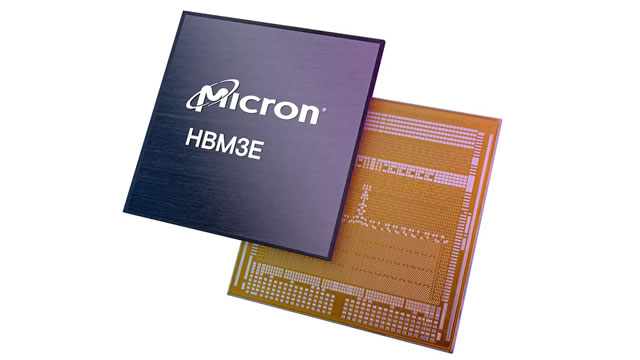

Micron Technology Inc. (MU)

Why Micron Technology Rallied Today

Shares of Micron Technology (MU 6.62%) rallied 6.8% on Monday, as of 1:41 p.m. ET.

Why Micron's stock could be poised for a post-earnings gain — with one catch

One analyst is “very bullish” on Micron's stock ahead of what could be a mixed report on Wednesday. But he cautioned that a post-earnings stock bump might not last long.

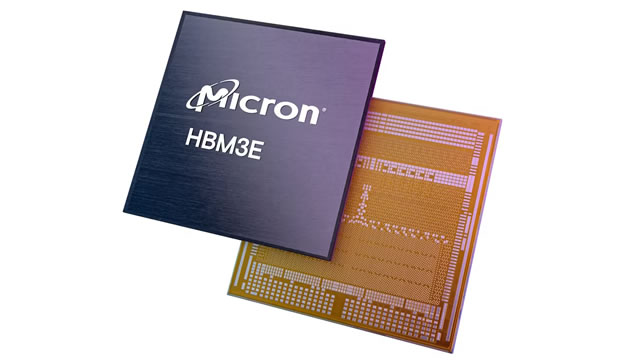

AI Investment Boom to Aid Micron Technology's Q1 Earnings?

Rising investments in AI and strategic partnerships with tech giants are likely to have aided MU's overall performance in the first quarter of fiscal 2025.

Wall Street Brunch: Fed Accompli

The Federal Reserve is expected to cut rates to 4.25%-4.5%. Key earnings reports from FedEx, Nike, and Micron will provide insights into consumer health and AI demand in the semiconductor sector.

What Wall Street Analysts Think of Micron's Stock Ahead of Earnings

Micron Technology (MU) is set to report fiscal 2025 first-quarter earnings after the market closes Wednesday, with analysts overwhelmingly bullish on the chipmaker's stock.

Micron stock price forecast ahead of earnings: buy or sell?

Micron stock price will be in the spotlight as it publishes its final quarterly results next week. These numbers will come at a time when the MU share price has crashed by about 35% from the year-to-date high, moving it into a deep bear market.

Micron (MU) Q1 Earnings on the Horizon: Analysts' Insights on Key Performance Measures

Beyond analysts' top -and-bottom-line estimates for Micron (MU), evaluate projections for some of its key metrics to gain a better insight into how the business might have performed for the quarter ended November 2024.

Micron to Report Q1 Earnings: How to Play MU Stock Ahead of Results

MU's Q1 performance is likely to have benefited from an improving demand-supply environment and strong demand for memory chips used for GPU-enabled AI servers.

Micron: A Solid Buy Into Earnings

Micron's robust AI demand, stellar earnings, and undervaluation suggest a high probability of substantial stock appreciation into year-end and 2025. Technical analysis indicates minimal downside risk, with a potential breakout above $110-115, opening a significant upside for Micron's stock. Micron's fiscal 2025 EPS could reach $9, making its current valuation of 10-11 times EPS estimates extremely attractive.

Should You Buy Micron Stock Before Dec. 18?

Micron (MU -4.59%) is scheduled to report quarterly financial results that could have enormous implications for stock market investors.

2 Artificial Intelligence (AI) Stocks That Are Screaming Buys in December

The growing adoption of artificial intelligence (AI) has lifted many technology stocks this year, and the good part is that this trend is likely to continue in 2025.

Micron Lands $6 Billion in Federal Grants To Make Chips in US

The Commerce Department said Tuesday that Micron Technology (MU) has been awarded up to $6.165 billion to make semiconductors in the U.S. as part of the CHIPS and Science Act of 2022.