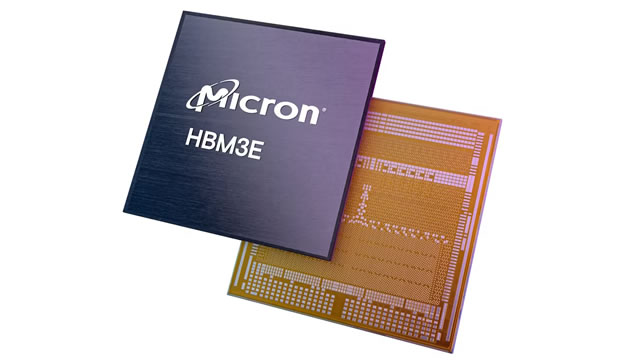

Micron Technology Inc. (MU)

One Stock Will Outgrow Nvidia At Year's End, Analysts Say

Nvidia won investors' respect this year with its off-the-hook revenue growth. But the S&P 500 AI champ is about to get bumped to second place.

Micron (MU) Stock Slides as Market Rises: Facts to Know Before You Trade

In the latest trading session, Micron (MU) closed at $97.95, marking a -0.25% move from the previous day.

Micron Technology, Inc. (MU) Is a Trending Stock: Facts to Know Before Betting on It

Micron (MU) has been one of the stocks most watched by Zacks.com users lately. So, it is worth exploring what lies ahead for the stock.

Micron: Buying Opportunity Before Its Next Monster Move

Micron investors have held their ground firmly above the $95 level, even as the stock has underperformed its semi-peers since peaking in June. Micron's growth prospects in the high bandwidth memory market appear robust. Nvidia must depend on its AI memory supply chain to improve its supply constraints, bolstering near-term opportunities for Micron to gain more share.

Micron: Here's Why It Keeps Dropping And Here's Why I Keep Buying

MU has dropped 15% from recent highs despite strong earnings and an upbeat Q1 2025 forecast. Concerns over memory demand and oversupply are looming. Micron's high-margin product offerings will drive growth and offset weakness.

Should You Buy Micron Stock After the Dip? Wall Street Has a Clear Answer for Investors.

Micron may prove to be a solid pick in the coming months.

Better Artificial Intelligence (AI) Stock: Nvidia vs. Micron Technology

Both chipmakers are on track to deliver outstanding growth thanks to the robust demand for AI chips.

Micron (MU) Declines More Than Market: Some Information for Investors

The latest trading day saw Micron (MU) settling at $99.18, representing a -0.74% change from its previous close.

Is Micron (MU) a Buy as Wall Street Analysts Look Optimistic?

Investors often turn to recommendations made by Wall Street analysts before making a Buy, Sell, or Hold decision about a stock. While media reports about rating changes by these brokerage-firm employed (or sell-side) analysts often affect a stock's price, do they really matter?

Micron: A Rare Buying Opportunity

Micron's fundamentals are improving, with promising new product releases and significant growth in R&D spending, supporting a 'Strong buy' recommendation. Wall Street analysts forecast aggressive revenue and EPS growth, with FY2025 revenue expected to be 24% higher than FY2022. Micron is capitalizing on favorable trends in data centers, mobile, and automotive markets, with significant CapEx and R&D investments.

Why Micron Stock Sank Today

New analysis suggest that Micron's performance in 2025 could fall short of investors' expectations.

Micron Up 11% in Three Months: Should You Buy, Sell or Hold the Stock?

Micron's recent gains and strategic moves are promising, but risks persist. Here's why holding the stock is the best move now.