiconductor Manufacturing Co. Ltd. ADR (TSM)

TSMC Stock: Why I Have No Plans To Sell

TSMC dominates AI chip manufacturing with over 90% market share, leveraging advanced technology and strong customer relationships with Nvidia, Apple, and AMD. Stellar Q2 results highlight robust AI demand, with revenue up 44.4% YoY and management raising full-year growth guidance to 30%. The company's proven ability to consistently generate strong profits demonstrates its economies of scale, cost efficiency, and pricing power due to its leadership position in chip manufacturing.

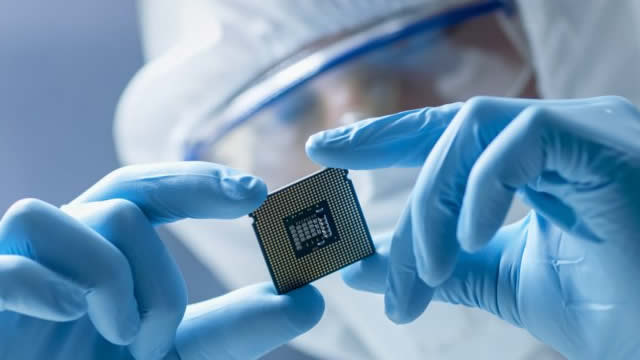

TSMC: The Only AI Fab Game In Town

Taiwan Semiconductor Manufacturing Company Limited delivered strong Q2 results, beating earnings estimates and showcasing robust revenue growth driven by soaring AI chip demand. Margin expansion highlights TSMC's ability to translate top line growth into higher profitability, reinforcing its leadership in the chip manufacturing sector. TSMC remained widely free cash flow profitable in Q2'25 and the outlook implies strong tailwinds for FCF and earnings growth.

Taiwan Semiconductor Q2 Earnings and Revenues Surpass Expectations

TSM tops Q2 forecasts with 61% EPS growth, driven by strong demand for advanced chip nodes.

TSMC is executing flawlessly and becoming the only foundry needed for new AI and smartphone chips

Mehdi Hosseini, senior equity research analyst at Susquehanna, says that while TSMC's revenue mix could get a few percentage points of upside from its China business, the main growth drivers going forward are the shipments of Nvidia Blackwell chips to the U.S. and the introduction of 2nm smartphone chips.

Chips analyst sees higher margins for TSMC despite currency headwinds

Kevin Wang, Semiconductor Analyst at Mizuho Securities, discusses TSMC's latest Q2 earnings and explains why the world's biggest contract chipmaker is still poised for higher profits down the road.

TSMC: Growth Moderation Ahead, But Still A Buy (Rating Downgrade)

Taiwan Semiconductor Manufacturing Company Limited delivered outstanding Q2 results, with revenue up 44.4% YoY and significant margin expansion, reflecting robust demand and pricing power. TSMC's latest technology ramp, especially 3nm, is driving growth, while High Performance Computing continues to gain importance within the revenue mix. Q3 guidance is softer, with expected deceleration in revenue growth and margin contraction, tempering the near-term outlook.

TSMC Q2: AI Growth Is Booming, Yet I'm Holding Off

Taiwan Semiconductor Manufacturing Company Limited stock is currently still experiencing bullish momentum, which is understandable following robust Q2 results. However, taking a longer-term view reveals the likelihood for TSM stock valuation multiple contraction. High-performance computing revenue is currently 60% of TSMC's total revenue, with AI-related revenues shifting from 100% to about 50% annual growth next year.

A New $70 Billion AI Investment Could Push Taiwan Semiconductor

There have been a few times in the stock market when investors received a clear signal, as they do right now, with a focus on the technology sector amid a race for artificial intelligence dominance and a broader market share for the United States. As trade tariffs begin to create more uncertainty and rivalry with countries like China, onshoring the manufacturing and supply capacity of chips and semiconductors has become a top priority.

TSMC: The Bull Run Has Only Just Begun

Demand for AI and HPC chips is relentless. Taiwan Semiconductor Manufacturing Company Limited is growing at a rate of 30%, which is unusual for a company that brings in $30B in revenue per quarter. The utilization rate for the 5nm process node was so high in Q2 that the company had to deploy resources from the older 7nm node to meet demand. TSMC's $165B US investment should help mitigate reciprocal and sectoral tariff risks, with effective rates likely landing between 15-20% after August 1.

Taiwan Semi is speeding up U.S. chip production due to demand, CEO says

Squawk Box Europe

TSMC: Surging To New All-Time High After Blowout Quarter

Taiwan Semiconductor Manufacturing Company Limited delivered outstanding Q2 results, with 44% revenue growth and a 61% jump in net income, fueled by surging AI demand. The company's dominant foundry position and advanced 3nm/5nm technologies make it a key beneficiary of global AI and data center expansion. TSMC's margin expansion and pricing power, combined with strong execution, reinforce confidence in its long-term growth prospects.

Taiwan Semiconductor Manufacturing Company Limited (TSM) Q2 2025 Earnings Call Transcript

Taiwan Semiconductor Manufacturing Company Limited (NYSE:TSM ) Q2 2025 Earnings Conference Call July 17, 2025 2:00 AM ET Company Participants C. C. Wei - Chairman & CEO Jeff Su - Director of Investor Relations Jen-Chau Huang - Senior VP of Finance & CFO Conference Call Participants Brad Lin - BofA Securities, Research Division Brett William Simpson - Arete Research Services LLP Charlie Chan - Morgan Stanley, Research Division Chia Yi Chen - Citigroup Inc., Research Division Gokul Hariharan - JPMorgan Chase & Co, Research Division Junhong Pan - KGI Securities Co. Ltd.