Micron Technology Inc. (MU)

Micron (MU) Suffers a Larger Drop Than the General Market: Key Insights

The latest trading day saw Micron (MU) settling at $91.24, representing a -1.36% change from its previous close.

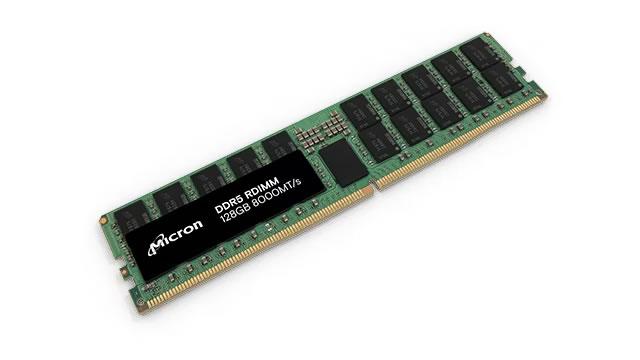

Samsung's 'lackluster' chip business is losing ground to SK Hynix and Micron, says strategist

Eric Ross, chief investment strategist at Cascend Securities, discusses Samsung's chip business and how it's being "leapfrogged" by SK Hynix and Micron in the DRAM market.

Micron Technology, Inc. (MU) is Attracting Investor Attention: Here is What You Should Know

Recently, Zacks.com users have been paying close attention to Micron (MU). This makes it worthwhile to examine what the stock has in store.

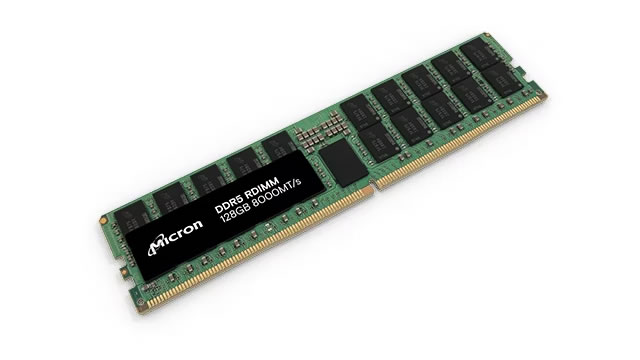

Micron: A Bet On Continued AI Boom And Government Support

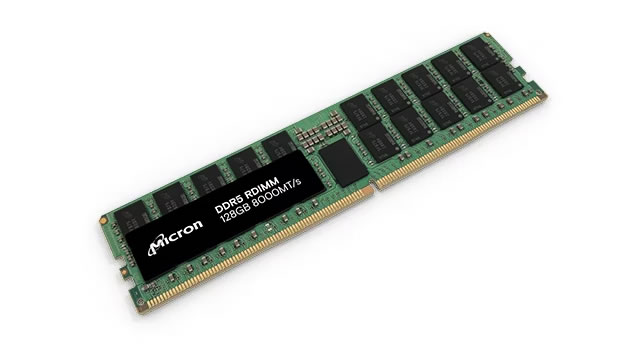

Micron Technology's growth is driven by AI development and US government support, including a $6.1 billion agreement for new DRAM manufacturing plants. The company is a major player in DRAM and NAND markets, with significant revenue from data centers, PCs, and mobile devices. Despite competition, Micron aims to capture a 20%-25% share of the high-bandwidth memory market by 2025.

2 Leading Tech Stocks to Buy in 2025

Many tech stocks are soaring sky-high in early 2025. The artificial intelligence (AI) boom that started about two years ago is going strong.

This Artificial Intelligence (AI) Stock Has Jumped 30% Already in 2025. It Could Jump Another 32%, According to Wall Street.

Shares of Micron Technology (MU -1.57%) have gotten off to a hot start in 2025, gaining an impressive 30% as of this writing and outpacing the 8% gains clocked by the PHLX Semiconductor Sector index. And analysts expect the memory specialist to deliver more upside in the coming year.

Micron (MU) Registers a Bigger Fall Than the Market: Important Facts to Note

Micron (MU) reachead $103.19 at the closing of the latest trading day, reflecting a -1.57% change compared to its last close.

SK Hynix Shared Great Insight for Micron and Nvidia Stock Investors

In today's video, I discuss the recent updates impacting Nvidia (NVDA -1.07%) and Micron Technology (MU -0.94%)after SK Hynix reported earnings. To learn more, check out the short video, consider subscribing, and click the s pecial offer link below.

Should You Forget Nvidia and Buy This Tech Stock Instead?

Chip designer Nvidia (NVDA 0.10%) is a hot topic. Its 147% total return in 52 weeks is among the 10 best performances on the S&P 500 (^GSPC 0.53%) index.

Wall Street Expert Expects This AI Stock to Pop Over 138% This Year

Micron (NASDAQ: MU) makes memory chips and storage for phones and computers.

Why Micron Technology Stock Is Sinking Today

Why Micron Technology Stock Is Sinking Today

If I Could Buy Only 1 AI Stock, This Would Be It

Artificial intelligence (AI) has been one of the hottest investment themes on Wall Street in 2024. Although the euphoria surrounding AI seems to have lessened by now, the allure of high-quality and fundamentally strong AI-powered stocks is still strong -- on the back of strong demand for AI solutions across industries and functions.