Advanced Micro Devices, Inc. (AMD)

AMD vs. Broadcom: Which Semiconductor Stock Has Greater Upside?

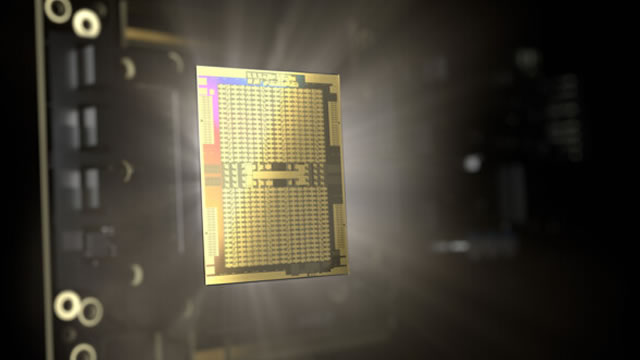

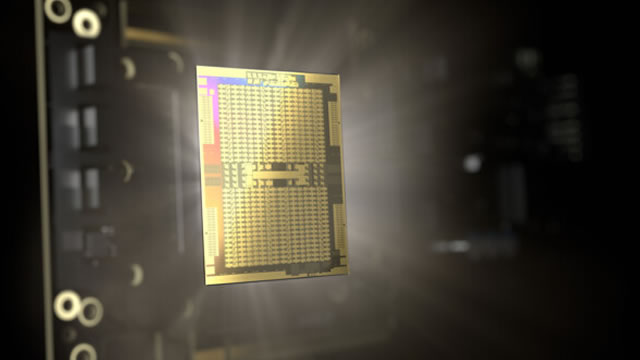

Advanced Micro Devices AMD and Broadcom AVGO are key providers of semiconductor chips that power artificial intelligence (AI). Chips from these companies support running of Large Language Models that form the backbone of Generative AI (Gen AI).

Why AMD Stock Is Sinking After Opening With Big Gains Today

Despite opening the day solidly in the green, Advanced Micro Devices (AMD -1.70%) stock is now moving lower in Tuesday's trading. The company's share price was down 1.9% as of 1:30 p.m.

Investors Heavily Search Advanced Micro Devices, Inc. (AMD): Here is What You Need to Know

Advanced Micro (AMD) has been one of the stocks most watched by Zacks.com users lately. So, it is worth exploring what lies ahead for the stock.

AMD stock downgraded amid market turmoil

Advanced Micro Devices (NASDAQ: AMD) has been struggling ever since July of 2024. The recent tariff-driven crash has done AMD stock no favors.

President Trump Announces Tariffs That Are Causing AMD Stock to Fall. Should Investors Buy AMD Stock?

AMD (AMD -2.87%) outsources production to Taiwan Semiconductor Manufacturing (TSM -0.68%), which could make it vulnerable to tariffs.

AMD: The Market Hasn't Seen What's Coming

AMD's data center revenue nearly doubled in 2024, with over $5 billion driven by Instinct AI GPUs alone. The MI350X, launching in H2 2025, promises 35x inference performance over MI250, featuring 288GB of HBM3E memory. If AMD captures just 15–20% of AI inference market, it becomes a multi-billion-dollar second-source alternative to Nvidia.

AMD Vs. Nvidia: AMD Has Significantly Better Growth Prospects Post 2028

AI's potential is significant, but historical trends suggest cautious optimism. New technologies often take longer to impact productivity and profitability than initially expected. I discuss the AI market outlook and share my thoughts on which stock to invest in.

2 Top Artificial Intelligence (AI) Stocks Ready for a Bull Run

The recent market sell-off has created some nice opportunities in the market for long-term investors, particularly among artificial intelligence (AI) stocks. This includes several AI semiconductor stocks besides Nvidia, which has also seen its stock come under pressure.

Can AMD Outperform NVIDIA? Let's See if the Stock is Worth Buying Now

Advanced Micro Devices, Inc. AMD has become a dominant player in the data center business. It is contending with NVIDIA Corporation NVDA in the graphic processing units (GPUs) market and has acquired some of the latter's top clients.

Buy AMD Stock Now To Capitalize On The Generational AI Megatrend

Advanced Micro Devices, Inc. harnesses HPC and GPU synergies to ride explosive AI data center growth, fueling massive upside through 2027. With undervaluation, strong AI momentum, and the ROCm ecosystem, AMD stock appears poised for $200 soon. Black-swan threats (e.g., a Taiwan crisis) demand hedging, yet AMD's AI-driven return potential remains largely unmatched—except, perhaps, by Nvidia.

AMD CEO Lisa Su: Trump tariffs could have "short term" impact on chips

"I do think that there could be some short-term impacts," AMD (AMD) CEO Lisa Su told Brian Sozzi in a Yahoo Finance exclusive on Monday. "I think it's too early to say what the longer-term impacts are.

Good News for AMD Stock Investors

In this video, I will talk about recent updates regarding Advanced Micro Devices (AMD -0.01%). Watch the short video to learn more, consider subscribing, and click the special offer link below.