Advanced Micro Devices, Inc. (AMD)

AMD: Don't Give Up Yet

The upcoming earnings of AMD will be crucial for the company in terms of forward guidance on AI revenue trajectory and the impact of tariffs. We could see AMD beat estimates for first quarter similar to Intel due to customers pulling ahead their purchases to prevent a tariff hit. AMD has stopped giving guidance for AI revenue, but the product pipeline is strong, and the company could still reach over $10 billion in AI revenue in 2025.

AMD Q1 Preview: Inflection Point Approaching (Technical Analysis)

Trading patterns in the past 3~4 weeks suggest an imminent trend reversal for AMD stock prices. Technical indicators such as bullish crossover and rising RSI suggest increasing upward momentum and buying interest. I further expect AMD's upcoming FQ1 earnings report (ER, scheduled on May 6, 2025) to provide the trigger for such a reversal.

Advanced Micro Devices (AMD) Stock Sinks As Market Gains: Here's Why

Advanced Micro Devices (AMD) reachead $96.39 at the closing of the latest trading day, reflecting a -0.26% change compared to its last close.

Why AMD Stock Jumped Today

Advanced Micro Devices (AMD 4.49%) stock recorded another day of strong gains Thursday. Amid a 2% jump for the S&P 500 and a 2.7% rally for the Nasdaq Composite, the semiconductor specialist's share price closed out the day up 4.5%.

AMD Vs. Arm: Which Is The Better Investment Ahead Of Earnings

ARM and AMD are strong AI picks with solid growth, but AMD offers more direct exposure to generative AI and trades at a cheaper valuation. ARM has higher profit margins due to its royalty model, but trades at a rich premium compared to AMD. I discuss which is a better pick ahead of upcoming earnings.

Prediction: 2 Artificial Intelligence (AI) Stocks That Could Be Worth More Than Nvidia by 2030

Despite the fanfare, the artificial intelligence (AI) revolution has just begun. With the AI market valued at $189 billion in 2023, the United Nations believes it will become a $4.8 trillion market by 2033.

AMD Jumped Today -- Is the Artificial Intelligence (AI) Stock a Buy?

Advanced Micro Devices (AMD 4.81%) stock closed out Wednesday's daily session with big gains. The semiconductor company's share price rose 4.9% in a day of trading that saw the S&P 500 index climb 1.6% and the Nasdaq Composite rise 2.5%.

Why AMD, Broadcom, and Taiwan Semiconductor Manufacturing Stocks Rallied on Wednesday

The uncertainty that has gripped the market recently has been palpable. Concerns about the on-again, off-again tariffs, a high-profile spat between the White House and the Federal Reserve Bank, and the ongoing trade war with China have raised concerns about the impact on the broader economy and led to historic volatility.

2 Artificial Intelligence (AI) Stocks That Could Soar in the Second Half of 2025

The tariff-driven stock market sell-off has put the indexes into a correction phase, hitting artificial intelligence (AI) stocks hard. Many of these stocks lost one-third or more of their value, and a few sell for less than half of their recent highs.

Advanced Micro Devices (AMD) Ascends But Remains Behind Market: Some Facts to Note

In the closing of the recent trading day, Advanced Micro Devices (AMD) stood at $86.26, denoting a +0.82% change from the preceding trading day.

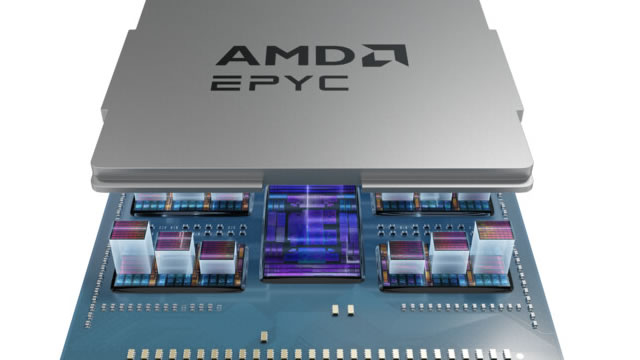

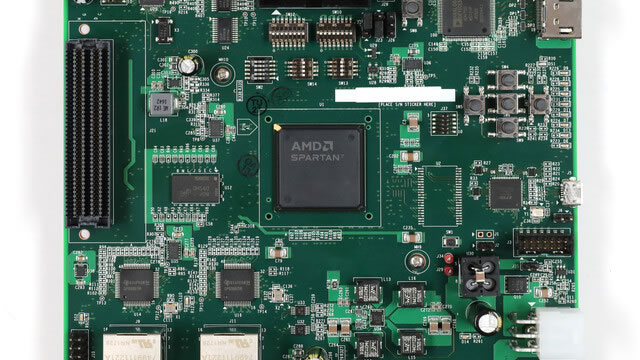

AMD Q1 Preview: Ryzen 9000 Is Sold Out

I reiterate a "Buy" rating on Advanced Micro Devices, Inc. with a fair value of $104 per share, driven by strong growth in EPYC and Ryzen processors. AMD's Ryzen 9000, utilizing Zen 5 architecture, has captured 70% of the desktop power processor market, competing effectively with Intel's 15th Gen. Anticipate 25% revenue growth for FY25, driven by data center segment growth (35%) and client segment growth (30%), despite $800M impact from export controls.

AMD: Brace For A 10% Impact On EPS For FY 2025

A 10% hit to Advanced Micro Devices, Inc.'s EPS in 2025 is quite likely, yet the consensus on Wall Street has only priced in a 3% drop so far. To be specific, I believe the market is underestimating the risk of AMD's $800M inventory charge if export licenses aren't approved, which is a likely scenario. Another headwind includes the upcoming tariffs on semiconductors, which can range anywhere from 25% to 100%. AMD imports a significant amount of AI chips from TSMC.