Applied Materials Inc. (AMAT)

Applied Materials (AMAT) Outperforms Broader Market: What You Need to Know

Applied Materials (AMAT) concluded the recent trading session at $217.51, signifying a +2.81% move from its prior day's close.

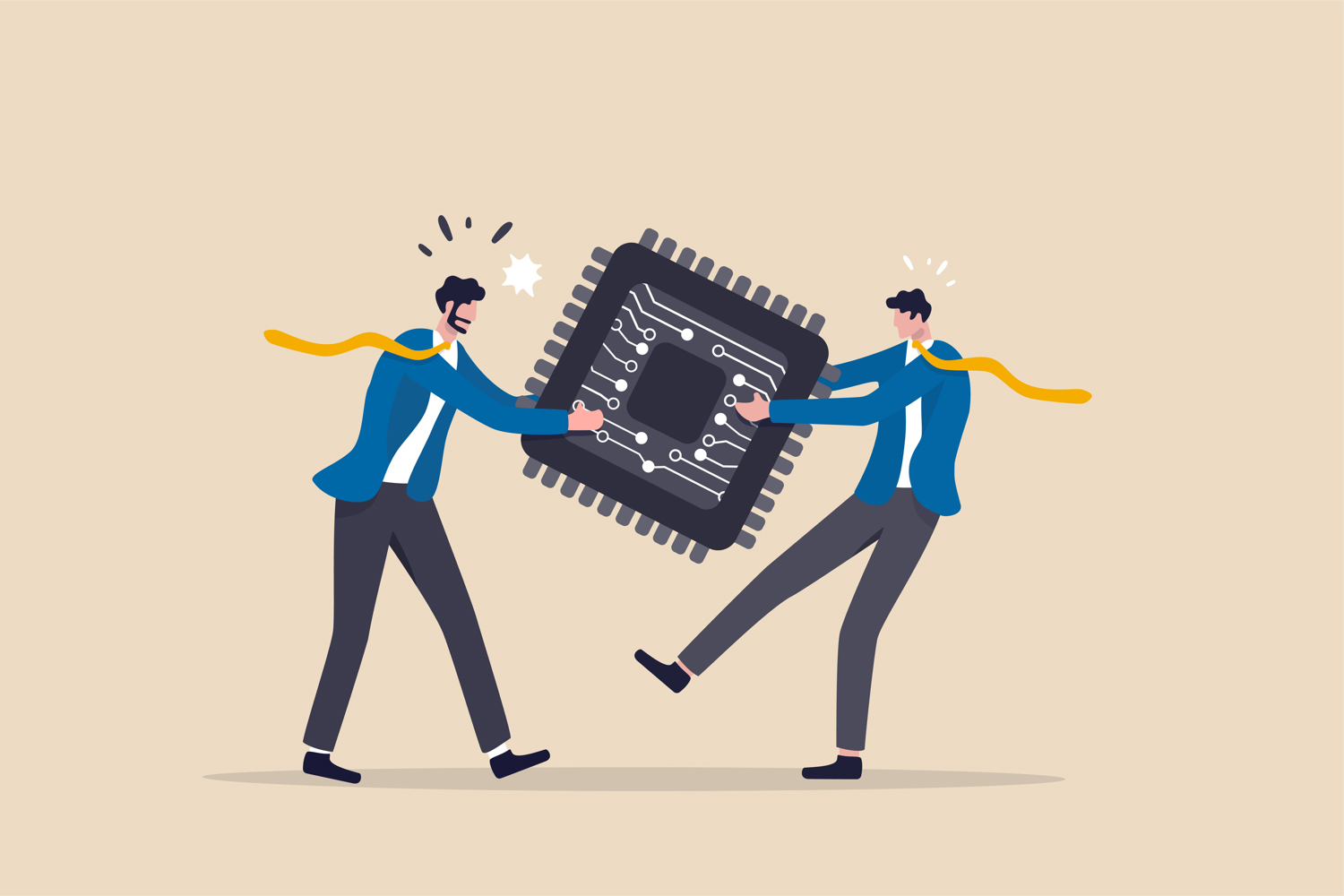

Wall Street Breakfast Podcast: Lawmakers Urge Broader China Chip Curbs

U.S. lawmakers seek broader restrictions on chipmaking equipment sales to China, spotlighting AMAT, LRCX, and KLAC after a major increase in Chinese purchases. A bipartisan report reveals Chinese semiconductor firms spent $38 billion on advanced machinery, fueling domestic chip capacity and AI ambitions despite export controls.

Brokers Suggest Investing in Applied Materials (AMAT): Read This Before Placing a Bet

The recommendations of Wall Street analysts are often relied on by investors when deciding whether to buy, sell, or hold a stock. Media reports about these brokerage-firm-employed (or sell-side) analysts changing their ratings often affect a stock's price.

Applied Materials stock falls on sales warning from China export restrictions

Applied Materials Inc (NASDAQ:AMAT, ETR:AP2) shares slipped more than 3% in early trading on Friday after the maker of machinery used to manufacture semiconductors revealed in a regulatory filing that new US export restrictions to China would hurt its revenue. The company expects the decision will result in about $600 million of lost revenue in fiscal 2026, which runs through next October.

These chip stocks are falling in the face of a new China setback

Semiconductor stocks have been impacted this year by evolving U.S. rules governing the sale of chips to China. Applied Materials just called out a fresh set of challenges.

AMAT Trades 54% Above Its 52-Week Low: Time to Hold or Fold the Stock?

Applied Materials rides DRAM strength and R&D push, but China headwinds, weak memory demand and rivals weigh on its outlook.

Applied Materials Stock Builds on Rally After Bull Note

Shares of Applied Materials Inc (NASDAQ:AMAT) are up 2.8% to trade at $195.48 at last check, after Morgan Stanley Securities upgraded the stock to "overweight" and raised its price target to $209.

Can AMAT Maintain Strong Margins Amid Rising R&D Expenses?

Applied Materials offsets soaring R&D with cost cuts, driving record gross margins and expanded operating profitability.

AMAT's Etch Business Crosses $1B: Can DRAM Momentum Continue?

Applied Materials' etch business surpasses $1B in Q3 as DRAM demand for AI workloads fuels momentum and future market share gains.

AMAT's Display Revenues Rebound: Is it a Sign of Stability?

Applied Materials' display segment surges on OLED demand, with Q4 revenues projected to soar 66% year over year.

Buy, Sell Or Hold Applied Materials Stock?

Applied Materials (NASDAQ:AMAT) published a set of Q3 results that exceeded expectations last week, yet the stock has declined approximately 15% since the earnings announcement due to worries about future demand, especially from China. Although Applied is well-placed to gain from a higher proportion of advanced equipment linked to generative AI and next-generation process technologies, geopolitical factors seem to impede progress.

AMAT Stock Trades at a P/E of 16.69X: Should You Buy, Sell or Hold?

Applied Materials trades at a discount P/E, but China woes, weak memory demand and bearish trends cloud its outlook.