Walmart Inc. (WMT)

Why Walmart (WMT) is a Top Growth Stock for the Long-Term

Wondering how to pick strong, market-beating stocks for your investment portfolio? Look no further than the Zacks Style Scores.

Exclusive: Amazon, Walmart shareholder pushes firms to report impact of Trump's immigration policies

A union-aligned investment group sent letters to Amazon, Walmart and Alphabet on Wednesday, asking how U.S. President Donald Trump's immigration policies were impacting their finances and supply chains, according to the documents seen by Reuters.

Pepsi Worked to Keep Prices Higher at Retailers to Protect Walmart's Prices, FTC Found

The allegations were made in an FTC lawsuit, dropped in May by the Trump administration, that was recently unsealed.

Walmart & 2 More Blue Chip Retail Stocks to Watch Heading Into 2026

WMT, COST and LOW stand out for stability, tech adoption and steady growth as 2026 approaches.

Investors Heavily Search Walmart Inc. (WMT): Here is What You Need to Know

Recently, Zacks.com users have been paying close attention to Walmart (WMT). This makes it worthwhile to examine what the stock has in store.

Walmart's US Comp Sales Up 4.5%: Transaction Growth to Last in 2026?

WMT's U.S. comp sales rise 4.5% in Q3 as transactions and units grow, with omnichannel traffic, faster fulfillment and value driving demand.

Walmart was too late for a Nasdaq-100 spot — but these 6 stocks made the cut

Six companies will join the Nasdaq-100 later this month — but not Walmart, which switched its listing away from the New York Stock Exchange too late to qualify for a spot in the tech-heavy index.

Walmart's Valuation Makes Zero Mathematical Sense

Walmart is rated a strong sell due to extreme overvaluation versus slow expected growth rates and cheaper peer metrics. WMT trades at historically high multiples—particularly its P/E of 40x—eclipsing peers like Target, Costco, and Amazon. Earnings and free cash flow yields lag well below risk-free money market rates, with rather slight company growth projections around 10% annually.

AI shopping could drive $263 billion in holiday sales. Walmart and Target are racing to get in

AI could drive $263 billion in global holiday sales this year, representing 21% of all holiday orders, Salesforce predicts. Companies like Walmart and Target are overhauling their AI strategies to ensure they're meeting consumers where they're shopping.

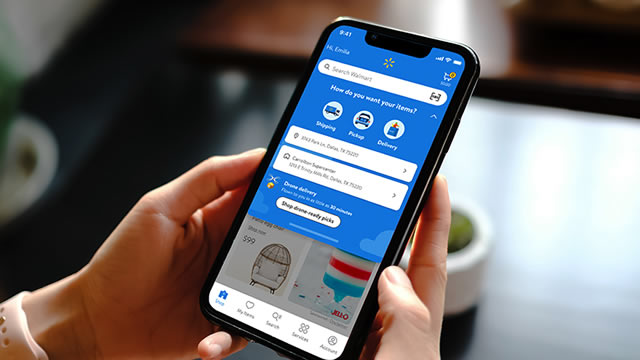

Walmart Joins Nasdaq as Amazon Competition Goes High-Tech and Agentic

When one thinks of retail competition, the battle between eCommerce and brick-and-mortar is typically what leaps to mind. Traditionally, Amazon has been the eCommerce landscape's leading representative, and Walmart the flag bearer for traditional physical shopping.

Walmart Stock Up 25% in 2025: What's the Smart Move for 2026?

WMT's 2025 rally, fueled by e-commerce strength and higher-margin growth, sets the stage for a balanced but watchful outlook heading into 2026.

Walmart's NASDAQ Switch Could Change Everything for WMT Stock

There's something different about Walmart Inc. NASDAQ: WMT this holiday season, and it has nothing to do with the health of the consumer. On Dec. 9, the company began publicly trading on the NASDAQ exchange.