Micron Technology Inc. (MU)

How Much Is Micron Stock Really Worth?

This semiconductor company is poised to benefit from the rising effectiveness of AI.

Should You Forget Nvidia and Buy These 2 Tech Stocks Instead?

If you're worried about investing in Nvidia at its current valuation, you may want to take a closer look at these two other names.

Think Micron Technology Stock Is Expensive? This Chart Might Change Your Mind.

Is Micron Technology a pricey tech stock or a hidden gem in plain sight? This eye-opening chart might help you decide.

2 Artificial Intelligence Stocks to Double Up on Right Now

Both these AI-powered businesses are positioned for long-term success.

Micron's Rebound: Riding AI Tailwinds Amid Memory Market Headwinds

AI-driven demand and recovery in traditional segments position Micron for strong growth into 2025. Inventory normalization from traditional markets boosts Micron's revenue after a challenging 2023. HBM chips are sold out, with orders already booked into 2026-2027, supporting future growth.

These 12 stocks are behind Goldman's S&P 500 optimism — and Micron stands out

Goldman expects corporate profit margins to increase through 2026. These companies' gross margins have already improved for four straight quarters.

Micron Technology: One Of The Top Picks In The AI Hardware Landscape

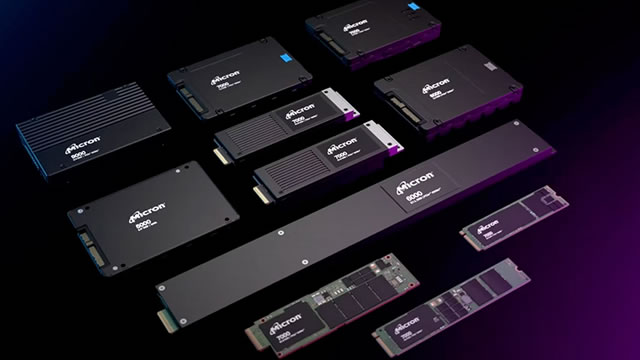

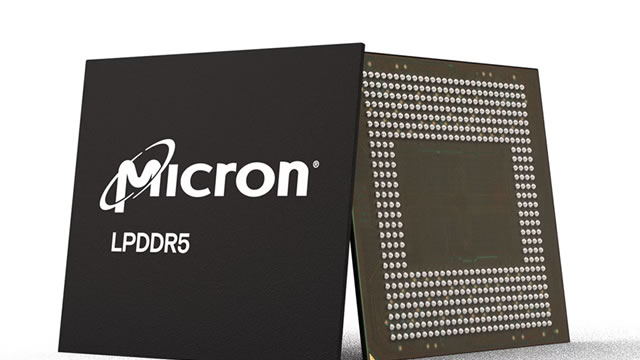

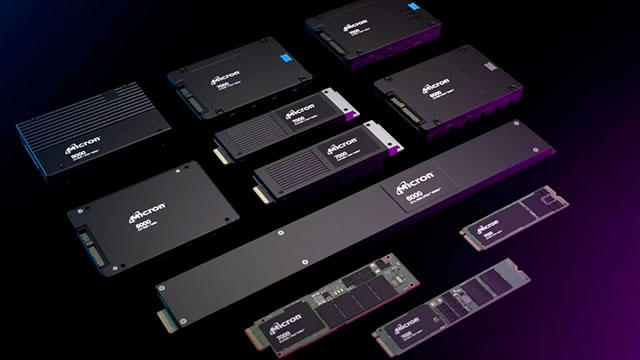

Micron provides essential memory and storage solutions, which are crucial for AI and cloud computing. Micron's new 12-Hi HBM3E memory stacks offer 36GB capacity, 50% more than previous versions, enabling larger AI models and faster data processing. Micron benefits from strategic partnerships with NVIDIA and TSM, ensuring compatibility and enhancing its role in the AI-driven hardware space.

Decoding Micron Technology Inc (MU): A Strategic SWOT Insight

On October 4, 2024, Micron Technology Inc (MU, Financial) filed its 10-K report, offering a comprehensive view of its financial health and strategic positioning. As one of the world's leading semiconductor companies, Micron specializes in memory and storage solutions, with a strong presence in dynamic random access memory (DRAM) and NAND flash chips.

Investing In Micron: Riding The Upturn In The Memory Chip Market

Micron Technology remains a buy despite recent underperformance, driven by strong AI-driven demand and expected recovery in PC, smartphone, and consumer electronics markets. Short-term concerns in the chip sector and inventory buildup by manufacturers have impacted Micron's ability to raise prices immediately. Micron's FY 2025 outlook is robust, with record revenue and profitability expected, supported by increased CapEx for advanced technology and new fabs.

Micron Technology: The Market May Be Wrong

I believe Micron is now undervalued after its 33.6% year-to-date dip off its highs, trading below its 10-year median EV/EBITDA on a forwarding basis. Strong Q4 performance driven by record revenues in NAND and Storage segments, with significant advancements in memory technologies like 1-beta DRAM and G8/G9 NAND. AI-driven demand and strategic investments in cutting-edge technologies are expected to sustain growth, despite industry cyclicality concerns.

Where Will Micron Stock Be in 1 Year?

Micron benefits from tailwinds, but volatility could undermine its potential gains.

Micron: Strong Q4 Results Set To Continue Long Term

Micron's stock is a buy due to attractive valuation and strong long-term revenue prospects, driven by AI, 5G, and other technological advancements. Recent Q4 results show strong performance with revenue growth, margin expansion, and high demand for high-value solutions like HBM and SSDs. Improved pricing outlook and industry supply constraints are expected to drive higher ASPs, benefiting Micron's profitability and capital returns.