Advanced Micro Devices, Inc. (AMD)

MoneyShow's Best Investment Ideas For 2025: Part 10

MoneyShow's Best Investment Ideas For 2025: Part 10

AMD Has Yet To Hit Its Peak Growth Trajectory

Advanced Micro Devices, Inc. closed FY24 with 14% top-line growth, driven by strong performance in the Data Center and Client segments, despite declines in Gaming and Embedded. AMD is well-positioned for durable growth in CPU & GPU sales, with strong support from the hyperscalers capital outlay for CY25. AMD's financial outlook remains robust, with anticipated growth in Data Center and Client segments as more AI applications move to production environments.

AMD: Don't Be Fooled By The Hype (Rating Downgrade)

Advanced Micro Devices, Inc.'s Q4 earnings report revealed strong revenue growth but highlighted concerns about stagnant data center operating margins and limited future growth prospects. Despite significant hype and innovation, AMD's forward P/E ratio requires cautious analysis due to potential risks and compressed margins. AMD's guidance for Q1 2025 indicates limited growth, raising concerns about capitalizing on the current AI and cloud infrastructure investment wave.

AMD: MI350 Keeps Me Bullish

Advanced Micro Devices, Inc. shares have dropped 12% since January, but I remain bullish due to strong growth prospects and the new MI350 GPU launch. Despite a Q4 data center revenue miss, AMD posted impressive YoY growth, with revenue of $7.7 billion and EPS of $1.09. AMD's valuation is conservative, with a forward PEG ratio significantly below the sector median, indicating potential upside of 247.17%.

Eye Disease Focused 4D Molecular Therapeutics Lays Out 52-Week Results From Wet AMD Study

On Saturday, 4D Molecular Therapeutics FDMT announced initial interim 52-week data from the Phase 2b Population Extension cohort of the PRISM trial of 4D-150 in a broad wet age-related macular degeneration (wet AMD) patient population.

Investors Heavily Search Advanced Micro Devices, Inc. (AMD): Here is What You Need to Know

Advanced Micro (AMD) has received quite a bit of attention from Zacks.com users lately. Therefore, it is wise to be aware of the facts that can impact the stock's prospects.

1 Artificial Intelligence (AI) Chip Stock to Buy the Dip Right Now (Hint: It's Not Nvidia)

Over the past year, a number of semiconductor stocks have witnessed meteoric gains thanks to ongoing euphoria surrounding artificial intelligence (AI). The share prices of Nvidia, Taiwan Semiconductor Manufacturing, and Broadcom have all risen approximately 80% over the last 12 months -- handily outperforming both the S&P 500 and Nasdaq Composite.

AMD: The Market Could Be Misjudging, Here's Why

Despite a 37% y/y drop in AMD's stock price, I maintain a 'strong buy' rating due to its significant growth prospects and undervaluation. DeepSeek's misleading $6M LLM development cost caused market panic, but actual CAPEX and resources were much higher, impacting AMD and NVIDIA stocks. AMD's strong financial performance and expanding AI and data center presence position it well as a solid number two to NVIDIA.

AMD: The Market Is Just Wrong

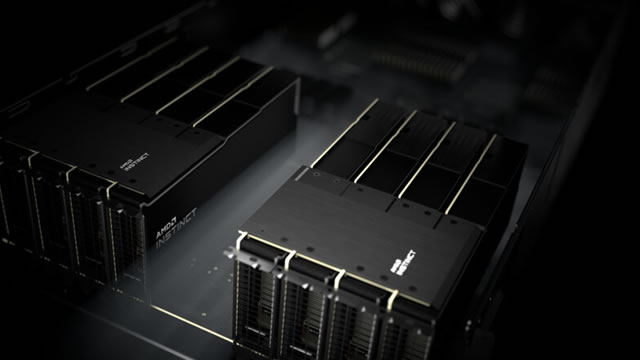

AMD beat Q4 top-line estimates, driven by strong Data Center growth. AMD saw 24% top-line growth, but its Data Center business grew at a massive 69% Y/Y growth rate in Q4 due to strong AMD Instinct shipments. The chipmaker reported a massive upswing in free cash flow and significantly boosted its FCF profitability in the fourth quarter.

Will AMD Be the Best Artificial Intelligence (AI) Stock of 2025?

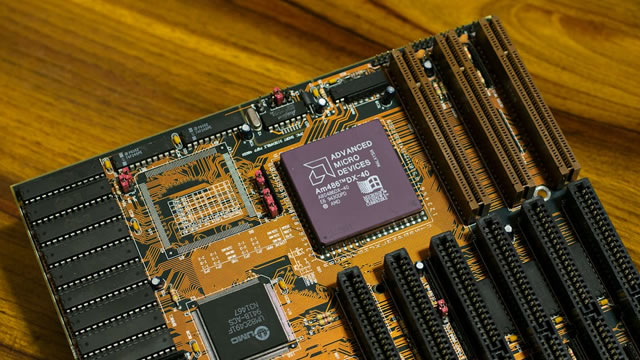

Advanced Micro Devices (AMD -2.36%) is one of the biggest names in the computing industry but has played second-fiddle to many competitors throughout its lifetime. While it was behind Intel in PC processors for many years, it's now considered a neck-and-neck competitor.

Should You Buy Advanced Micro Devices (AMD) Stock After Its 49% Drop?

Despite supplying some of the world's most sought-after chips, Advanced Micro Devices (AMD -2.36%) has declined 49% since it peaked in March 2024. Over the same period, Nvidia stock has increased about 40%.

AMD: AI Path Pulled Forward

AMD's Q4 report showed mixed results, but the company is poised for strong future growth with upcoming AI GPU upgrades, particularly the MI350 series. Data Center revenues now exceed 50% of AMD's total, positioning the company for significant growth despite weaknesses in Embedded and Gaming sectors. AMD's AI GPU revenue is expected to surge from $5 billion in 2024 to over $20 billion in future years, driven by increased Data Center spending.