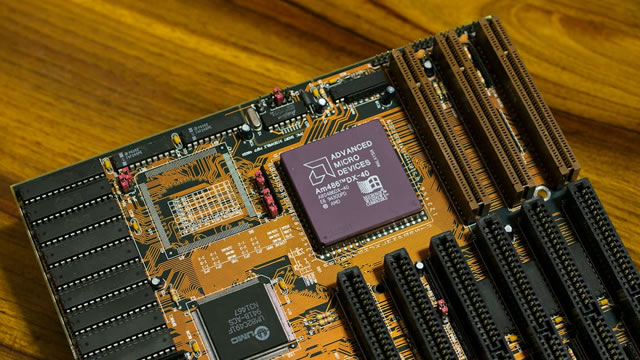

Advanced Micro Devices, Inc. (AMD)

Nvidia and AMD to pay US 15% of China revenues in rare export deal

Nvidia Corp (NASDAQ:NVDA, ETR:NVD) and Advanced Micro Devices Inc (NASDAQ:AMD, ETR:AMD) have struck an unprecedented agreement to pay the US government 15% of their revenues from chip sales in China to secure export licences. This follows US restrictions on advanced chips, particularly those used in artificial intelligence, amid national security concerns.

Nvidia and AMD strike major revenue-sharing deal with US government over China chip sales

Revenue-sharing deal between Nvidia, AMD and U.S. government covers AI chip sales to China, a key market worth billions for both companies.

Trump Administration to Take 15% Cut of Nvidia and AMD Chip Sales to China

The unusual arrangement follows Nvidia CEO Jensen Huang's meeting with President Trump.

Nvidia, AMD to pay 15% of China chip sale revenues to US: report

Nvidia and AMD have agreed to give the US government 15% of their revenues from chip sales in China, under an arrangement to obtain export licenses for the semiconductors, the Financial Times reported on Sunday.

U.S. Government to Take Cut of Nvidia and AMD A.I. Chip Sales to China

In a highly unusual arrangement with President Trump, the companies are expected to kick 15 percent of what they make in China to the U.S. government.

Nvidia and AMD to pay 15% of China chip sales revenues to the U.S. government, FT reports

In exchange for 15% of revenues from the chip sales, the two chipmakers will receive export licenses to sell Nvidia's H20 and AMD's MI308 chips in China, according to the Financial Times. Nvidia CEO Jensen Huang met with Trump last week, the FT reported.

Nvidia and AMD reportedly will give U.S. government 15% of its China chip revenues

Nvidia Corp. and Advanced Micro Devices Inc. will give 15% of their chip revenue from sales in China to the U.S. government as a condition of receiving new export licenses, according to a report Sunday.

Nvidia, AMD To Give 15% Of China Chip Revenue To U.S. Government: FT

Nvidia and Advanced Micro Devices have agreed to give the U.S. government 15% of China chip sale revenue, the Financial Times reported Sunday.

Trump's $12-$15 Trillion of New Capital Makes These 4 AI Stocks (and 1 ETF) a Buy

The passage of the Big Beautiful Bill (BBB) gave economic stability, assuring of tax cuts that stimulate investment, job creation, and GDP growth.

AMD: Inference Is The Future Of AI

AMD is strategically positioned to dominate the rapidly growing AI inference market, which could be 10x larger than training by 2030. The MI300X's memory advantage and ROCm's ecosystem progress make AMD the cost-efficient, open alternative as AI workloads shift to inference. Strong Q2 results, robust data center growth, and hyperscaler/sovereign demand support my price target, with multi-segment upside potential.

AMD: Record-Breaking Q2, But Don't Buy Until $156

I explain why I maintain a 'strong buy' rating on AMD, but recommend waiting for a dip to the mid-$150s before adding to positions. AMD's record free cash flow, strong balance sheet, and leadership in server/desktop CPUs support the long-term bull thesis. Short-term risks include recent EPS miss, AI GPU revenue decline, and elevated valuation metrics (especially forward EV/EBITDA).

AMD: Q3 Guidance Leaves Out China -- A Trade Deal Could Be A Nice Surprise

I reiterate my strong buy rating on Advanced Micro Devices, Inc. I now expect the share price to test the $200s before year-end. In my view, the likely approval of MI308 GPU exports to China is a key catalyst ahead, as the current guidance excludes China sales. The MI350 GPU ramp, plus record EPYC CPU sales, should, I believe, push AMD Q3 revenue past management's and the Street's estimates and hold gross margins near 54%.