Winners, Inc. (WNRS)

Inflation Declines, Raising Interest Rate Cut Hopes: 5 Winners

Investing in discretionary stocks like YETI Holdings (YETI), The Toro Company (TTC), Skechers U.S.A.(SKX), Royal Caribbean Cruises (RCL) and Norwegian Cruise Line Holdings (NCLH) on rising rate cut hopes.

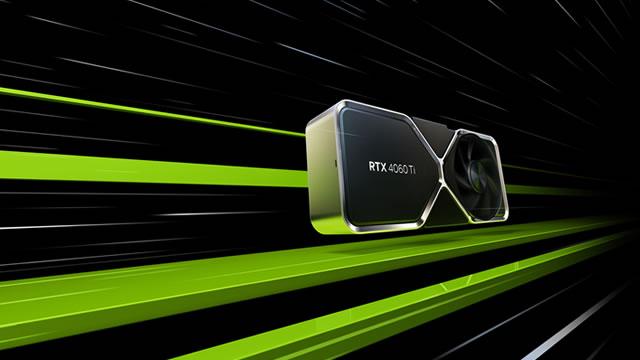

AI's Hidden Winners: 3 Affordable Downstream Plays to Invest In Now

The apparent winners of the artificial intelligence (AI) boom have been smoking hot of late. While some of the names may be overdue for a correction over the next year, I view many of them as reasonably priced, given the magnitude of growth-powering tailwinds.

History Says These 3 AI Stocks Could Be Big Winners in the Second Half of 2024

Nvidia's surging stock price has made it one of the three most valuable companies in the world. Advanced Micro Devices has the potential to deliver some strong results in its upcoming quarters.

Bank of America: Let Your Winners Run

Bank of America investors have outperformed the S&P 500 recently. BofA has a solid banking franchise, benefiting from a higher-for-longer Fed. BAC's exposure to CRE loans is expected to remain well-controlled.

Tap the Rally in Commodities With These ETF Winners

Commodities have been performing remarkably well this year driven by higher prices for coffee, silver and oil.

3 Winners From the Next Massive AI Spending Boom (Hint: It's Not NVIDIA)

Another week, and more good news for AI investors. Last week it was revealed that memory maker SK Hynix plans to invest $74.6 billion into expanding its capacity to make chips for the AI boom.

Energy Stocks: Winners And Losers At The Beginning Of H2 2024

The energy sector underperformed the S&P500 in Q2 2024, continuing a trend that started earlier, and this is likely to continue heading into H2 2024. There are a number of factors that seem to be weighing on the energy sector, although some stocks are affected more than others. Crude oil is hemmed in between two opposing forces, which are both trying to impose their influence on prices.

3 AI Stock Winners Defying Tech Sector Turbulence

With the kick-off of the year's second half underway, investors may wonder if the same themes that outperformed in the first half will continue to work. Undoubtedly, AI chip stocks will still stand out as exciting growth bets for investors looking to play the technological revolution.

Nvidia Among Biggest Stock Market Winners In 2024, But This Is No. 1

Nvidia has more than doubled so far this year, but the biggest S&P 500 stock winner is Super Micro, one of several big AI performers.

The Next Big Winners: 3 Up-and-Coming Stocks With Strong Potential

If you're looking for robust returns and can handle the potential for near-term volatility, then the concept of targeting up-and-coming stocks could be right for you. By this category, I'm not necessarily referring to entities that just incorporated a few days ago.

Prison Stocks Gain After Presidential Debate: Winners Regardless Of Trump Or Biden In Office?

The stock market is reacting to the first 2024 presidential debate and prison stocks could be the winner based on what was said by the two candidates Thursday night.

CHIPS Act Winners Reside in This ETF

Two years ago, President Biden signed the CHIPS and Science Act into law. Certainly, assuming it's implemented to its fullest potential, the legislation could be a boon for a variety of semiconductor stocks.