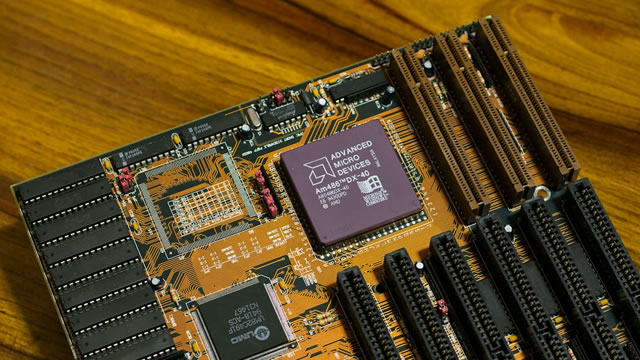

Advanced Micro Devices, Inc. (AMD)

Live Markets: GOOGL, AMD, AMZN Weigh on Nasdaq

Today’s trading reveals technology investors see the glass half empty at the moment. A tech malaise fueled by Google parent Alphabet (Nasdaq: GOOGL) and chipmaker AMD (Nasdaq: AMD) is pressuring the Nasdaq Composite and S&P 500 moderately lower while the Dow Jones Industrial Average is eking out a gain. The tech malaise can be blamed on Alphabet’s steep 8% drop, owing to a revenue shortfall coupled on top of an aggressive AI spending plan that didn’t sit well with Wall Street. AMD stock, a member of the Nasdaq Composite, is currently down 9% as of mid-morning. Amazon (Nasdaq: AMZN) shares are down in sympathy ahead of the company’s earnings report after the closing bell tomorrow. Key Points Tech is weighing on the Nasdaq Composite and S&P 500 while the Dow Jones Industrial Average is eking out modest gains. Google parent Alphabet stock is sinking 8% on aggressive AI capex plans despite a revenue miss. AMD shares are down a steep 9% on weak data center results, but Wall Street says the quarter was “better than feared.” Amazon shares are down in sympathy ahead of the company’s quarterly results on Thursday. Despite selling pressure the S&P 500 is managing to hover above the key 6,000 level, buoyed by stocks like Newmont Mining (NYSE: NEM) with a 4% gain and trucking company Old Dominion Freight Line (Nasdaq: ODFL) with a 6% jump in response to earnings. On the economic front, the economy appears to be humming as the workforce added a higher than expected 183,000 private payrolls in January, fueled by service providers, while wages rose, according to ADP data. Here’s a look at the performance as of morning trading: Dow Jones Industrial Average: up 38.57 (+0.09%) Nasdaq Composite: down 78.77 (-0.41%) S&P 500: down 7.76 (-0.13%) Tech Earnings Roundup Alphabet’s Q4 revenue missed consensus estimates while the company has earmarked a whopping $75 billion in AI capex, including the development of data centers, amid fierce competitive headwinds from the U.S. and China. Google’s YouTube was another drag as its ad revenue slowed. AMD’s stock is reeling after its data center revenue failed to meet high expectations. It shows how much AI is running the show, as AMD’s top and bottom lines came in better than expected. Wall Street Moves A slew of analysts responded to AMD’s earnings print. Among them, Citi described AMD’s results as “decent” but lacking on AI revenue guidance. Goldman Sachs analysts called the results “better than feared” while the data center performance fell short. As for Alphabet, Goldman Sachs maintains a “buy” rating with a $220 price target, while BofA said, “Street could be underestimating AI Overview benefits for Search monetization in 2025.” Grab Holdings (Nasdaq: GRAB) is down 6% on the heels of a JPMorgan analyst downgrade to a “neutral” rating from “overweight” with a $5.60 price target, saying they are looking to better entry levels on the stock. The post Live Markets: GOOGL, AMD, AMZN Weigh on Nasdaq appeared first on 24/7 Wall St..

Is AMD in Trouble After Wednesday's Stock Drop?

Shares of Advanced Micro Devices (AMD -6.94%) took a painful hit on Wednesday. Following the chip designer's fourth-quarter report, the stock fell as much as 10.9% in the morning session.

AMD Stock Slumps as Analysts Cut Price Targets After Data Center Revenue Misses Estimates

Advanced Micro Devices (AMD) shares plunged Wednesday and several analysts dropped their price targets after the chipmaker's data center sales missed expectations.

Analysts weigh in after AMD's Q4 earning report — What comes next?

Advanced Micro Devices (NASDAQ: AMD) saw its stock fall over 10% on Wednesday, February 5, after missing Wall Street expectations for its key data center segment.

AMD's AI Ambitions Face NVIDIA's Dominance—Analysts See Growth, But Challenges Remain

Advanced Micro Devices, Inc. AMD shares are trading lower on Wednesday.

GOOGL's A.I. Push, AMD's "Fatal Mistake" & QCOM's Smartphone Play

Futurum Group CEO, Daniel Newman, offers a big picture perspective on the state of the tech sector. For Alphabet (GOOGL), he thinks the company needs to emphasize generative A.I.

AMD Q4 Earnings Beat Estimates, Shares Down on Weak Guidance

Advanced Micro Devices' Q4 2024 results reflect robust Client and Data Center revenues, offsetting weakness in the Gaming and Embedded segments.

AMD Stock Suffers Another Post-Earnings Meltdown

Advanced Micro Devices Inc (NASDAQ:AMD) is the talk of Wall Street today, last seen down 9.4% to trade at $108.23.

AMD Stock Crashes After Earnings -- Is It Going Lower?

In this video, I go over AMD's (AMD) fourth-quarter earnings report. Watch the short video to learn more, consider subscribing, and click the special offer link below.

Live Markets: GOOGL, AMD, AMZN Weigh on Nasdaq

Today’s trading reveals technology investors see the glass half empty at the moment. A tech malaise fueled by Google parent Alphabet (Nasdaq: GOOGL) and chipmaker AMD (Nasdaq: AMD) is pressuring the Nasdaq Composite and S&P 500 moderately lower while the Dow Jones Industrial Average is eking out a gain. The tech malaise can be blamed on Alphabet’s steep 8% drop, owing to a revenue shortfall coupled on top of an aggressive AI spending plan that didn’t sit well with Wall Street. AMD stock, a member of the Nasdaq Composite, is currently down 9% as of mid-morning. Amazon (Nasdaq: AMZN) shares are down in sympathy ahead of the company’s earnings report after the closing bell tomorrow. Key Points Tech is weighing on the Nasdaq Composite and S&P 500 while the Dow Jones Industrial Average is eking out modest gains. Google parent Alphabet stock is sinking 8% on aggressive AI capex plans despite a revenue miss. AMD shares are down a steep 9% on weak data center results, but Wall Street says the quarter was “better than feared.” Amazon shares are down in sympathy ahead of the company’s quarterly results on Thursday. Despite selling pressure the S&P 500 is managing to hover above the key 6,000 level, buoyed by stocks like Newmont Mining (NYSE: NEM) with a 4% gain and trucking company Old Dominion Freight Line (Nasdaq: ODFL) with a 6% jump in response to earnings. On the economic front, the economy appears to be humming as the workforce added a higher than expected 183,000 private payrolls in January, fueled by service providers, while wages rose, according to ADP data. Here’s a look at the performance as of morning trading: Dow Jones Industrial Average: up 38.57 (+0.09%) Nasdaq Composite: down 78.77 (-0.41%) S&P 500: down 7.76 (-0.13%) Tech Earnings Roundup Alphabet’s Q4 revenue missed consensus estimates while the company has earmarked a whopping $75 billion in AI capex, including the development of data centers, amid fierce competitive headwinds from the U.S. and China. Google’s YouTube was another drag as its ad revenue slowed. AMD’s stock is reeling after its data center revenue failed to meet high expectations. It shows how much AI is running the show, as AMD’s top and bottom lines came in better than expected. Wall Street Moves A slew of analysts responded to AMD’s earnings print. Among them, Citi described AMD’s results as “decent” but lacking on AI revenue guidance. Goldman Sachs analysts called the results “better than feared” while the data center performance fell short. As for Alphabet, Goldman Sachs maintains a “buy” rating with a $220 price target, while BofA said, “Street could be underestimating AI Overview benefits for Search monetization in 2025.” Grab Holdings (Nasdaq: GRAB) is down 6% on the heels of a JPMorgan analyst downgrade to a “neutral” rating from “overweight” with a $5.60 price target, saying they are looking to better entry levels on the stock. The post Live Markets: GOOGL, AMD, AMZN Weigh on Nasdaq appeared first on 24/7 Wall St..

AMD: A Cooldown To $100 Might Be Coming

I expect Advanced Micro Devices, Inc. to hit $100 before reassessing my sell rating. Price action in the coming days or weeks will be key to signaling a reversal or further downside. Some drivers for the selloff include a slowdown in data center revenue growth, weak Q1 2025 guidance, and stagnation in non-GAAP gross margins. AMD's MI350 launch this year could challenge Nvidia's Blackwell chips, but I see timing and ecosystem adoption as major hurdles.

AMD, Alphabet slide post-earnings: What Wall Street is saying

Wall Street investors are reacting negatively to the recent earnings results from tech giant Alphabet (GOOG, GOOGL) and semiconductor manufacturer Advanced Micro Devices (AMD). Yahoo Finance tech editor Dan Howley joins Morning Brief to highlight the takeaways from AMD's latest report, including its promising first quarter guidance and flat data center revenue.