Micron Technology Inc. (MU)

Stocks Head for Third Consecutive Winning Week Amid String of Record Closes

Recent economic data reinforces the underlying strength of this bull market.

Micron's Earnings Don't Change Our Bearish View

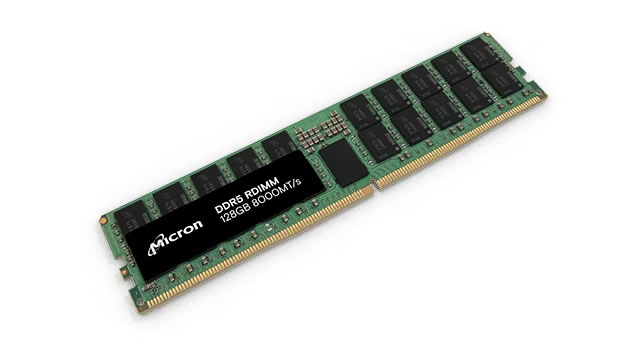

Micron's strong earnings and market reaction don't justify its valuation, with FCF annualized at sub 1%, making it a poor investment. Heavy investments in fabs and AI could strain financials, with capex growth potentially risky if the market downturns. Competition from SK Hynix and Samsung, both ahead in AI memory technology, poses significant challenges to Micron's market position.

Micron: Q4 Signals To Buy Now For An Exceptional FY25 Price Return

Micron stock is currently well-positioned for strong FY25 returns. Despite a high valuation, especially after sentiment improved following its strong Q4 report, this could be sustained for now. Toward the end of FY25, it is reasonable to expect downside volatility as a result of lower growth forecasts for FY26. Therefore, this is a substantial short-term opportunity. That being said, Micron is investing heavily in its long-term capacity with new fabs being built and an effort to compete in HBM4 with SK Hynix and Samsung.

Why Micron Rallied 21% This Week

Micron delivered a beat on revenue, earnings, and guidance. AI demand is leading to a surge in data center DRAM demand.

Micron: As FY25 Begins, Get Ready For A Fresh Rally

Shares of Micron popped 15% after reporting Q4 results and announcing bullish remarks for FY25, and I recommend holding on for further gains. Micron expects substantial profitability, gross margin expansion, and healthy supply-demand dynamics for DRAM and NAND in FY25. Data center sales continue to be robust as AI applications demand more HBM chips, while refresh cycles are compressing for both PCs and mobile phones.

Micron Technology Just Delivered Spectacular News for AI Semiconductor Investors

Micron Technology's earnings caused the semiconductor market to rally.

Micron To $150? Here Are 10 Top Analyst Forecasts For Friday

Top Wall Street analysts changed their outlook on these top names. For a complete view of all analyst rating changes, including upgrades and downgrades, please see our analyst ratings page.

Micron Stock Leaps 16% — More To Come?

Micron Technology (NASDAQ: MU) stock surged by about 16% in pre-market trading on Thursday, following a stronger-than-expected Q4 earnings report. Revenue rose 93% year-over-year to $7.75 billion, with adjusted earnings at $1.18 per share.

S&P 500 Gains and Losses Today: Micron Stock Pops as Sales and Guidance Impress

Major U.S. equities indexes pushed higher as the latest estimates from the Bureau of Economic Analysis showed that U.S. gross domestic product (GDP) growth slightly outpaced expectations in the second quarter of 2024.

Stock Of The Day: Micron Technology Price Level Converts From Support To Resistance And Vice Versa

Micron Technology, Inc. MU continued its upward trajectory Thursday after reporting upbeat quarterly results.

Stock Market Today: S&P 500 Hits New High as Micron Soars

The main indexes gained ground Thursday as strong earnings from memory chipmaker Micron fueled AI optimism.

Micron: Here's Why We're Flipping To A Buy After Q4 FY2024 Earnings

Micron Technology, Inc.'s F4Q24 outperformance and better-than-expected FY2025 outlook continues to reinforce its mission-critical role in enabling the AI transformation. Yet, the stock continues to trade discounted on both an intrinsic and relative basis following its steep sell-off since June despite the post-earnings upsurge. Micron's attractive valuation at current levels is further supported by improved durability to its long-term demand outlook against an inherently elevated exposure to cyclical risks.