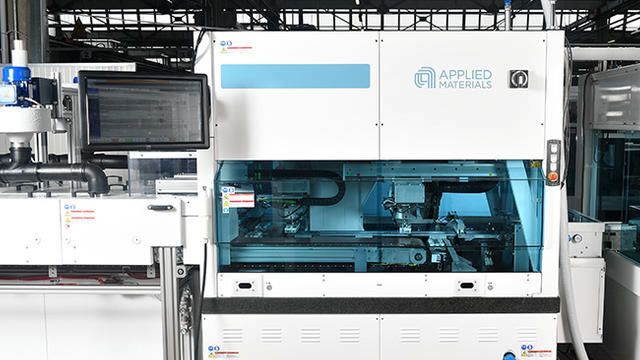

Applied Materials Inc. (AMAT)

Applied Materials Warns Uncertainty Is Slowing Its Business, Especially in China

Shares of Applied Materials (AMAT) sank 13% in premarket trading Friday, a day after the semiconductor equipment manufacturer gave weaker-than-expected guidance as global economic and tariff worries impact its business, especially in China.

Applied Materials Earnings: Is The Semiconductor Cycle About To Change?

Applied Materials, Inc. delivered record Q3 results, with strong revenue, EPS, margins, and robust cash flow, highlighting the current strength in the semiconductor cycle. Q4 guidance signals a potential slowdown: projected revenue and EPS are both down year-over-year, with Semiconductor Systems orders showing notable weakness. China digestion, uneven leading-edge demand, and policy uncertainty (including potential tariffs) are creating headwinds and could mark the start of a cyclical downturn.

Applied Materials, Inc. (AMAT) Q3 2025 Earnings Call Transcript

Applied Materials, Inc. (NASDAQ:AMAT ) Q3 2025 Earnings Conference Call August 14, 2025 4:30 PM ET Company Participants Brice A. Hill - Senior VP, CFO & leads Global Information Services Gary E.

Market Indexes Fight Back to Flat for the Day

Markets were mostly flat for the day, aside from the small-cap Russell 2000, which gave back the majority of its +2% gains yesterday.

Compared to Estimates, Applied Materials (AMAT) Q3 Earnings: A Look at Key Metrics

The headline numbers for Applied Materials (AMAT) give insight into how the company performed in the quarter ended July 2025, but it may be worthwhile to compare some of its key metrics to Wall Street estimates and the year-ago actuals.

Applied Materials (AMAT) Q3 Earnings and Revenues Beat Estimates

Applied Materials (AMAT) came out with quarterly earnings of $2.48 per share, beating the Zacks Consensus Estimate of $2.34 per share. This compares to earnings of $2.12 per share a year ago.

Options Corner: AMAT Neutral Example Trade

On the technical front, Applied Materials (AMAT) is underperforming the overall markets says Rick Ducat. He compares the company to other semiconductor-related names before showing recent resistance points for investors to watch ahead of earnings.

This Tech Hardware Stock Could Steal the Show

Subscribers to Chart of the Week received this commentary on Sunday, August 9.

4 Stocks That May Get a Big Earnings Bump This Week

As Amazon.com Inc. NASDAQ: AMZN reminds us, sometimes it can be difficult to predict how the market will respond to a company's earnings report, even if the firm comes out ahead of analyst expectations for earnings and revenue. Amazon's dip following its latest report, despite top- and bottom-line beats, shows that sometimes details like forward guidance or the suggestion of short-term difficulties can be enough to undo any investor goodwill that may have built.

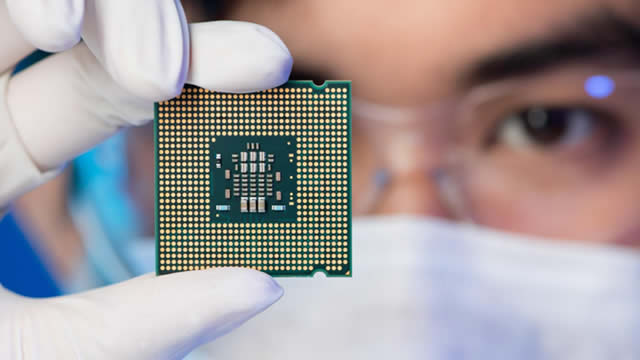

2 Stocks to Buy From the Challenging Semiconductor Industry

The Zacks Electronics - Semiconductors industry players like AVGO and AMAT gain from the growing proliferation of AI, ML and consumer electronic devices.

Applied Materials Before Q3 Earnings: How to Play the Stock

AMAT's third-quarter fiscal 2025 performance is likely to grow on the back of AI-driven chip demand, but trade tensions can weigh on results.

Insights Into Applied Materials (AMAT) Q3: Wall Street Projections for Key Metrics

Looking beyond Wall Street's top-and-bottom-line estimate forecasts for Applied Materials (AMAT), delve into some of its key metrics to gain a deeper insight into the company's potential performance for the quarter ended July 2025.