Wolfspeed Inc. (WOLF)

Is $6 a Reality for Wolfspeed (WOLF) Or Wishful Thinking?

Wolfspeed, Inc. is a semiconductor company that is undergoing a Chapter 11 bankruptcy restructuring thanks to the help of Apollo Global Management and a $1.25 billion secured note with an option for $750 million more.

Wolfspeed: The Wolf Is Shedding Its Debt, Not Its Teeth

Wolfspeed, Inc. is set to rebuild with Apollo and Renesas. Aiming to slash about $4.6 billion in debt. This positioning the company for a turnaround after Chapter 11 protection. Renesas converts $2 billion deposit into equity. They take a 38.7% share in Wolfspeed and become its largest stakeholder. A bullish sign showing strong strategic backing for the company's recovery. New management appointments and higher fab utilization could drive margin improvements, which they aim to do post-rebuild with a clean slate.

WOLF Stock To $20?

While Wolfspeed faces severe financial challenges, recent developments suggest a potential turnaround story that could deliver exceptional returns for risk-tolerant investors willing to bet on the company's survival and recovery.

Wolfspeed files for bankruptcy in effort to turn around NC chipmaker

The 38-year-old Durham, North Carolina, semiconductor supplier Wolfspeed filed for Chapter 11 bankruptcy, officially starting a reorganization the company says will allow it to shed billions in debt.

What's Happening With WOLF Stock?

Wolfspeed stock (NYSE:WOLF) surged nearly 100% during after-hours trading on Monday, June 30, following the silicon carbide semiconductor firm's filing for Chapter 11 bankruptcy protection, indicating a significant shift in its restructuring strategy. The bankruptcy protection filing presents a tactical chance for Wolfspeed to realign its financial foundation.

Wolfspeed Stock Dives. Why It Is Filing for Bankruptcy and What Happens Next.

Wolfspeed said the bankruptcy was part of a planned restructuring which would cut its overall debt by around 70%, or $4.6 billion.

Wolfspeed reaches agreement with creditors, plans bankruptcy filing

Wolfspeed said on Sunday that it has reached a restructuring agreement with creditors and plans to file for bankruptcy in the U.S. in the near future.

Among the Market's Most Shorted: 2 Firms With +40% Short Interest

In a market increasingly driven by speculation and sentiment, two stocks have emerged as battlegrounds for bearish investors: Wolfspeed NYSE: WOLF and Kohl's NYSE: KSS. Both names currently rank among the most heavily shorted on Wall Street, with short interest exceeding a staggering 40% of their floated shares.

This Wolf Isn't Dead Yet: Initiating Wolfspeed Stock With A Buy

Wolfspeed, Inc. faces severe financial distress, with bankruptcy rumors and an 78% stock drop, but I believe the worst is priced in. Gallium nitride technology demand is surging, especially after Nvidia's recent deal, positioning Wolfspeed's tech for a potential turnaround. Despite debt and missed CHIPS Act funding, Wolfspeed's low valuation and strategic assets make it an attractive acquisition target.

Wolfspeed reportedly preparing to file for bankruptcy, shares plummet

Wolfspeed Inc (NYSE:WOLF) shares plunged almost 70% after the Wall Street Journal (WSJ) revealed the chipmaker is preparing to file for Chapter 11 bankruptcy within weeks due to its inability to manage its substantial debt load, which totals around $6.5 billion. According to the report, which cited sources with knowledge of the matter, the company has rejected multiple out-of-court debt restructuring proposals from creditors and is now focusing on a prepackaged bankruptcy plan that would have the support of a majority of its creditors.

Wolfspeed Stock Plunges 56% on Worries About the Chip Supplier's Financial Health

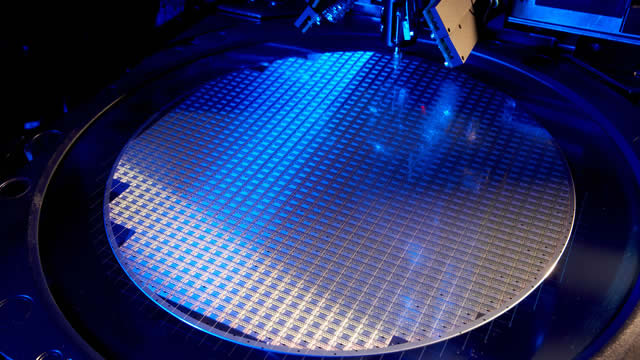

The embattled wafer maker could file for bankruptcy within weeks, The Wall Street Journal reports.

WOLF Stock Looks Risky Amid Mounting Challenges: Time to Step Aside?

Mounting debt, slowing material sales and funding setbacks cloud Wolfspeed's path to profitability, raising concerns over its financial stability.